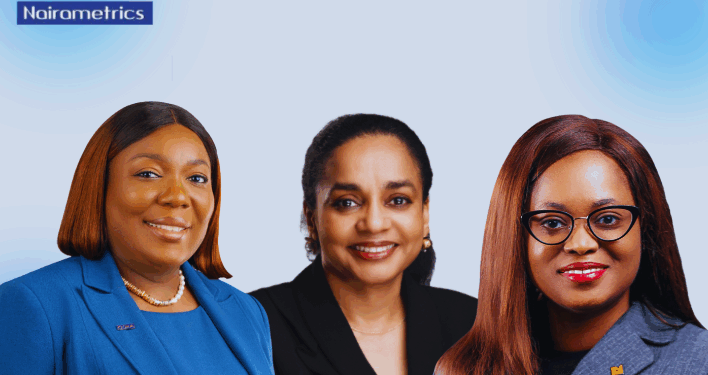

In Nigeria’s corporate landscape, women at the helm of finance functions are playing pivotal roles in steering balance sheets, driving growth, and consolidating performance.

These Chief Financial Officers (CFOs) oversee trillions in assets, navigating complex regulatory frameworks while shaping strategy across industries from banking and insurance to oil, gas, and consumer goods.

The influence of these finance leaders extends beyond numbers. They embody resilience, international exposure, and technical depth, combining strong academic pedigrees with hands-on experience in treasury, taxation, and corporate finance. Their leadership has been instrumental in growing profitability, shoring up investor confidence, and positioning their companies for long-term sustainability.

In 2024, the ranking of Nigeria’s top female CFOs by assets managed offers an insightful snapshot of where financial leadership meets corporate performance. From mega-banking groups to consumer goods giants, these women are charting paths that redefine financial management in Africa’s largest economy.

Below is a breakdown of the top female CFOs in Nigeria’s listed companies by total assets under management in 2024.

Top female CFOs in Nigeria by total assets managed as of 2024

Total assets being managed as of 2024 – N38.62 billion

- Appointed in March 2021, Yemisi Rotimi has spent 4 years 6 months at Leadway Assurance. In addition to her role, she continues as a Non-Executive Director at Capworth Consulting Ltd, signaling her strong presence in both executive and governance roles. Rotimi’s leadership comes at a crucial time as Nigeria’s insurance sector undergoes recapitalization efforts, requiring careful capital allocation and robust financial strategies.

- She is a qualified accountant with over 25 years’ experience as a senior Finance executive, having held senior positions within global organizations including Royal Mail Plc, Bank of Ireland, and Lehman Brothers. Yemisi began her career in practice with BDO before moving into industry and financial services, covering Finance functions such as Planning, Budgeting, Regulatory Reporting, Risk, Treasury, Tax, Procurement, and Financial Control.

- Leadway Assurance posted a 107.47% increase in PAT to N5.97 billion in 2024, up from N2.88 billion in 2023. Cash and cash equivalents surged 112.68% to N20.31 billion, compared to N9.55 billion in the previous year.

- She holds a Master’s degree from the University of Greenwich, UK, and is a Fellow of the Institute of Chartered Accountants of Nigeria (FCA). She is also an Associate of the Chartered Institute of Management Accountants (CIMA, UK) and Chartered Global Management Accountants (CGMA). Currently, she is pursuing a Doctorate in Business Administration focusing on Risk Management at London Southbank University.