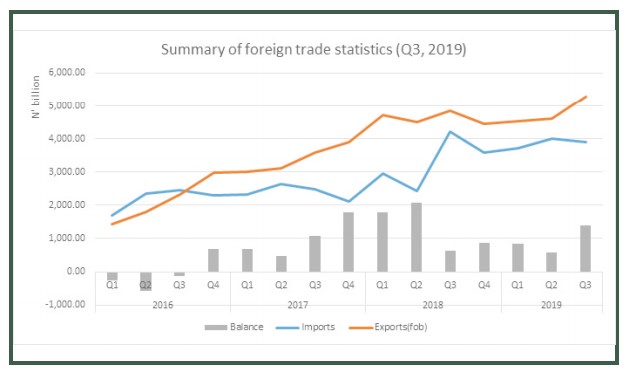

Nigeria’s total foreign trade (value of exports and imports) rose to N9.18 trillion in the third quarter (Q3) of 2019, up from N8.60 trillion recorded in the previous quarter (Q2).

According to the latest foreign trade report released by the National Bureau of Statistics (NBS), the total foreign trade increased by 6.67% within the quarter, a rise of N582.3 billion.

Basic Highlights

Nigeria’s value of the export rose significantly more than import. According to the foreign trade report, export component stood at N5.28 trillion, a 15.02% increase when compared to N4.59 trillion in Q2 2019.

[READ: Korea expresses desire to deepen trade ties with Nigeria]

- On the other hand, Nigeria’s total import in Q3 was valued at N3.89 trillion, a 2.70% drop against N4.01 trillion in Q2 2019.

- According to the NBS report, the increase in exports coupled with the decrease in imports led to a positive trade balance of N1.38 trillion during the period under review.

- Trade balance rose by 135.3% when compared to N590.4 billion recorded in Q2 2019.

- A quick breakdown shows that Nigeria’s non-oil export rose faster than oil export within the period under review.

- Specifically, non-oil export rose by 374.5% from N227.6 billion in Q2 to N1.08 trillion in Q3 2019.

Export gains momentum as Agric. sector down again

Nigeria’s total export trade rose significantly in Q3 2019, the biggest in the year. According to the report, the value of total exports in Q3 2019 increased by 15.02% compared to the level recorded (8.97%) increase in Q3, 2018.

- The value of total exports in Q3, 2019 stood at N5.28 trillion.

- Crude oil export accounted for N3.74 trillion or 70.84% of total exports during the period under period. On the other hand, non-crude oil export grew significantly, valued at N1.54 trillion or 29.13% growth.

- Further breakdown showed that the value of agricultural exports decreased by 42.69% in Q3 2019 relative to Q2.

- Meanwhile, the value of manufactured goods exports increased by 839.44% in Q3, 2019 when compared with the value recorded in Q2. Specifically, the export of manufactured goods accounted for N996.8 billion.

- The notable increase recorded in the export of manufactured goods was due to the re-exports of high-value cable sheaths of iron, as well as submersible drilling platform, Vessels and other floating structures.

- Analysis of trade by region disclosed that Nigeria exported most products to Europe (N1.86 trillion or 35%), followed by Africa (N1.45 trillion or 27.6%), Asia (N1.36 trillion or 25.74%), America (N598.3billion or 11.3%) and Oceania (N8.1 billion or 0.1%).

- Within Africa, exports to ECOWAS member states was worth N1.14 trillion, or 21.56% of total exports.

- According to the Bureau, the value of exports to Africa and ECOWAS was notably high in Q3 2019 due to exports of Cable sheaths of iron and submersible drilling platforms exported to Ghana.

Import down by N108.2 billion in 3-month

Nigeria’s import dropped by N108.2 billion (2.70%) in the period under review, and this was largely driven by a fall in the importation of solid minerals and other oil products.

- The importation of solid minerals dropped by 31.73%, lower than the value in Q2, 2019.

- The value of other oil products imported decreased by 41.85% in Q3, 2019 against the level recorded in Q2.

- Meanwhile, the importation of manufactured goods grew by 12.46% in Q3 2019 against the value recorded in Q2 2019.

- Importation of energy goods increased by 243.92% in Q3, 2019. This was due to the rise in import of other wood charcoal, electrical energy and charcoal of bamboo.

- During the quarter, Nigeria imported goods mainly from Asia and valued at N1.99 trillion or 51.3% of total imports.

- Other major imports originated from Europe, valued at N1.19 trillion or 30.6% while imports from the Americas and Africa amounted to N576.7 billion (14.8%) and N106.0 billion (2.7%).

- Also, import from Oceania stood at N23.8 billion (0.6%) of total imports while goods valued at N19.1 billion originated from ECOWAS.

Implications for the Nigerian economy

The latest foreign trade report shows some positives as Nigeria’s trade balance rose a high N1.38 trillion. This means the country’s trade balance (export-import) rose by N582.3 billion, and this was largely triggered by a fall in imports.

- When a country’s exports are greater than its imports, it has a trade surplus. This implies Nigeria’s trade surplus rose within the period and this is good for the economy.

- Also, the export of manufactured goods rose significantly, and this drove the country’s non-oil exports. This suggests the country’s diversification agenda may be yielding some positive results.

- However, despite the improvements in the country’s trade, agricultural exports suffered a major setback within the period.

- In Q3 2019, Nigeria exported only N42.1 billion worth of agricultural export, the lowest since Q4 2017. This means the nation’s agricultural sector has continued to witness slow momentum for investors.

- Also, despite the improvement in total trade, Nigeria is still largely an oil-dependent economy, as the country’s oil export constituted 70.87% of total export revenue in the period.