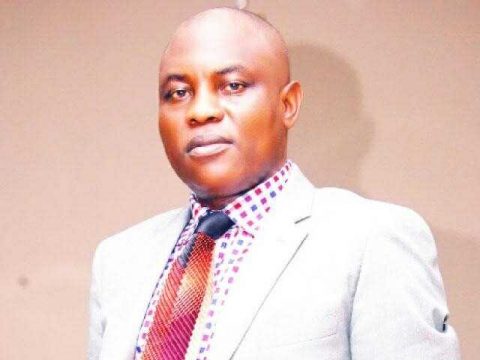

In a display of honesty and integrity, the Managing Director of Peace Mass Transit (PMT), Dr Maduka Onyishi has returned an excess sum of N2.2 billion mistakenly paid into his bank account.

According to a report, the cheque of N2.2 billion was collected by Kokelu Ben, the Business Manager, Commercial Banking of First Bank and Branch Manager of Unity Bank, Enugu Branch, Mrs Ifeoma Eleanya.

[READ MORE: GAZ banks take the lead once more]

Excess money: Onyishi explained that he requested for the sum of $3 million from the Central Bank through Unity Bank only for his First Bank account to be credited with $10 million, resulting into an excess of N2,219,500,000.

“The amount they paid in was N3,219,500,000 but my money there is N1,000,000,000, so the balance is not mine. I said I cannot invest this money and be profiting from another person’s sweat, and I can’t also keep it. I can’t keep $7 million that doesn’t belong to me.”

Onyishi, who was determined to get to the bottom of the matter, called his bank and queried them for making excess deposit into his account. His bank could not clarify the mistake, so they responded that the money was originally his.

[READ MORE: Here’s why Huawei’s ‘HarmonyOS’ won’t be replacing ‘Android’ anytime soon]

Bent on tracing the excess money to its real owner, Onyishi discovered the bank had also made the same mistake by paying someone else extra money. This was after demanding a statement of account.

“I told my bank to pay money into my account that I want to take $3 million but they paid $10 million instead. I called them and informed them of the overpayment but they said the $10 million was mine.

“I told them they failed to give me a statement of my account even when I demanded it severally. I discovered later that the amount was even more than what we are talking about because there was another person I asked the bank to pay who they paid extra.”

The process of reconciling the money took a month after which nothing happened. All of these culminated into a move where the Peace Mass Transit boss returned the money after informing the Central Bank of the loophole.

“That’s why I invited First Bank and Unity Bank and reporters. I said let me give the money to First Bank, if they find out that the money is mine, they should return it. If it belongs to Unity Bank or CBN, give it to them. If it is your own, keep it. So, I am giving this money to you to keep on trust.”

The Business Manager, Commercial Banking of First Bank, Ben Kokelu was elated as he lauded the move. Going forward, he promised that the situation will be analyzed and solved.

“I must state that Dr Onyishi is a man of integrity. When we look into the situation, we will advise him on what happened and how to remedy this situation.”

[READ FURTHER: Xenophobic attacks: Buhari and Ramaphosa to meet]