“Akara and moin moin get the same parent, na wetin dem pass through make dem different” – Niger Delta proverb.

A little over a year ago, in March 2018, FairMoney, an online lending platform, launched in Nigeria. Now, disbursing over one thousand five hundred loans daily, the company has helped thousands of individuals and small businesses get closer to their dreams and most importantly access to critical finance made possible by the power of technology.

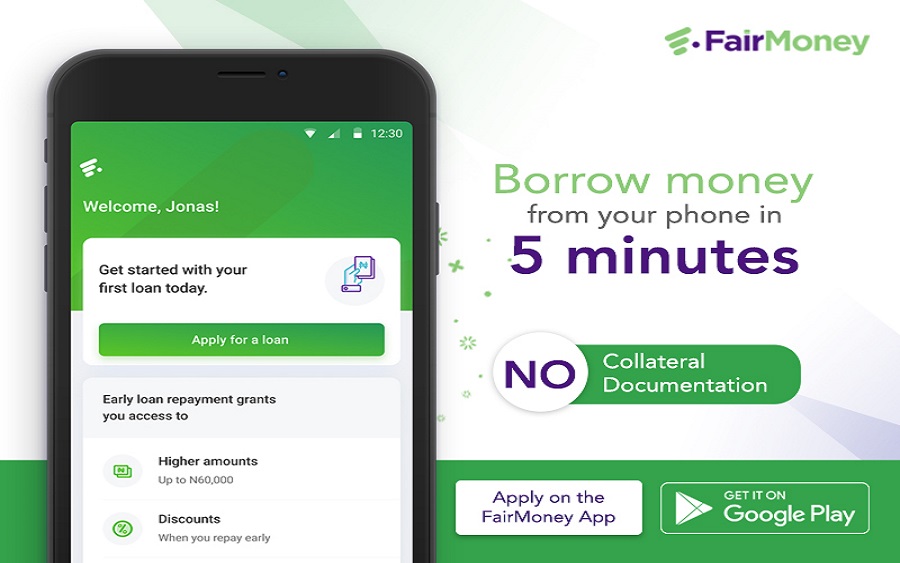

Customers access instant loans on FairMoney without collateral, extensive documentation or office visits which typically make borrowing money stressful for users.

FairMoney is taking customer experience to the next level and has launched an upgraded android app to reflect this as it enters the next phase of growth. The new FairMoney app is easier to use and reflects the new brand which portrays the vision of providing access to financial services for everyone in Nigeria.

According to FairMoney’s Head of Growth and Marketing, Joy Uzuegbu, the short-term loan provider has optimised its processes and improved overall customer experience.

How to get a Loan on FairMoney

Getting a loan on FairMoney is easy and straightforward as described in a few steps below:

- Download the Android app from Google Play Store

- Sign up or log in with your phone number or Facebook profile

- Create your profile (for new users) and/or submit an application.

- Receive money in your bank account within minutes.

In addition, customers can access higher amounts of up to N150,000 and 3 – month Installment loans. Customers with positive loan history performance would also be able to enjoy flexible interest rates.

While the Nigerian society has a sort of love-hate relationship with borrowing, the use cases for a product like FairMoney are extensive. From personal needs like paying bills, shopping and family dependencies to business loans for starting that side hustle or building a credit profile, FairMoney’s loan product covers a wide range of options.

FairMoney’s proposition seems built around customer-focus, secure technology and speed – all of which makes sense for an online loan service that doesn’t rely on collateral to reduce lending risk. It’s 4.3-star rating on the Google Play Store validates that proposition to a certain degree. If you’re interested in short-term, quick loans that don’t require collateral or office visits, FairMoney is a good place to start.

Fairmoney is completely useless after a long registration process they offered me a loan of N1,500, lunch money, completely useless

FairMoney is so unprofessional and fraudulent.

Comment:

I have been trying to access loan from Fair Branch for two weeks now to no avail. All necessary calculations have been done by the bank but no money was posted into my account. Why?

I need phone number of your clerk,that I can discuss with about payment plan.Thanks.

I borrow money for him I’m a business man I’m living in ede osun state ararumi

I NEED MONEY FOR FAMANY

please I need an urgent loan for my business please

I need the money for something

Hello, am one of your customer,you promise to reduce my loan interest anytime I pay early but u didn’t give and you also increased the interest. Please can you explain why (am Saruffson)

Does fairmoney request password before upgrading your account

Hi good morning am on Abel to fill the form

I want loan your workers are not responded hope no problem

I borrowed a loan of 2500 which they said I was credited but didn’t receive alert on my phone why.

I connected my card and the usual fifty naira was deducted but was keep asking to connect my card. Honestly this is prostrating. I also paid my loan since April this year but I was told to go and pay and over due long. Please correct this difficulty for me. Thanks ?

Have been applying for the loan for the past three weeks now, have filled all the necessary forms but you keep telling me that my card is invalid and my account number is invalid this is the card and account am using. If you don’t want to give the loan stop messaging me to apply. Ok

Nothing works well in Nigeria systems and institution . One day everything will be ok as God puts in some body sensible in government

I need loan please

I need loans pls

I need load please

I need a load please 🥺