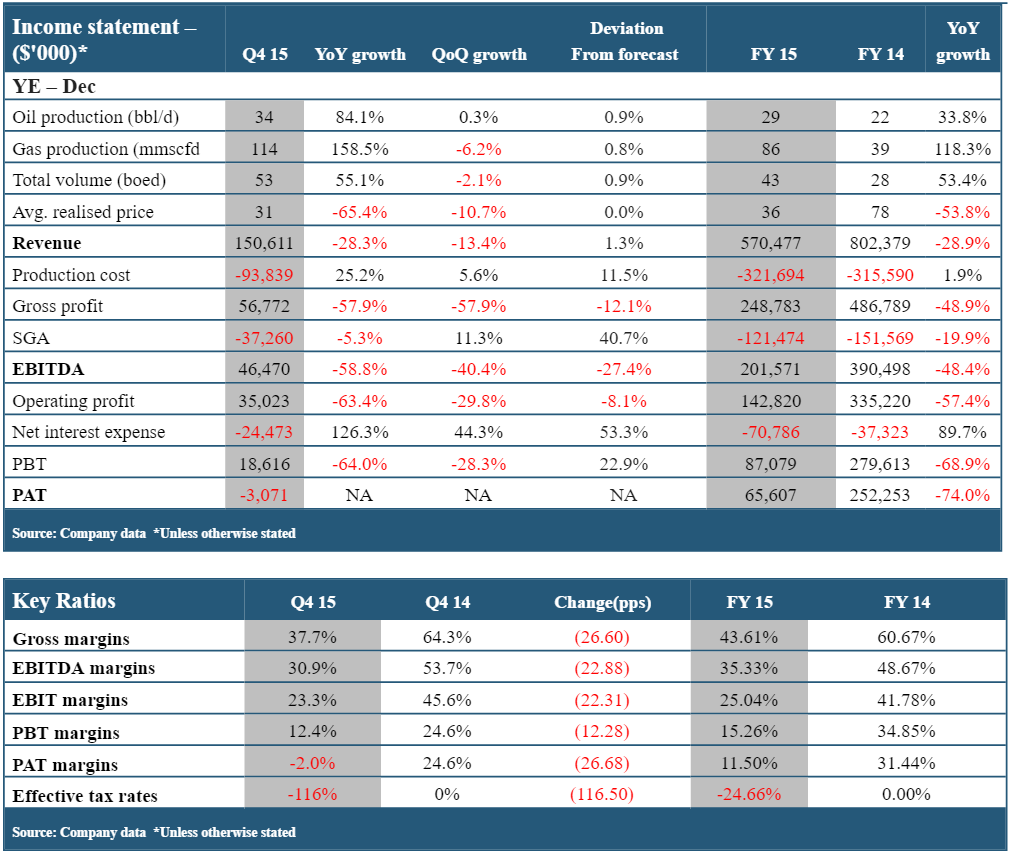

Seplat, Nigeria’s leading local upstream oil and gas company released its 2015 FY results on the London Stock Exchange today, showing profits dropped 74%. The company which has a dual listing in both the UK and Nigeria reported a profit after tax of about $65.6million (2014: $252.1m). The company reports its earnings in dollars.

The drop in profits was largely a result of the fall in oil prices recorded in 2015. Even though, production rose by 84%, the company still posted a revenue drop of about 28%. The average realised price for the company was $31, a 65% drop from a year earlier.

Despite the drop in profits, the pretax profits beat its forecast by about 22.9%.

Highlights

- Seplat Plc. posted a record output of 55kboed in Q4 15 (+55% YoY).

- However, lower realised prices of $31/bbl (-55% YoY) amidst increase in extraction cost (+25% YoY) and fairly stable administrative expense weighed on operating profit $35 million (-63% YoY).

- A tax charge of $21 million compounded the earnings pressure with Seplat posting Q4 15 loss-after tax of $3.1 million.

- Management have proposed a final dividend per share of $0.04 (

N8.00) bringing FY 2015 gross pay-out to $0.08 (N16.00) vs. $0.15 (N30.00) in FY 14. - Current market price of

N308/share implies a 2% premium to our FVE ofN301.84 ($1.51). - ARM upgrade its rating on the stock to a NEUTRAL from SELL.