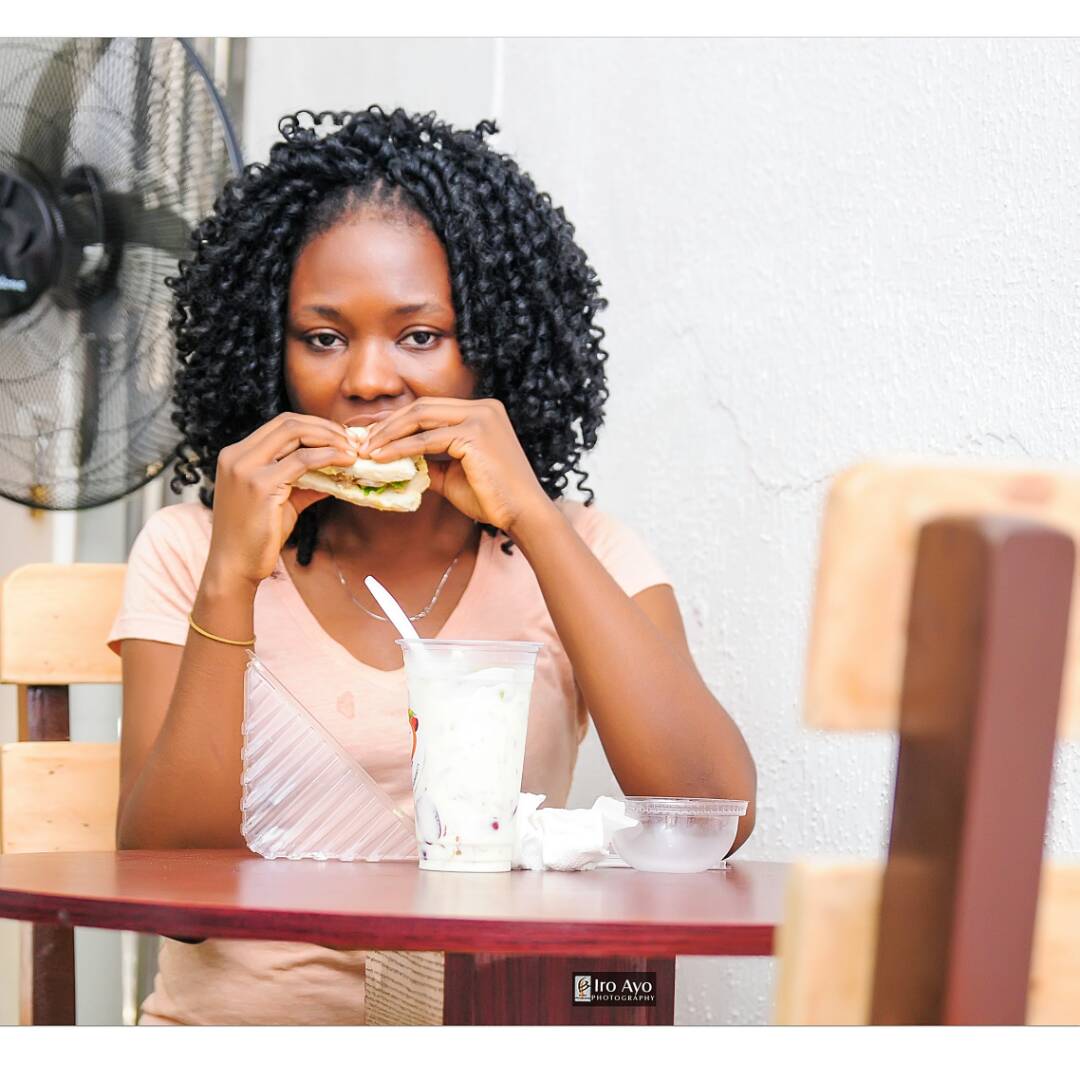

JokemFruities and Events Enterprises is a healthy living company, registered in 2016 with an outlet at 3, Adeyemi Odukomaya Street, Shangisha Magodo. The business is divided into two segments: the retail side and the event side.

On the retail aspect of the business, Jokem provides healthy salads (shrimp, shredded chicken, and snail) Natural fruit juice, fruit salads, smoothies, fruit parfait, sandwich.

On the event side, Jokem caters to corporate and social events with their fruit tree, cocktails and desserts.

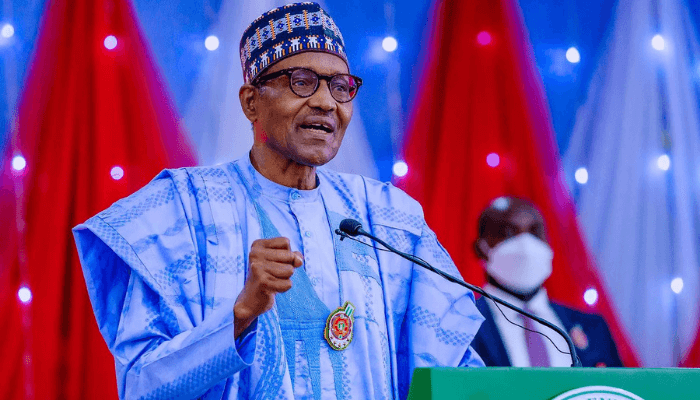

In an interview with Nairametrics Lead Analyst Onome Ohwovoriole, Oluwakemi Johnson, the founder of Jokem discusses a wide range of topics from her start-up capital to advice for entrepreneurs.

Onome Ohwovoriole (O.O): Why the name Jokem?

Olukemi Johnson (OJ): Jokem was a nickname given by one of my teachers in secondary school, and since then the name stuck. I chose the name Jokem because people were more familiar with that.

O.O: What led you to the juice and salad business?

0.J: Entrepreneurship classes were introduced in my final year at the Adekunle Ajasin University (AAU) Akungba Akoko. I belonged to the fresh juice group as a student. I enrolled for fashion designing while waiting for NYSC, but switched to learning about fruits when the fashion house did not show seriousness.

Initially, I wanted to work in a media house because I studied English language at the university and I served in one during NYSC. However, this was not forthcoming, so I had to look inwards. Fortunately, healthy living was just becoming a thing back then, so I decided to key into consumer’s appreciation for healthy living.

Starting my business was tough at first, funds were limited and this was what necessitated my relocation to Akure, Ondo state, from Lagos.

O.O: How much did you start with?

O.O: How much did you start with?

OJ: I got ₦8,000 from an aunt but was left with ₦4,000 after I had done a market survey. I started in December 2013 with ₦4,000. I bought a few take away packs and a few fruits.

My aunt was also kind enough to give me an apartment, which was close to a few Ministries. From there, I got my first set of clients. The very first order I made was 10 packs, and they sold out. The same thing happened in the 2nd and 3rd week.

The civil servants were impressed with my neatness and determination to do something for myself, rather than beg them for money. I got my first corporate event to supply fruit packs at a wedding, a few weeks after I started out.

The acceptance I got, encouraged me to press on. Sometimes I had to wake up early to make the juice and keep it chilled when there was a power failure.

O.O: Which do you prefer between corporate events and retail?

OJ: Corporate and retail events compliment each other. Retail customers recommend my company for corporate events. At corporate events, I also get referrals. Retail clients also help to keep the business going, at periods when there are few corporate events such as the early part of the year.

O.O: What is your current turn over?

OJ: Jokem’s annual turn over currently run into millions of Naira.

O.O: What are the challenges you face running this business?

OJ: My biggest challenge is the epileptic power situation in the country, which means sometimes means I have to wake early to make juice. A sudden change of plans by clients sometimes crops up. So a client could ask me to deliver at 6 am, rather than later in the evening as previously agreed.

O.O What would you do differently, if you were starting out all over?

OJ: I would have embraced social media much earlier to promote my business. Social media gives prospective clients a means of verifying my authenticity, especially in this era of fakes and copycats.

O.O: How do you deal with difficult customers?

OJ: I try as much as possible to satisfy my customers because they are essential to my business. I have had to replace packs earlier ordered because customers did not like them. I also take specific notes of preferences by each customer. I encourage my staff to do the same.

I am lucky to have a good staff, who take initiative in my absence. My dispatch rider often comes around to ask how else he can help

O.O: What has been your worst day so far

OJ: My worst day so far was when I had to make a delivery to Sango Ota. The client told me she was on the mainland. I ended up carrying the packages on my head. I had to go through with the order because I got the reference from someone who was based abroad, and I don’t like to disappoint my customers.

O.O: What advice do you have for upcoming entrepreneurs?

OJ: Consistency. Upcoming entrepreneurs should start small and be consistent in what they do.

Well done. Keep it up!

Well do madam I would like to know more on this business and also want to lean how to make fruit salad please can you teach me.

My email:uyiken@yahoo.com

Comment: Great Job madam, Would like to be trained by you.How can I reach you please….

Weldone ma, I Studied food science and technology, I will love to be trained by you on this course