No fewer than 1000 petty traders and artisans in Kwara state are set to benefit from N1 billion loan disbursement by the Kwara State Social Investment programme (KWSSIP) under the Kwara State Government.

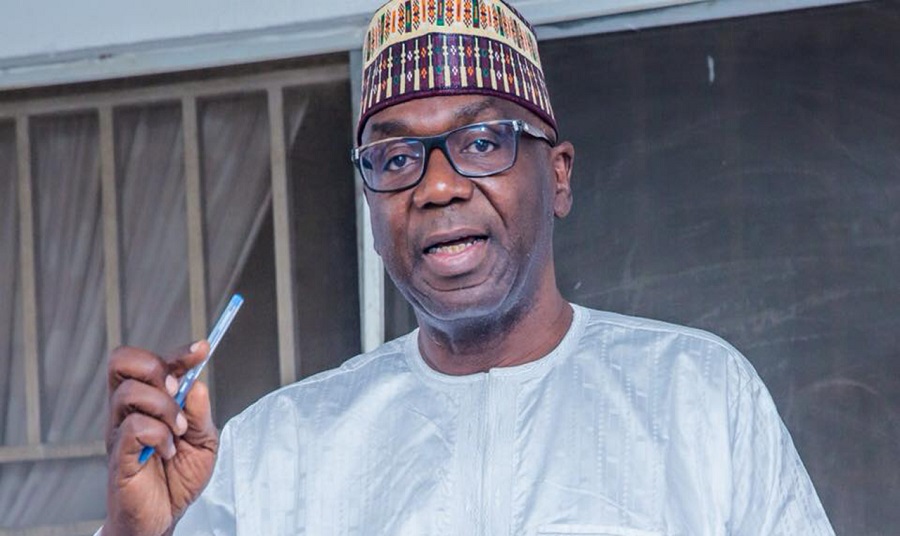

The loan disbursement plans was disclosed by the state governor, Governor AbdulRahman AbdulRazaq during a meeting with journalists, in Ilorin.

AbdulRazaq said that the Poverty Reduction Programme aims to assist Kwarans to acquire and develop lifelong skills. He explained that this programme will help make available credit to petty traders, artisans, farmers, enterprising youths, men and women, while the homegrown school feeding programme would improve nutrition.

READ MORE: Ondo State Government boosts SMEs with N166 million disbursement

“Under the Kwara State Social Investment Programme, for instance, we plan to spend N1bn to help traders and artisans with soft loans. We are looking at roughly 1000 beneficiaries of such soft loans. We cannot watch while our people are suffering. We have to do something in that regard.” He said.

About the Kwara State Social Investment Programme (KWSSIP): The programme which is in line with the Federal Government’s Social Investment Programmes, the KWSSIP also comprises of the Kwara State Conditional Cash Transfer. This Conditional Cash Transfer is built to support citizens in the state living within the lowest poverty bracket with the aim of improving their nutrition and increasing household consumption.

AbdulRazaq spoke on the idea behind the programme, explaining that it was developed in line with his vision of an administration centred on human capital and infrastructural development. He noted that it will attract investments, combat poverty and take Kwara to the top of the table of revenue generation and competitiveness.

READ ALSO: UNDP to partner with Tony Elumelu Foundation to support youths in Africa

He further added that the World Bank has indicated interest in the scheme, which is the first of such state-led initiatives modelled after the Federal Government Social Investment Programme.

Why this matters: The funding will help in boosting the businesses of the traders and artisans in the state. More of this should be encouraged because the major challenges Nigerian businesses face is lack of adequate credit facility and business expansions.

Taraba