The National Bureau of Statistics just released the December 2018 inflation report, which showed that inflation rate increased by 0.16% to 11.44% in December 2018, from 11.28% in November. This came in 0.10% higher than our projection of 11.34%. The mood in the equities market is expected to remain unchanged, as the uncertainties regarding the upcoming elections should continue to shape activities within the space. We also do not envisage any major change within the fixed income environment, as the bearish equities market and relatively high yield environment in the fixed income space should continue to tilt investors preference towards fixed income instruments.

Festive Season Kept Food Prices Up in December

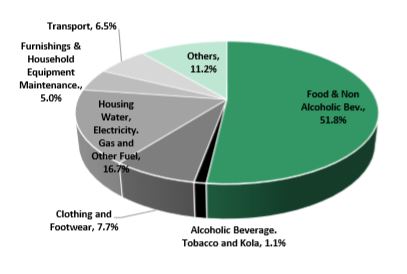

The higher inflation rate in December was majorly driven by the pressure on the food sub-index. Increased demand-side activities in preparation for the festive season impacted prices of food in December, as the food sub-index rose by 13.56% YoY from 13.30% in November. The core sub-index, however, came in lower at 9.77% in December from 9.79% in November 2018. The regular CBN intervention alongside the creation of an additional day for FX injections supported prices of the components in the core-index.

Equities Market Performance to Remain Unchanged

The bearish mood in the equities market persists in 2019, as the NSEASI closed down on the first two weeks of trading, bringing the YtD return to -5.09% as at Friday the 11th of January 2019. The rising political uncertainty, as the election draws nearer, should still weigh on investment decision. Hence, we do not exepect this newly released inflation numbers to have any significant impact on market activities.

Yield Environment to remain Attractive

The higher inflation expectation from the pressure of the festive season alongside campaign related spendings have already been priced into the yields of fixed income instruments. We, therefore, do not expect any major change in the yield environment, as yields should remain attractive inorder to keep the real rate of return positive and also control capital flight due to the rising political uncertainty.