Daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, bonds, Forex inflation, oil price.

- Bond Yields Trend Higher as Market Players Stay Risk Off

- Global banks HSBC, UBS close Nigeria offices, foreign investment falls

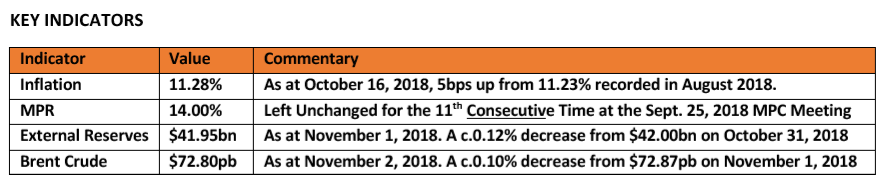

KEY INDICATORS

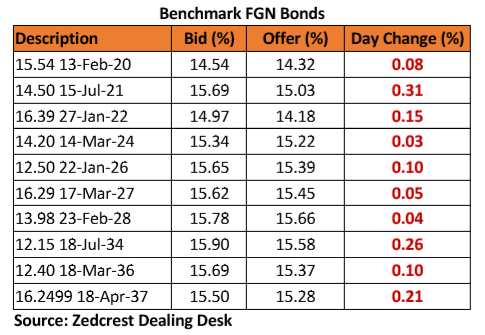

Bonds

The bond market remained bearish in today’s session, with increased selloffs pressuring yields higher by c.13bps across the curve. The recent selloffs have now pushed yields above the 15.50% mark on most of the mid and long tenured bonds, with selloffs most notable on the 2028 and 2034 bonds, which traded as high as 15.74% and 15.68% in today’s session.

The market looks to now be net long of bonds from a prior net short positon in the previous month. Given the recent wave of selloffs and weaker local client interests, we expect these bearish pressures to persist, with a 16% level for bonds now in the horizon as market players maintain a relatively risk off stance across the curve.

Treasury Bills

The Tbills market was dominated by interests on the shorter end of the curve, mostly on the Nov maturities, due to the relatively buoyant level of liquidity in the system. Market players however stayed flat on most other maturities, due to expectations for continued OMO auctions at more attractive levels on the mid and long tenors.

In the coming week, we expect the market to trend slightly bearish, with expectations of a renewed tightening of system liquidity via further OMO and FX interventions by the CBN.

Money Market

In line with our expectations, the OBB and OVN rates remained relatively unchanged at 4.08% and 4.83%, as system liquidity improve significantly to c.N810bn on the back of some unidentified inflows from the CBN.

On the back of the robust system liquidity levels, we expect rates to remaining moderated opening next week.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.60/$ (spot), while the SMIS rate was eased by the CBN to N361.45/$ from N362.82/$ previously. At the I&E FX window a total of $231.24mn was traded in 284 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate depreciated by c.0.06% to N363.74/$ from N364.54/$ previously.

At the parallel market segment, the cash and transfer rates remained unchanged, closing at N361.00/$ and N364.00/$ respectively.

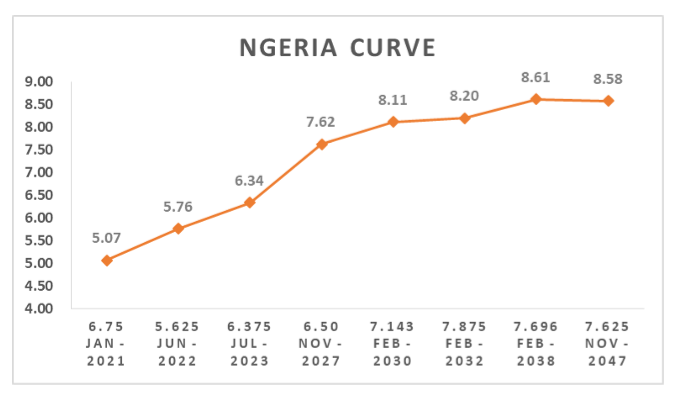

Eurobonds

The NGERIA Sovereigns regained some grounds in today’s session, as yields compressed by c.10bps on average, with the most interests seen on the 2038 (+0.60pct) and 2047 (+0.70pct) PX gains.

In the NGERIA Corps, clients showed the most interests on the SEPLLN 23s which gained c.0.40pct on the day. Interests were also seen on the ACCESS 21s (both), ZENITH 22s and UBANL 22s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

I want to invest in treasury bill please when is the next investment period needs to be guided thanks.

How do I get daily update on treasury bills in Nigeria