Nigeria’s public debt stock rose to N25.7 trillion in June 2019. Consequently, the payment for servicing the debt has continued to be a major source of concern.

Reports from the website of the Central Bank of Nigeria confirmed that Nigeria spent a whopping $1.12 billion as external debt service payment between January and October 2019 (10-month).

Debt and its attendant cost

Nigeria’s total debt stock constitutes both external and domestic debts. According to the latest DMO report for June 2019, the country’s total external debt rose to N8.32 trillion ($27.1 billion), representing about 32.38% of the total debt stock while the domestic debt constitutes 67.68%.

- The breakdown of the total external debt showed that the Federal Government accounted for the biggest external debt stock in the country.

- As at June 2019, out of the N8.32 trillion external debt, the Federal Government accounted for 7.01 trillion while states and FCT accounted for only N1.30 trillion. This means the Federal Government accounts for 84% of Nigeria’s total external debt.

- While Nigeria’s debt stock rose to a new height in the second quarter of 2019, the cost of servicing debt jumped by $1.12 billion (2019, YTD).

- Experts have stated that while the country’s debt to GDP ratio may be sustainable in the meantime, the cost of servicing the debt eats deep into the country’s already depleting revenue.

- Nigeria pays a lump sum to the several external organizations which grant loans to the country, and these include World Bank, African Development Bank, Exim Bank of China, Exim Bank of India and so on. Data from the Debt Management Office (DMO) shows that Nigeria paid over $60 million to the World Bank.

Meanwhile, IMF passes vote of confidence on Nigeria’s debt

In a recent report, the International Monetary Fund (IMF) warned that though Nigeria’s debt to gross domestic product ratio has increased to 28%, it remains lower than the average ratio recorded in sub-Saharan Africa.

Meanwhile, the United Nations specialized agency has disclosed that 40% of African countries are in a position where they can’t afford to pay back their debts.

According to the Managing Director of IMF, Kristanlina Georgieva, while the IMF is optimistic about some of its investments in Africa, it is also concerned about the debt stress levels on the continent.

“Are we worried about debt levels in Africa? Yes, because 40% of the countries have gone into debt distress levels. In some cases, we are concerned about that but in other cases, we see that investment is going to pay off over time.

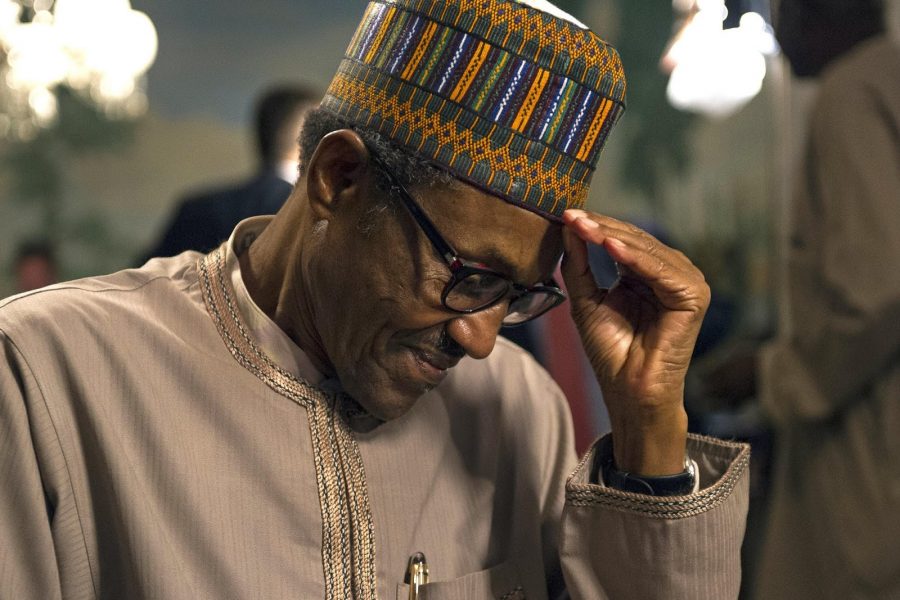

[READ MORE: Debt servicing gulps N7.04 trillion under President Buhari’s administration]

“Take the case of Kenya, we advise Kenya to be more cautious in building debt but we have seen good macroeconomic policy in Kenya.

“In cases where debt is dangerous like Zambia, we do say you need to get a handle on your debt. In Ethiopia, we say you need to renegotiate some of your debts because it is non-concessional for things that should be on a concessional basis.”

Nigeria’s debt stock is expected to rise further as the country still faces a huge fiscal revenue quagmire ahead of the implementation of the 2020 budget.

[READ ALSO: High debt servicing cost remains a sore thumb]

It is in this context that the Federal Government continues to intensify efforts to drive revenue. Some of the policies introduced by the government include increasing target for revenue-generating agencies, raising VAT by 50%, and reviews of various tax laws which are all included in the 2019 Finance Bill.

I require loan

The government did not raise tax by 50%, please edit your article.

Following the passage of Finance Bill, VAT has been raised by 50% from 5% to 7.5% and it would take effect on Jan 2, 2020.

The government did not ACTUALLY raise tax by 50%

good update i love it

omo nigeria is full of debt and we cant get out of this