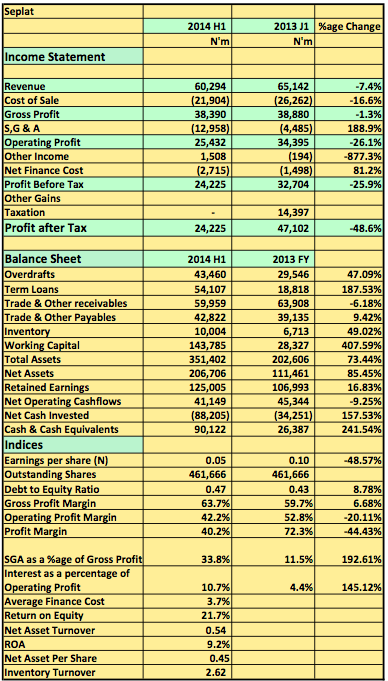

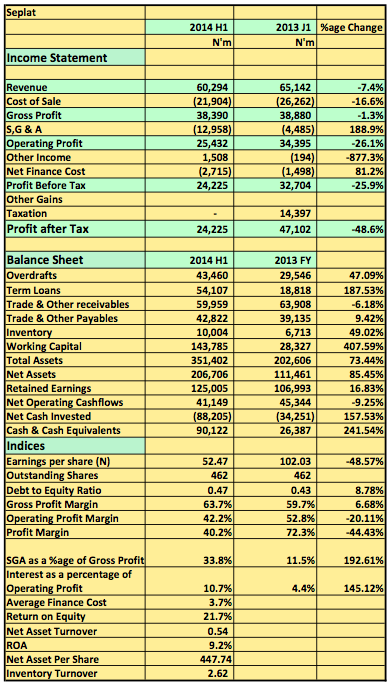

Seplat 2014 Half year results surprising showed a near 50% drop in earnings per share. The result which probably is just a blip considering the reasons given also buttresses the importance of Revenue in the company’s results as it navigates through the very critical path of growth in a high risk high reward upstream oil and gas sector. Here is how the company explained the results focusing on revenue, operating expenses as well as finance cost. My comments are also embedded in blue.

Revenue

Gross revenue for H1 2014 is $388.2million (N60.3 billion) (H1 2013, $419.4million – N65.1 billion) which is 7% lower than the comparative period in prior year. Crude revenue (after adjusting for changes in lifting) were US$ 378.6 million (N58.8 billion) for the H1 2014, an 8% decrease from the H1 2013 US$ 413.1 million (N64.2 billion) mainly due to 45 days downtime in H1 2014.

Revenue is a critical aspect of the company’s operations. The fact that a third party downtime could slice off 7% of the company’s revenue is a huge risk. The company responded that plans are underway to mitigate this risk so lets hope it never occurs again. Nevertheless, revenue needs to be growing at double digits if its current P.E ratio of about 13x is to be justified.

Gross Profit

Gross profit for the H1 2014 was US$247.2 million (N38.4 billion), which represents a 1% decrease over H1 2013 US$250.3 million (N38.9 billion). Variance is mainly driven by lower revenue in H1 2014 due to lifting adjustments over working interest of 302 mbbls. This was partly offset by lower costs of sales as a result of the reduction in crude handling fees by 25% and royalties by 19%. The work-over costs on the existing wells as at H1 2014 were US$12.7 million (N2.0 billion), this represents a decrease of 56% compared to H1 2013. This decrease was due to a switch from work-overs to development drilling program.

Expectedly, gross profit margins should either remain the same or improve.I would have been surprised if it hadn’t because the reason for the downtime was due to a service provider whose cost will be captured in the company’s cost of sale. I like the fact that margins improved 6% over the same period last year.

Operating expenses

General and administration expenses increased by US$54.6 million (N8.5 billion) as at the end of H1 2014 compared to H1 2013, this is mainly due to commitment and arrangement fees paid to banks for the new loan facility – US$12 million (N1.8 billion), higher staff costs due to increase in head count (included in this amount is a onetime payment of IPO bonus to staff, in line with the Prospectus of US$5.0 million), US$12 million, regulatory payment of US$14 million (N2.5 billion), which is also a onetime cost that will not re-occur in future periods, costs for the accounting and procurement system change US$7 million (N1.0 billion) and new business development costs for evaluation of prospect for new ventures.

This explains how important revenues are to the operations of this company. As it navigates through capacity expansion and growth, it is likely to continue to incur operating expenses which needs to be placated by fascinating revenue growth. It did claim some of the expenses are one time cost but I doubt the company’s opex will remain stable in the near term due to its rapid expansion plans. It will want to attract the best hands, contract lawyers, tax consultants, advisors, etc and these cost money. Depreciation cost and other amortised cost will continue to pose a risk too. All of these won’t matter much if revenue continues to prosper exponentially.

Finance Cost

Finance costs as at end of H1 2014 were US$21.6 million, (N3.4 billion) (H1 2013: $10.7 million, N1.7 billion). The increase in finance costs in H1 2014 is due to higher outstanding debts due to draw down of the balance of US$215 million (N33.4 billion) on the US$550 million (N85.4 billion) loan and additional new loan of US$200 million (N31.0 billion) compared to the same period in 2013.

Seplat total external loans is now N98billion but still under 50% of its net assets as such debt equity structure seem fine. Return on asset of about 18% also provides comfortable debt service coverage for the company. More importantly they are cash rich with over N90billion in the bank and N143billion in working capital. But all of these doesn’t take away the fact that we are now in an interest risk territory.

Profits

Profit after tax for the H1 2014 was US$156.0 million (N24.3 billion) (H1 2013: US$303.3 million, N47.1 billion), a 94% decrease over the comparative period in 2013, mainly attributed to deferred tax liabilities of US$92.7m (N14.4billion) released in H1 2013 as a result of pioneer status granted to the group, and lower revenue due to downtime on the TFP for 45 days. This was partly offset by a reduction in work-overs (US$16.4 million, N2.5 billion) and DDA costs (US$2.8 million, N435 million), royalties (US$18.3 million, N2.8 billion) and Crude handling (US$4.5 million, N699.0 million).

This explains the huge drop in earnings per share which I hoped the CEO would have explained in his summary. In this case 2013 was better because the company wrote back into profits deferred tax liabilities which it ought to have paid due to its post 2013 pioneer status. Though an accounting profit, it shows the impact of taxes on a company’s bottom line. For interim results I like to look at pre-tax earnings and this result shows a 26% drop all due to the higher operating expenses, finance cost and lower revenues. That’s what matters.