I wrote an article on how to invest in foreign stock markets, and I received lots of comments from people requesting more specific information on what countries to invest and how to go about it. Personally, I had been doing some research on where to invest and had written down some countries I felt were stable and secure for my hard-earned money to be put to work.

One of the countries that piqued my interest was Singapore, and I’ll briefly explain why.

READ: 20 Financial Terms You Need To Know In The Stock Market

Through the guidance of the founding father of one of Asia’s smallest but developed economies, Singapore emerged as one of the countries with the most developed financial and trade sectors in the world. It is also known for its low tax regime and openness towards foreign investment.

READ: Nigeria’s trade balance hits recession low, records N579 billion deficit in Q4 2019

Advantage of investing in Singapore:

Open Economy: Ease of doing business, low tax rate and limited corruption

The disadvantage of investing in Singapore:

Over-reliance on foreign trade: Singapore’s economy is heavily reliant on foreign trade which makes it prone to contraction if there is a global recession.

READ MORE: Top eight investment destinations for Nigerians

Taking these factors into consideration, I continued my research by looking for stockbroking firms in Singapore and gathered some info on some of them which are stated below;

are stated below;

| Stockbroking Firm | Markets Available to trade-in | Products Available | Website |

| Philip Securities Singapore | Online: Hong Kong, Indonesia, Japan, Malaysia, Singapore, Thailand, UK, USA

Broker Assisted: Australia, Canada, China B, France, Germany, Korea, Philippines, Sri Lanka, Taiwan |

Stocks, Exchange Traded Funds, Unit Trust, Bonds, Money Market Fund etc | www.poems.com.sg |

| KGI Securities | Online: Australia, China B, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, Thailand, UK, USA

Broker Assisted: Canada, Korea, New Zealand, Taiwan

|

Stocks, Exchange Traded Funds, Forex, Futures etc | www.kgieworld.sg |

| Maybank | Online: Singapore, Hong Kong, USA, Thailand, Malaysia, UK

Offline: Access to 25 markets not limited to – Australia, Belgium, Canada, Denmark, Finland, France, Germany, Indonesia, Ireland, Italy, Japan, Korea, Netherlands, Spain, Switzerland amongst others. |

Stocks, Forex, Exchange Traded Funds, Bonds & Fixed Income, Real Investment Trusts, etc | Maybank-ke.com.sg |

READ MORE: How To Invest In The Nigerian Stock Exchange

Further research done by me showed that most of the companies require the following documents for foreigners who want to open an account;

- 18 years and above, financially well or not bankrupt.

- Valid Passport

- Work permit/Employment pass (where applicable)

- Proof of residential address (within the last 3 months.

- Utility Bill reflecting your name and residential address.

- Latest income documents (e.g pay slip).

- Latest 3 months bank statement.

- Tax payer identification number details.

READ: Nigeria spends N1.9 trillion on goods from China in H1, up by 88%

The Feedback I got

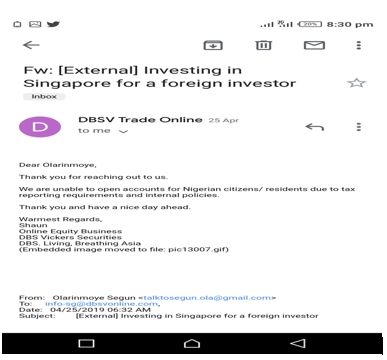

I sent a mail to DBS Vickers and I was told they are unable to open accounts for Nigerian citizens due to tax reporting requirements and internal policies. Below is the extract of the mail

In my opinion Philip Securities offered the best opportunity for a Nigerian to invest. Philip Securities enables you access a wide range of regional markets at a reasonable cost and ease. When I placed a call to them the customer service was very responsive and helpful. For more detailed info just visit their website poems.com.sg.

READ MORE: Why the London Stock Exchange is scouting for potential African listings

Minimum investments are usually quite small, say about $1000. So you should stop procrastinating, get serious with saving your money and start investing.

On a final note, please seek the advice of a competent financial advisor before you put your hard-earned money to work.

READ: Nigeria’s Foreign Trade hits N9.18 trillion in Q3, as non-oil export rose by 374.5%