The Nigerian Stock Exchange has just been notified that First Bank of Nigeria, the largest subsidiary of FBN Holdings plc, intends to exercise its option to redeem the fixed rate Note held by FBN Finance Company BV before its maturity date.

In exercising its option, the company intends to call the $300 million 8.25% subordinated Note raised from the international debt markets. The notes which were to mature in 2020, without the call option, will be called and repaid on August 7, 2018. According to the SEC filing, the objective of this corporate action is to manage the company’s liquidity as well as enhancing the efficiency of the bank’s balance sheet.

As a recap, a callable bond is a bond that grants the issuer the option to redeem or repay the principal of the bond before its maturity date. Different factors such as prevailing market rate determine whether an issuer will call a callable bond or not, so it is not always that a callable bond gets called. Now that FBN Holdings has decided to call the bond, the question is, does it make economic sense to do so, if yes, why?

We strongly feel that this corporate action is a smart move on the part of FBN to call the bond and here is why:

Strong Balance Sheet

FBN Holdings has a strong balance sheet and the cashflow to effectively redeem the bond. According to its March 31, 2018 financial statement, FGN Holdings has N1.4 trillion in its cash and cash equivalent at the end of the period which translates into $3.9 billion at a conservative exchange rate of N360/$. This is more than enough to execute the bond redemption and continue to grow the business.

Saving on Interest Expense

This callable bond pays 8.25% annual interest which amounts to about $24.75m annually. Fortunately for the bank, yield has been falling globally with some countries recording negative interest rates.

For example, the yield on the US 10-year Treasury note stood at 2.8327 percent on Friday, July 5th, 2018, although there are projections by analysts in the US that the rate will most likely spike to between 3.5% and 3.75% by the end of the year. There is therefore no gain for FBN to continue to pay 8.25% on the bond when the market interest rate has fallen to around 2.85%. Even if the Holdings Company does not have enough cash to redeem the bond, it makes economic sense to refinance it with another bond that pays far less in coupon interest.

Therefore, by redeeming the bond, FBN will be saving about $24.75m yearly August 8th 2018 to 2020 assuming that there is no alternative investment that would yield more than 8.25% to the company. In addition, having so much money in cash that pays minimal interest while paying 8.25% on callable Notes will have negative impact on the company’s balance sheet and as such, redeeming or calling the Note is quite a smart move.

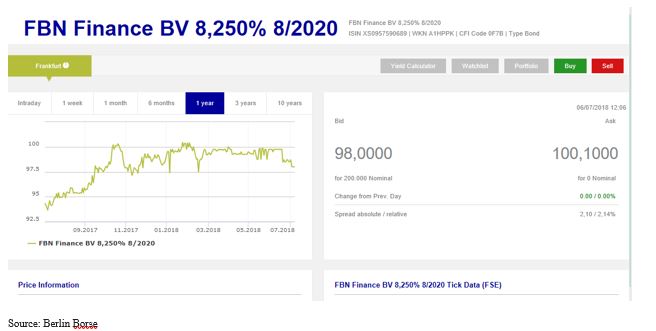

Pricing Action Suggests Investor Readiness for a call

Ordinarily, as bonds head to maturity or expected call date, they undergo what is usually known as “pull to par or pull to maturity or pull to call”, which is the tendency for prices to trend towards par value unless there is a high likelihood of default, in which case, the price of the bond trades at discount to par. Pricing action for this Note suggests that investors were expecting a call. It may not be a thing of surprise to institutional investors that FBN Holdings is calling the bond as price analysis shows that the bond was being priced very close to par.

According to available pricing information, the bond was priced at 100.1(which is very close to par of 100) on July 5th, 2018 suggesting that institutional investors and analysts were pricing the bond in anticipation of a possible call.

So, on the basis of the above, we feel very strongly that FBN’s decision to call the Note is a decision in the right direction.