- In this review of the best mobile banking apps in Nigeria, some usual apps are featured.

- This is mainly because these apps have continued to be the best regardless of their shortcomings.

- The review is intended as a call to action for banks to do more in order to continually improve on user experience.

Sometime in April this year, Omolara found herself in a scary emergency situation. It was about 2:45 AM and she was having the worst stomach upset ever. The pain was unimaginable. And as a young woman who lives by herself in a luxury Lagos apartment where all the neighbours mind their businesses, the only option she had was to call either one of her friends or family members to take her to the hospital.

Grabbing her phone as she laid still in a foetal position, she tried calling Makinde, her boyfriend. Unfortunately, there was no call credit on her phone. She then tried texting him on Whatsapp but got no immediate response. So, she decided to top up her credit using her mobile banking app in order to call Makinde.

But the app malfunctioned. Omolara tried many times to use it but all to no avail. To make the matter worse, she was debited for as many times as she tried buying airtime with the app, even though her phone was never recharged. This only aggravated her already bad situation. Sadly, she had to endure the pain until later that morning when her boyfriend saw her messages and rushed down to help. Eventually, Omolara had to switch to a different financial services provider mainly because of that bad experience she had.

[READ: Renmoney improves loan access with mobile centres]

Need for efficient mobile banking

Omolara’s story underscores the importance of efficient banking services and in this case, functional mobile banking. The phenomenon has become an integral aspect of banking, especially nowadays when many people want to be able to do many things on their phone; albeit easily.

It is our tradition, here at Nairametrics, to constantly monitor and analyse developments in the Nigerian mobile banking space. We also like to periodically rank the apps, based on our observations and what the people customers are saying.

The top mobile banking apps in H1 2019

In the past six months of 2019 which came and went like the speed of light, a lot of things happened in the Nigerian banking sector, especially as it pertains to mobile banking. While some banks continued to improve on their mobiles in order to deliver better services to their customers, others lagged behind.

That said, below are the top best mobile banking apps in Nigeria as of H1 2019.

1. UBA Mobile Banking

This mobile app is one of the most downloaded across platforms such as Google Play, Apple App Store, and Microsoft Store. It has all the basic features of a typical and functional app. Star rating on Google Play stands at 4.4 out of 5, and 3.9 out of 5 on Apple Store. Security is not a problem. By all standards, it is a pretty good mobile app.

Regardless of the positive reviews, some customers aren’t quite happy about some issues. Apparently, the latest upgrades that were carried out cause some features to malfunction. Complaints range from the app not showing details of transactions to money not being sent to recipients.

Regardless of the complaints, this is a good app that will become even better as UBA continually improve on it. You should definitely download it if you are a UBA customer.

[READ: Airtel partners phone brands to woo customers as subscribers decline]

2. Zenith Bank Mobile App

Much like the UBA Mobile App, this app has been downloaded over a million times by users. It offers the basic features of a mobile banking app and has generally received a total of 4.3 stars on Google Play and 3.1 stars on Apple Store.

Users love it for many reasons, although it is not perfect. As always, many customers complain that since the app was last upgraded, it has often been difficult to either login or even use it to perform simple transactions like purchase airtime. One of the complaints that caught our attention read thus;

“I just noticed this app has been updated to a completely new look. However, I’m unable to login, it just shows connecting without access. Secondly, I’m amazed that there is no notification informing us in advance prior to this. Was there any, which I missed? What do I need to do to be able to login in?”

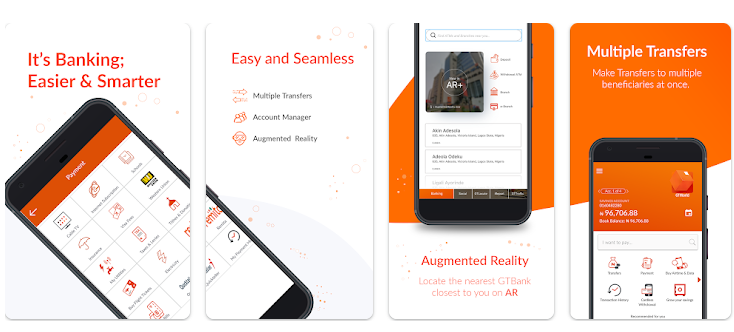

3. GTWorld

This is another one of the very good mobile banking apps in Nigeria right now. GTWorld has 4.1 stars on Google Play and 2.7 stars on Apple Store. Nearly a million people have downloaded it. The app is very easy to use and hardly malfunctions, although sometimes it can be difficult to login; especially when the network connection is poor.

On Google Play right now, all the latest reviews are mostly positive. That notwithstanding, customers want GTBank to continually improve on the app in order to ensure a better user experience. A particular comment best summed up our thought on the app;

“Setting up my account was easy. However, this is a world-class app so the developers need to do a little more work on it: 1) The title of the bottom right icon does not display fully 2) The interface of the quick credit needs some more work. a) I assume it should show me Max allowed the loan as a label field and allow me to specify the amount I want to collect b) The sliders don’t show values which leaves you having to guess what the position represents. It’s a work in progress…”

4. First Mobile

First Mobile by FirstBank has 4.3 stars on Google Play and 3.1 on Apple Store. It is one of the most used mobile banking apps in Nigeria and elsewhere, thanks to its efficient features. Reviewing the app, a particular customer said: “this app is great, I have used it for over 5yrs…”

However, not everyone is a fan. Some users are particularly upset over what they describe as the inability to make transactions following their last update. It is, perhaps, important to point out that this seems to be a general problem across all the apps. Major updates come along with minor issues as described by the comment below-

“I thought I was the only experiencing this since my last update. First, the app doesn’t allow one to view transaction history anymore, which is very sad. Secondly, some folks are complaining of not being able to take a screenshot. Yes, I noticed that too. But I think the option for saving transaction receipt is still ok. the former is the problem that needs urgent rectification.”

It is, therefore, important that FirstBank consider rectifying the issues raised by its customers in order to keep them happy whilst ensuring that the mobile banking process is easy and effortless.

[READ: Ecobank shakes up the competition, introduces low-cost remittance app]

5. Access Bank Mobile App

Being the largest bank in Sub-Saharan Africa by customer base, it is not surprising that Access Bank’s mobile app has been downloaded over a million times by users. What is also not very surprising is the fact that the app has been 4.3-star rating on Google Play and a 3.2-star rating on Apple Store.

By all standards, it is a functional app. However, it does need continuous improvements. As it is, customers complain that they often struggle to log in, even as others want the bank to make it possible for users to be able to sign in more than one accounts using the app.

Hopefully, these issues will be sorted out as the bank work towards launching its next updates soon.

6. Stanbic IBTC

This mobile app has a 4.1-star rating on Google Play as well as 3.6 stars on Apple Store. One of the reasons users love it is its easy to use features. Interestingly, the bank has a way to detect when customers are having issues using the app, even as they take swift action to contact them for assistance.

However, it is not the best app in Nigeria, considering that it has its own issues. While it does have very glowing remarks/reviews, the latest comment on Google Play warned prospective users thus;

“PLEASE DON’T DOWNLOAD!!!? This app is very bad. You won’t be to register no matter how hard you try. Going to the bank as suggested by Stanbic is a complete waste of time coz they can’t find a solution. They’ll waste your whole day… They’ll delay you. Believe me, there’s nothing they can do but to blame and direct everything to the Headquarter.”

[READ FURTHER: 11 money-saving apps you need to download now]

7. FCMB Mobile Plus

With its 4.0-star rating on Google Play and a 2.9-star rating on Apple Store, it is easy to see that the FCMB mobile app is beloved by many of the more than 100,000 people that use it. However, users have complained that the bank needs to update the app in order to make it possible to generate receipts after each transaction.

“Good morning. You guys should please your update the app, to make room for the creation of receipts. it’s very important. That’s a factor that makes your application acceptable.”

“The app is great, nice experience so far, but it doesn’t generate receipt after a transaction. plz look into that.”

8. Union Mobile

We chose this as one of the best apps in H1 2019 mainly because of its easy to use features, the 4.3-star rating and the 3.2 stars given to it by more than five hundred users. Apparently, it has a lot of efficient services to offer users. However, some people feel it could be better, which is why they’ve called for improvements.

“The most unhelpful banking app. My UnionMobile app. suddenly refused to function and told me to contact Customer Care. I did. I updated the app. But registering became a problem. I’ve been attempting to register for over a month, to no avail. I keep being told to enter the OTP sent to me via SMS, which I did, also to no avail. I keep getting the error message that the OTP I entered is invalid. They seem to expect the OTP to be entered almost before you’ve received it.”

9. PolarisMobile

This app has 3.8 stars on Google Play and 3.0 stars on Apple Store. About five hundred thousand people use it. It has received great reviews by users. Some others, however, have reasons to dislike it.

“I’m always seeing something bad that makes me dislike it. The update was made to better but to access someone’s account at his own time is a problem. It’s message always is, “we are sorry, but the service is temporarily unavailable”. What work do this bank do to resume service that can’t end for this long? I hate this App.”

10. Ecobank Mobile Banking

Someone said the app is the biggest trash in this life.

“The biggest trash in this life is the app. Not functional. After downloading the app, it will request processing for like 42 years and no response. I’ve been directed to several branches for assistance but none of them can handle the app. I wish there’s a negative star that I can give to this. It’s so annoying.”

While the user had his reasons for writing this review, we believe this is particularly harsh. After all, the app does have great features. This is why there are more than a million people using it, some of whom have given it a 4.0-star rating on Google Play and 2.9 stars on Apple Store.

However, just like all the other apps we’ve reviewed, Ecobank does need to continually improve on its mobile app in order to guarantee better user experience.

READ: FCMB declares and pays N2.77bn dividend for the 2018 financial year

There’s a good reason Nairametrics has only one Emmanuel. His kind of writers are rare to see.

Well done, young man.

Thank you.

Well done sir.

Thank you.

Unitymobile is also user friendly with high security.

Noted.

Trash

Thank you very much. Bless you.