- Champion Breweries Plc is raising N15.9 billion through a Rights Issue to fund the strategic acquisition of the Bullet brand, issuing 994,221,766 shares at N16 each on a 1-for-9 basis to existing shareholders as of September 4, 2025.

- The Rights Issue is the first phase of a two-step capital raise, with a Public Offer to follow, and is led by Rand Merchant Bank Nigeria Limited alongside several joint issuing houses.

- MD/CEO Dr. Adoga Inalegwu emphasized the importance of the acquisition for expanding Champion Breweries’ domestic and international footprint, urging shareholders to participate early due to the time-sensitive nature of the offer.

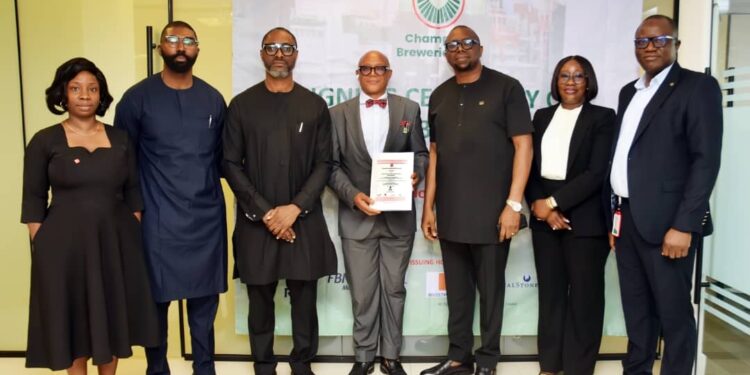

Champion Breweries Plc held a formal signing ceremony on Friday, November 14, 2025, as part of the arrangements to raise N15.9bn through a Rights Issue to existing shareholders.

The Rights Issue follows the shareholder approval received at Champion Breweries’ extraordinary general meeting of the shareholders held on 24th July 2025.

This Rights Issue represents the first phase of a two-step capital raise, with a Public Offer to follow shortly.

The proceeds will be utilized to fund the strategic acquisition of the Bullet brand, an important step in Champion Breweries’ domestic and international growth agenda. Under the offer terms, 994,221,766 ordinary shares of 50 Kobo each will be issued at N16 per share, on the basis of one (1) new share for every nine (9) existing shares held. The Qualification Date for determining eligible shareholders is September 4th, 2025.

At the signing ceremony held, Dr. Adoga Inalegwu, MD/CEO of Champion Breweries Plc, stated:

“This Rights Issue marks a turning point for Champion Breweries. Completing the Rights Issue for the Bullet acquisition, gives us the scale and strength to compete beyond Nigeria, unlock high-margin growth, and build a platform that resonates internationally.”

To ensure the completion of the Bullet acquisition before year-end, the offer period will be time-sensitive. Shareholders are strongly encouraged to participate early to maximize the success of this strategic transaction.

The Lead Issuing House for the Rights Issue is Rand Merchant Bank Nigeria Limited, with Joint Issuing Houses including FBNQuest Merchant Bank Limited, CardinalStone Partners Limited, Investment One Financial Services Limited and CFG Maynard Limited.

Full details, including allotment and subscription procedures, will be provided in the Rights Circular. Shareholders and prospective investors are advised to review the Circular carefully and seek professional guidance where necessary.