Nairametrics| Not too long ago Quantitative Financial Analytics reported that FBN Capital Asset management lost its position as the second largest mutual fund manager by assets to FSDH Asset Management Ltd. In the same article, it was predicted that based on historical trend of mutual funds asset under management, FBN Asset Management Ltd might regain the position before long. That has just happened.

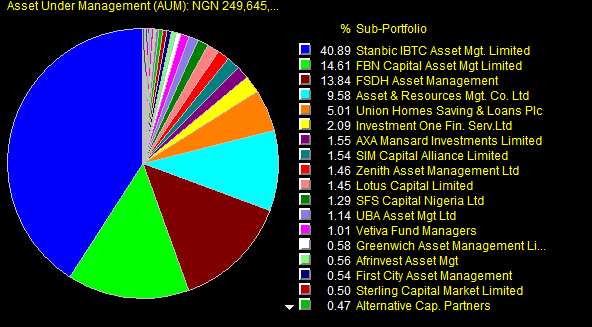

Going by available data and information, FBN Capital Asset management now manages 14.61% of mutual fund assets which puts it back in the second position as FDSH moves to the 3rd position with 13.84% of assets under its management.

Source: Quantitative Financial Analytics

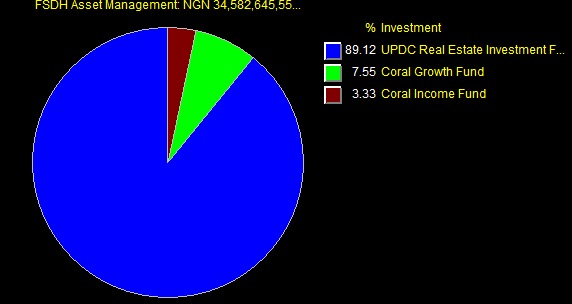

The major reason for the shift as revealed by analysis by Quantitative Financial Analytics Ltd is that FBN Capital Asset management attracted an estimated N6.5 billion worth of inflows and N0.812 billion of outflows so far in 2017 while FSDH received an estimated N0.304 billion of inflow and suffered an outflow of N0.345 billion leaving it with a negative net flow and taking its total asset from the 2016-year end value of N34.9 billion to N34.6 billion

Source: Quantitative Financial Analytics

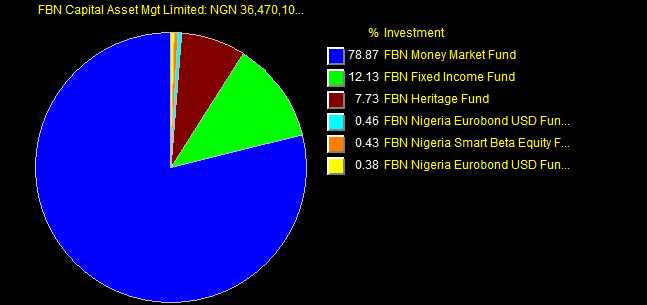

99% of the inflow to FBN went to FBN Money Market fund taking the fund management company’s AUM to N36.47 billion as at March 3 2017 from the 2016 year-end value of N30.7 billion.

Source: Quantitative Financial Analytics

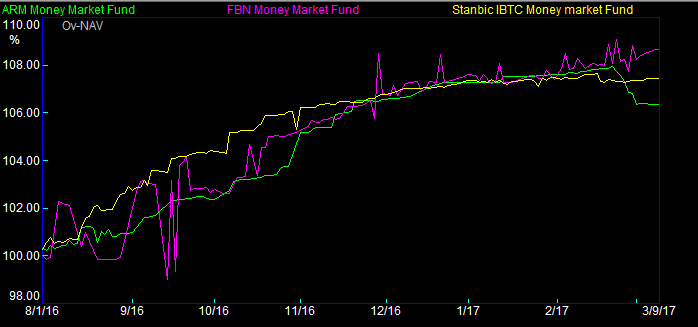

In our precious article, it was noted that FBN money market fund had the lowest yield among the three largest money market funds in Nigeria, however, that seems to have changed. There has been a dramatic increase in the yield being offered on the FBN Money market fund and that could explain why it generated so much inflow within the period under review. As at March 8th, Arm Money Market fund was offering 15.81%, Stanbic IBTC Money Market Fund, 17.53%, while FBN Money market Fund offered 16.47%.

Source: Quantitative Financial Analytics

Yields in Nigeria have moderated around 16% across all tenors in recent weeks putting the money market funds in a better position to compete for loanable funds but the proposed Savings Bond by the CBN through the DMO (debt Management Office) may increase the competition for retail investors. Until then, FBN is back to second position.

”As at March 8th, Arm Money Market fund was offering 15.81%, Stanbic IBTC Money Market Fund, 17.53%, while FBN Money market Fund offered 16.47%. ” – DEATH TO EQUITY

Conservatives.