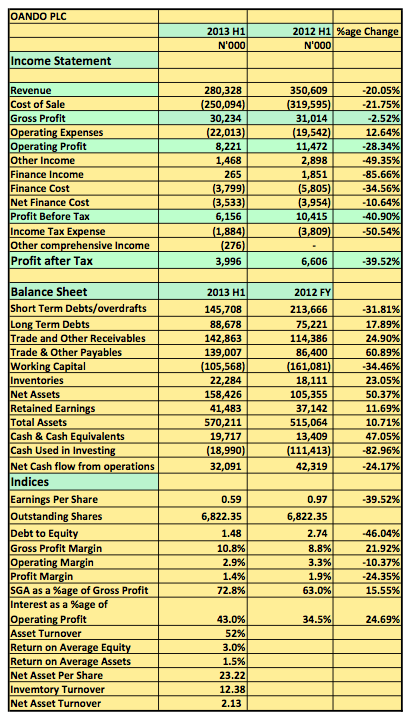

[upme_private]Oando Plc released its 2013 H1 results showing a revenue drop of 20% when compared to the previous quarter. Revenue was N280.3billion compared to N350.6billion same period 2012. Cost of sales however, reduced by 21% to help boos gross profit to N30.2billion despite the huge slide in revenue. Operating profit dropped 28% to N8.2billion compared to N11.4billion posted in the same period 2012. Pre-tax profits also dropped 41% to N6.1billion (2012 h1: N10.4billion).

Key Highlights

- The 20% YoY drop in revenue follows the same trend that was set in the first quarter of 2012.

- However, on a QoQ basis revenue climbed 32% to N159billion (April to June) compared to N121billion posted in Q1. The company reported in its Q1 earnings call that the drop in revenue in Q1 was due to a combination of a reduction in Oil revenue per barrel as well as a damage in one of their oil pipelines.

- It therefore suggest this has been fixed which probably is the reason for the better Q2 in terms of revenue.

- Operating Expenses rose 12.6% at the end of the period compared to the same period last year. In fact on a Q0Q basis operating expenses rose 62% from N8billion in Q1 to N22billion at the end of H1 adding about N13billion between April and June 2013. Combined operating cost was 73% of Gross Profit in 2013 H1 compared to 63% 2012 H1. This obviously cut into margins for the period.

- The company’s operating cost will continue to rise in my opinion as depreciation and other amortisation cost continue to take its toll on their earnings.

- Net finance cost dropped 10% compared to the same period last year as the company sliced off N63billion off its debt between April and June 2013. However, the company still paid a higher interest cost this quarter (N1.9billion) compared to last (N1.5billion).

- The rise in operating and finance cost this quarter led to the 41% decline in PBT for 2013 H1 compared to 2012 H1. On a QoQ basis pre-tax profit was N1.866billion compared to N4.2billion earned in the first quarter of 2013 a 57% decline.

- Oando’s cashed in on its over subscribed equity offer boosting net assets by over N50billion. The company consequently paid down its debts as expected helping it reduce its debt to equity from 2.7x to 1.5x. The cost off course is a continued dilution of equity. Despite there is little to show the debts will be reduced anytime soon.

- The impact of this will be felt in profitability as well as cash flow. Working capital is till a negative N105billion as the company continue to hedge its trade receivables agains is payables to the Gas and other input providers.

- Oando is a local company that is obviously ramping up its operations by acquiring any likeable assets at its disposal. This type of growth carries enormous risk that will affect profitability and hinder operational efficiency.

- The company is also exposed to numerous accounting and regulatory provisions that affect the way it recognises income and expenditure allowing for a lot of scepticism when reviewing its financial statements. It is also exposed to external factors such as pipeline vandalisation, acrimony towards the downstream sector and threat brought on by the shale gas discovery.

- Whilst too early to say, a major breakup of the company’s operations may materialise in the next 5 to 10 years if it cannot deliver a CAGR in profit margins and ROE of at least 4% and 14% respectively.

- Oando Plc currently trades at N12.2 a 62% drop from its N19.8 year high in March. P.E ratio is 2.66x and Price to book ratio is about 0.27x.

- This obviously presents a buying opportunity for anyone bullish about the company’s course of direction.

Oando Plc released its 2013 H1 results in the website of the NSE[/upme_private]

Despite Oando Plc performance, I am still going to increase my stake to 100,000 unit bcos i can see the future in oando plc in 3 to 4 years time.

Good move. Investment bets made with a long term outlook is safer that any. I’d buy more of the shares if I had this kind of believe in the future of the company..the price looks attractive.