Despite an inflation rate of 21.7% year-on-year, investors were willing to place their bet on Nigeria’s 364-day tenor Treasury bill at a 7.3% yield during the January 11, 2023 auction by the Central bank of Nigeria.

According to the auction result seen by Nairametrics, the CBN allotted N52.29 billion in treasury bills at 7.3%. The CBN initially intended to raise N53.89 billion for the one-year (364 days) tenor but recorded a total subscription of N310.43 billion, thus an oversubscription of N256.54 billion. But the apex bank ended up allotting only N52.29 billion worth of treasury bills resulting from bids ranging from 6 to 16%.

The CBN initially intended to raise N1.49 billion for the six months (182 days) tenor and recorded a total subscription of N56.2 billion, thus an oversubscription of N54.71 billion. But the apex bank ended up allotting only N1.49 billion worth of treasury bills at 4.33%, resulting from bids ranging from 4.33 to 7.45%.

Also, the CBN initially intended to raise N1.54 billion for three months (91 days) tenor treasury bills and recorded a total subscription of N22.4 billion, thus an oversubscription of N20.86 billion. But the apex bank ended up allotting only N3.15 billion worth of treasury bills at 2%, resulting from bids ranging from 2 to 9.24%.

Given the current national rate of inflation, and analysts’ projection for 2023 that inflation will slow to 16%, it is clear that investors are willing to settle for a loss on their investments, although the 7.3% rate represents another shift northward, and the highest rate in 35 months.

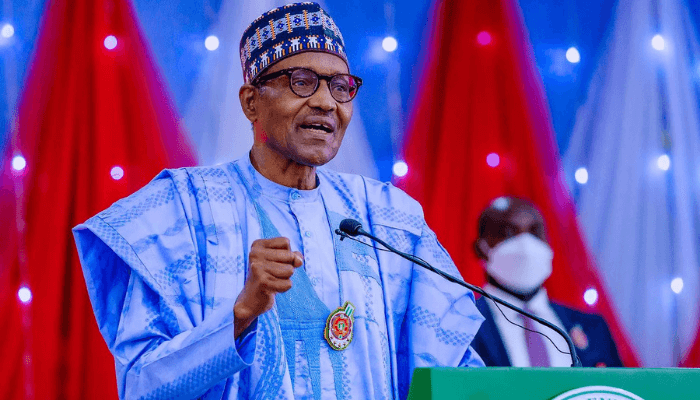

It is also a shift from the low treasury bills rate of the Buhari administration that had largely discouraged investment in government securities over the past several years, which, some analyst say may have contributed to the high rate of inflation.

Livinus Azosiwe, an investment analyst says the results of the auction exercise yesterday show that Nigerians’ investment options are dwindling. He stated that the mere fact that Nigerians would settle for treasury bills, which rates of return are lower than the national inflation rate means they are simply trying to salvage some value of their money from eroding due to high inflation, not to make a profit.

He said the federal government needs to improve the ease of doing business and create better business opportunities where investors can make money from their investments.