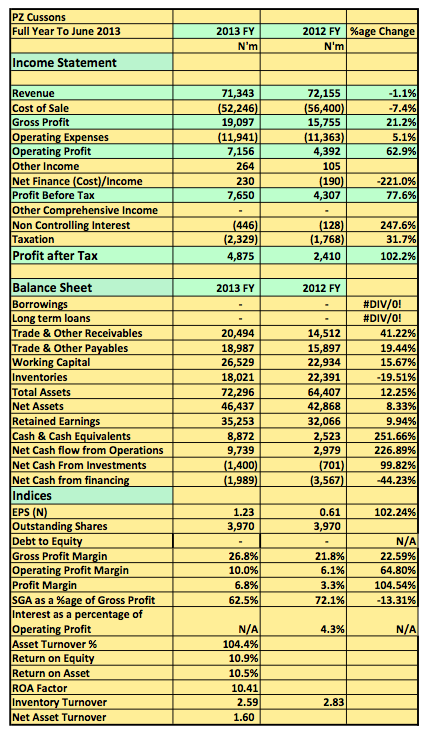

[upme_private]PZ Cussons Nigeria Plc released its 2013 FY results showing revenue remained flat at N71.3billion (2012 FY: N72.1billion). Gross Profit however rose 21.2% to N19billion (2012 FY: N15.7billion). Operating profit also rose two-thrids to N7.1billion (2012 FY: N4.4billion) as operating expenses remained largely stable. Profit after tax at the end of the period doubled to N4.8billion in comparison to the prior year.

Key Highlights

- Revenue was flat for the year dropping 1.1% when compared to the prior year.

- The drop in revenue growth is the first since 2010.

- This revenue growth may not be unconnected with the intense competition in the FMGC industry. I also suspect the White Goods segment experienced similar drop in revenues as consumers become more cautious with their spending.

- Despite challenges in revenue the company increased profitability by 100%. This was possible only because the company held cost of sales at 74% of Revenues compared to 80% in 2012. This rise in efficiency helped push Gross Profit margins by 22% when compared to the prior year.

- This is remarkable considering that Cost of sale rose 18% between 2012 and 2011 which helped lower profit after tax by 55% at the end of the period.

- Rising Operating expenses was also kept low at 5% higher than in 2012. In fact operating expenses was only 62.5% of Gross Profit compared to 72% a year earlier. This helped propel operating profit by 63% when compared to the same period last year

- PZ carried no debt and as such earned an incremental income of N230million from financial instruments and N264million from other sources of income.

- PZ Currently trades at N37.6 and trades an a price earnings multiple of N30.6

Expect more analysis and insights as to how they were able to manage cost when they release their 2013 Annual report.

PZ Cussons released its 2013 FY to June results in the website of the NSE[/upme_private]