This Corporate News Compilation for the week ended December 2nd, 2017 is brought to you by Bluechip Technology Ltd Nigeria.

- Wärtsilä a Finland based company and global leader in advanced technologies and complete lifecycle solutions has received a letter of award from Pan Africa Solar to build a 95.3MW solar project in Nigeria. They claim it could “power over a million homes in the country”. Pan Africa Solar Limited is 50:50 Nigerian/ European joint venture utility scale Solar Farm investor and developer presently focusing on Nigeria. Their “mission” apparently was to build 1000 Mega Watts of Electricity from our Solar Farms in Nigeria by 2017. The 95.3MW solar project is exclusively for on-grid application, meaning that the power will be sent to the grid. The project will be located in Katsina State. Their “mission” apparently was to build 1000 Mega Watts of Electricity from our Solar Farms in Nigeria by 2017. The 95.3MW solar project is exclusively for on-grid application, meaning that the power will be sent to the grid. The project will be located in Katsina State. In simple terms, this means instead of building fossil fuel fired power stations; we build solar ‘fired’ power stations.

- In more power related news, NBET announced that is has signed a Power Purchase Agreement (PPA) with Mabon Nigeria Limited, which is currently executing 40 megawatts hydro-power project. The power being generated will be sent to the grid. The company says the project cost about $48 million and is at 80% completion stages. The project is located in Gombe State.

- Matrix Energy, a downstream energy company, announced that its 5,000 metric tons storage facility located Warri South Local Government Area, Delta State, will open in December. The plant they claim will ensure the steady supply of affordable Liquified Petroleum Gas, LPG. They also said they have purchased about 17 LPG trucks and “expecting additional 30 trucks before the end of December to enhance operation.

- Last Week, OPEC agreed to not to cut Nigeria’s oil output allowing the country produce crude at the cap agreed in 2016. NNPC on the other hand is looking for creative ways to fund its huge cash shortfall which has so far, inhibited investment in the sector. The company, we gather will is offering a $5 billion cash for crude deal that will allow it to borrow money from creditors in exchange for crude over 5 to 7 years. Among the potential trading firms being spoken to by NNPC are Glencore, Vitol and Trafigura. The deal could involve about 70,000 barrels per day of crude. NNPC also has a 300,000bpd of crude oil swaps which it uses to import fuel.

- In a recent threat to fuel availability in Lagos and Ogun State, IPMAN said they wanted to shut down about 900 filing stations because they were operating at a loss. They claim this was because the DAPMAN, sold fuel to it at N141 per litre as against the N133.38 per litre agreed with NNPC. They claim losses are inevitable when you account for bank charges and overheads. DAPMAN stands for Depot and Petroleum Products Marketers Association (DAPMAN).

- Prepaid meter users in Nigerians who have been suspicious of the way their meter runs got their suspicions heard at the National Assembly last week. A member of the House of Representatives, Mr. Adedapo Lam-Adesina, had in a motion complained about the way the prepaid meters gobbled up units and specifically mentioned Mojec meters. However, the CEO of Mojec Meters, Chantelle Abdul, denied the claims saying that their “smart prepaid meters are best-in-class’ in terms of quality.”

- Novare Real Estate Africa, the owners of Novare Mall in Lekki and 2 other malls in Abuja, last week opened a new Mall in Abuja. The Novare Gateway Mall in Abuja is located on main 10-lane highway between the Nnamdi Azikiwe International Airport, and the Central Business District (CBD) and is said to cost about $68 million. The Mall sits on a 10,000sqm land and accommodates 33 or more shops with Shoprite as the anchor tenant. The Novare Mall is Lekki sits on 22,000sqm of land, and is one of the largest in Lagos. Novare Equity Partners is a South African based Real Estate Investment Company.

- Dangote and Jumia signed a deal last week that will see Dangote Cement being sold on Jumia. Based on the deal, anyone looking to buy 300 bags of 50kg to 600 and 900 at a time can now buy on Jumia at price of N2,500 per bag and have the product delivered at no extra cost to anywhere of their choice in Lagos, Port Harcourt and Abuja.

- And Jumia also reeled out some data on its Black Friday sales. According to the company, More than 1.9 million visits on Black Friday Big Bang. 14.4 million visits since the start of the sales event; Overall, 85% of all visits were made on a mobile device, compared to 72% in 2016; and 86,000 smart phones and counting have been sold in the past two weeks. It was also revealed that about 380,000 – Number of spaghetti packets that have shipped out, 208,214 – The number of times the Jumia app has been installed since the beginning of Black Friday festival. The top selling feature phone has been the Tecno T401 – (Triple Sim, Back Camera with Flash), Items sold on Black Friday 2017 Big Bang day was 174% more compared to the items sold in 2016.

- In a rather sobering news, Konga, one of Nigeria’s largest E-commerce website slashed its work force by 60%. Last time Konga slashed 10% of its workforce in January 2016, its founder and former CEO, Sim Shagaya stepped down. Konga also made a slew of announcements including switching to a prepay service. This will help the company curb issues around payment on delivery, cancellation of orders etc. Konga also said it will be charging its merchant a rental fee for selling their products on Konga. This is in addition to taking a commission of any item sold on Konga.

- Ntel announced last week that it had signed a national roaming deal with 9mobile, which will allow its users make calls using 9Mobile’s network. A bit like when you use your line to roam abroad but only this time it’s local. It’s commonly used abroad and is cost efficient especially for new entrants who do not need to have presence in remote parts of the country.

- PWC survey indicates Shared Service and Centralised Processing Centres are experiencing unprecedented change. According to the survey findings, organisations are implementing Shared Service and Centralised Processing Centres as an efficient strategy towards safeguarding the bottom line. They also claim winners will be those who can balance excellent service delivery and reduce cost. However, the interesting part of the survey is the use of bots. The report claims, the next frontier for most Nigerian business will be the use of robotics or bots to execute repetitive processes, thus reducing headcount and associated costs.

- Tech giant google has introduced Datally, an app that will enable customers to manage their data subscriptions more effectively. The app is targeted towards emerging markets such as Nigeria and the Philippines where internet access is relatively expensive. Datally can be downloaded on phones running on the android 5.0 Lollipop or newer. The app notifies the user how much data each app uses, and gives them the option of turning them off. Data usage can also be viewed on an hourly, daily, weekly and monthly basis.

- Osun State seems to be getting its own Industrial Park, if the recent MOU signed between the state government and Chinese firm, Jiangsu Wuxi Taihu Cocoa Food Company Limited materializes. The park said to cost about N216 billion will be built on 200 hectares of land. The partnership is also expected to support the state in six different investments; cocoa bean processing, chocolate and food processing, salt processing, cassava starch processing, gold mining and power plants. The Chinese company will be investing $600m. A background check of the Chinese company reveals they generate about $100m in sales annually and employ about 500 people. It used to be a state-owned company named Wuxi Huaxin Cocoa Food Co Ltd until it was privatized in 2005 and acquired by Shanghai Golden Monkey Group, a Chinese chocolate maker. In 2015, Shanghai Golden Monkey Group was acquired by the American chocolate maker Hershey’s and then changed its name in 2016 to Jiangsu Wuxi Taihu Cocoa Food Co Ltd.

- South Africa’s Tiger Brand is back in the market. The company, which bought Dangote Flour Mills for over $200m and ended up selling it back to Dangote for $1, after racking up losses, says it has now gotten its strategy right. It will be placing more emphasis on due diligence than in the past. It would closely assess all aspects of target firms, including routes to market.

- Affelka, the majority shareholders of Seven-Up Nigeria has informed the Nigerian Stock Exchange of its intention to buy out the remaining 27% of the shares of the company it currently does not own. The offer is seen as a sign that the owners of the company are looking to go private. Seven-Up has been facing declining margins and posted a loss of about N10 billion in the year ended March 2017. The company did not pay dividend and is likely to go another year without dividends as losses persist. The move also positions the company for a potential investor considering the slew of deals currently taking place in the beverage sector.

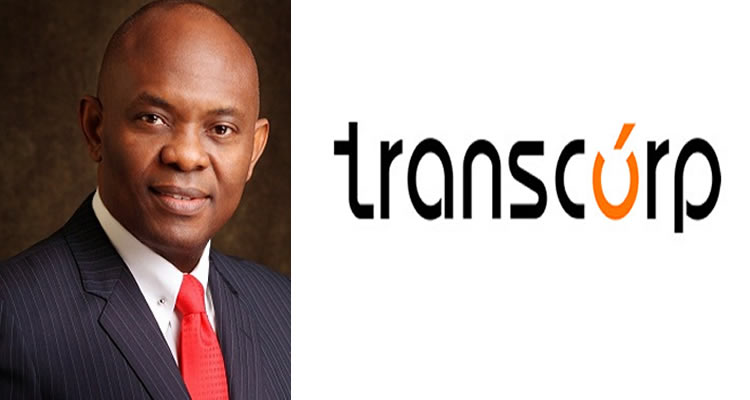

- Transcorp recorded a block sale of 11,274,668,322 units on Thursday at N1.26. The deal worth an estimated N14.2 billion sent shock waves through the market as investors wondered what was going on. However, we understand the deal is an intercompany transfer of shares between Heirs Holding, the majority shareholder and an unnamed entity, possibly owned by Mr Elumelu. Mr Elumelu directly and indirectly owns about 47% of Transcorp.