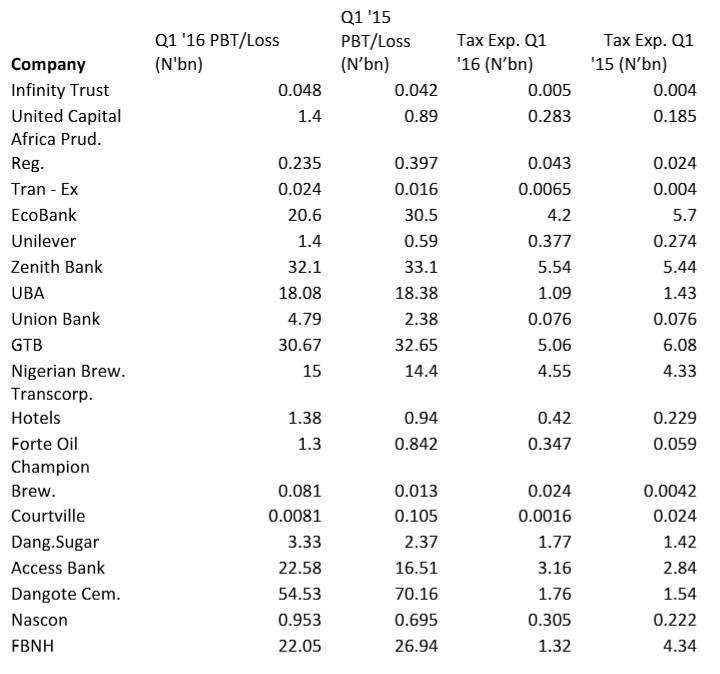

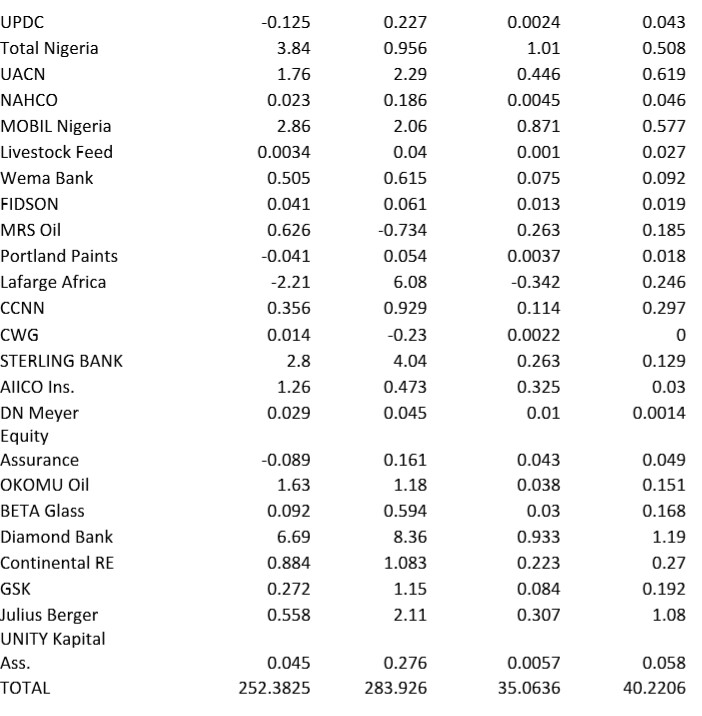

About 44 Major Companies listed on the Nigerian Stock Exchange have released First Quarter (Q1) 2016 results (See Fig Below), and Nairametrics has done some analysis to determine if there are any signals the results are flashing about the state of the Nigerian economy.

When we compared the firm’s results this quarter to the 2015 period it shows that combined profits (for all 44 firms) were down 11.1 % to N252.3 billion, from N283.9 billion in 2015.

This fall in profits was a little bit worse than expected a sign that Nigeria’s Q1 GDP may surprise to the downside.

Similarly Income tax expense for the firms fell by 12.97 % for the Q1, 2016 period to N35 billion from N40.2 billion.

This trend may make it harder for the Federal Government to achieve its goal of boosting non oil revenues especially taxes this year.

Digging deeper into the results shows that the major banks and Dangote Cement were the companies that reported any significant profits and paid majority of the taxes.

Dangote Cements Profits before taxes (PBT) of N54.53 billion was the biggest in the quarter, followed by Zenith Bank’s N32.1 billion, GTB with N30.67 billion, Access bank’s N22.5 billion and FBNH N22.05 billion to round up the top 5.

The poor state of the economy showed up in the construction and Cement industry as Lafarge Africa reported a quarterly loss, while Julius Berger, Dangote Cement and CCCN all reported lower profits this Q1, 2016 than in the earlier period.

Most of the banks also recorded lower profits compared to a year ago.

The results also show that there are a lot of small Nigerian companies who need to be supported by the government (through making the business environment friendlier), to grow large and have scale so they can also pay more taxes to the state.

Only 12 of the 44 companies had income tax expenses that exceeded the N500 million ($2.5 million) mark.