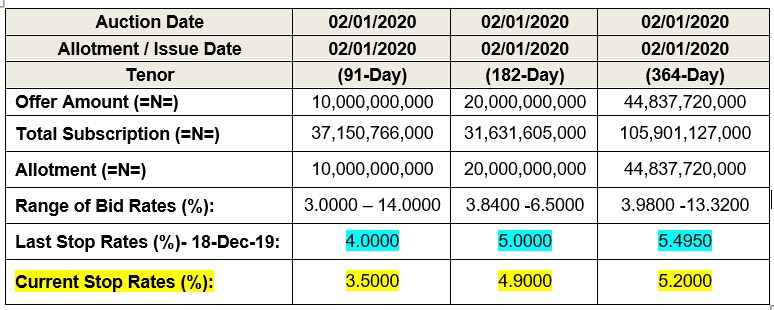

The latest data from the Central Bank of Nigeria reveals Nigeria’s 364-day treasury bills have fallen to 5.2%. This is the lowest we have seen in almost a decade indicative of the major disconnect in financial markets.

182-day bills went for stop rates of 4.9% and 91-day rates 3.5% per annum respectively. The total amount on offer for 364-day bills was N44.8 billion with investors staking about N105.9 billion. Bids for 182 and 91-day also outstripped offers by a combined N35 billion.

Why this matters: The massive disparity between the subscriptions and the offers suggests investors are willing to earn a negative real return (treasury bills rate less inflation rate) than take higher risk in other assets such as stocks and real estates.

The increase in demand for treasury bills compared to supply is largely due to a dearth in investable funds available to investors. Back in October, the Central Bank restricted investments in its lucrative OMO bills to commercial banks and foreign investors leaving hundreds of billions of naira in cash in the dust.

[READ ALSO: T-bills Trade Bullish to Close the Week as CBN Stalls on OMO Auction(Opens in a new browser tab)]

Before now, the OMO market was seen by investors such as Pension Funds, Insurance Companies, FinTEchs, etc. as a viable option for investing free cash flow. The restriction now leaves them with very little options. Most investors surveyed by Nairametrics complain that they will rather continue to invest in safe havens like the CBN’s treasury bills rather than investing in stocks despite their perceived low valuations.

Retail investors have also shown interest in buying dollars preferring to earn as low as 4% in the greenback as against holding the naira at 6%. However, if yields continue to be this low most investors could fall prey to Ponzi schemes which typically thrive in low yield environments.

Reliable sources also inform Nairametrics that the CBN is keeping a close watch on investor reactions to the low yield environment and considers this a temporary situation. Rates may pick up if the pressure triggers a spike in the demand for dollars.

The risk on government securities is low, so the high interest rates on T-Bills is the actual absurdity. In my opinion, this is long overdue.

what? all that matters is the inflation rate relative to the treasury bill rate.

this negative yield now implies that you now have to pay the govt for the pleasure of holding your money. its insane.

What are you talking about. It’s called safe investment because it’s supposed to make you money. With inflation discounting your investment at double digits and with a free falling naira, you’re losing money at this interest rate fam!

developed countries like America and uk has an incredibly low returns for decades and i always wondered why Nigeria consistently offer 10-12%, can you elaborate on this Admin? Will be greatly appreciated.

theyre always devaluing the currency, so they inflate it to make it seem more. its a trick. the real value of the currency is constantly depreciating.

I believe portfolio managers can still invest part of their funds in the stock market with some success. Those investors who are staying away from the stock market now due to the current low prices/returns are the same who would likely jump in later after prices have risen again, buying the bubble and risking losses due to profit taking by early investors. Good investors are known for taking calculated risks after diligent analysis and taking their positions early, not just following the crowd. One of the problems we have with investment as Nigerians is that we want very quick returns, hence our repeated vulnerability to ponzi schemes. This is also another reason (besides poor macro-economy) our stock market is still underdeveloped, as we cannot invest consistently in the stock market over a long time. We always wait for foreign investors to spark a rally, then local investors jump in and when the foreigners withdraw their funds, we also follow suit depressing prices below pre-rally levels taking us back to square one.

Well there is always up and down in any investment or business and Nigeria can’t be exceptional I believed this is a temporary situation because our economy is still not strong for this.

Dear Nairametrics,

My 365 days investment in TB matured some days ago. To my surprise, firstbank rolled over without my permission and paid me about 65,000 Naira on 3 million Naira. Am not happy about rollover without my conscience and the interest is ridiculous. Kindly advise if this rate is official and if not, what can I do to seek redress? I now live in Osun state but carried out the investement when I was in Lagos.

Ayodeji

Hello Ayodeji,

It’s an official rate. However, why not approach your bank and have them terminate it. Rgds

Good day Admin. Pls can you advice me on where to invest since T-bills and Fixed deposit rate is very low now. Thanks

Where one invest since this isn’t working again

Where will one invest