Carbon has become the first digital lender in Africa to initiate and complete an entire loan cycle via an iOS app.

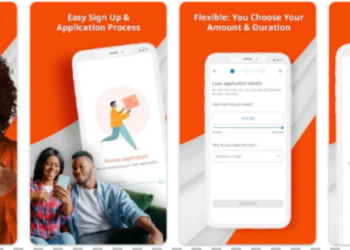

The fintech firm formerly known as Paylater, said the iOS app it launched was developed in order to make access to financial services easier for customers in different markets.

With Carbon already operating an Android app, the new development will ensure more people (both banked and unbanked) at every level of the market access Carbon’s services. The fintech firm said it would also add a USSD channel in the coming months.

Why this matters: Already, a recent Enhancing Financial Innovation and Access (EFInA) report suggests that more than one in three Nigerian adults (37%/36.6 million) are financially excluded, with 40% (14.9 million) of the excluded having no access to financial institutions at all.

With smartphone adoption predicted to quadruple (from 36 million to 144 million) by 2025, the addition of an iOS app represents an excellent opportunity to provide financial services to individuals that would otherwise be unbanked or underbanked.

[READ MORE: Carbon goes to Kenya, promises to provide purposeful lending)

Where is iOS app available? For users in need of the Carbon iOS app, it can be downloaded on Apple Store. But while it will be available in Nigeria, it will not be available in Kenya and other markets, until later.

Carbon, which prides itself as the first mobile app that provided access to credit digitally, said users can perform transactions or get loans at all 3 KYC tiers (low, medium and high value) provided by the Central Bank of Nigeria (CBN).

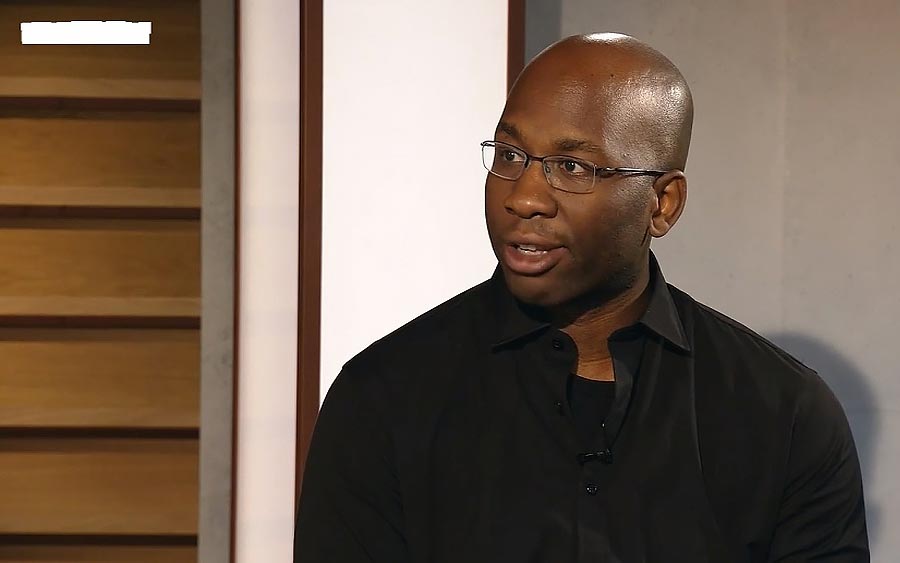

Speaking on the new addition to its app collection, the Chief Executive Officer and co-founder of Carbon, Chijioke Dozie, said, “We are really excited to add consumers on the Apple ecosystem to our network and we have channelled a lot of the learnings and user insights from the last four years on Android into this app. As we establish ourselves as a Pan-African digital bank, we want to go everywhere with our customers and be innovative and versatile enough to fulfil their needs.”

Since launching in 2016, Carbon has amassed 2.1 million users and disbursed more than $120 million in instant loans. The company empowers individuals and businesses across Africa with access to credit, simple payment solutions, high-yield investment opportunities and easy-to-use tools for personal finance management.

Competitive markets in Nigeria: Carbon is operating in a competitive market in Nigeria where the likes of QuickCheck, Sokoloan, Branch, Okash and many others are operating. The fintech space in the country is getting saturated, this is why some Fintechs are branching out to other countries.

Nice move