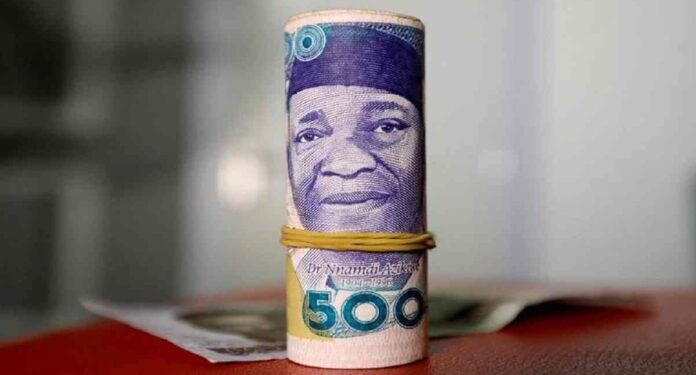

The naira appreciated to N1,565 per dollar on Thursday at the parallel market, up from N1,580 per dollar on Wednesday, according to a Nairametrics market survey in Lagos.

The naira remained largely stable during the week as it stood at N1580/$1 between Tuesday and Wednesday, down from N1575/$1 on Monday at the parallel market, according to Nairametrics data.

The exchange data released by the Central Bank of Nigeria (CBN) on Wednesday shows that the naira strengthened to N1,525 against the dollar on Wednesday, improving from the N1,527 it traded on Tuesday.

The data further shows the in-day activities with the naira trading at its highest at N1532/$1 and the lowest at N1524/$1.

Other major currencies

The naira also made big gains against other currencies in the parallel market on Thursday. Against the British pound, the naira traded at N2,170/£1 on Thursday, an increase from Wednesday’s N2,175/£1, Nairametrics data shows.

Wednesday’s gains against the British pound were also an improvement from Tuesday’s N2,180/£1. The trading week started at N2,195/£1 on Monday, which was down from the previous Friday’s rate of N2,185/£1, Nairametrics data shows.

Against the Euro, the naira showed stability all week long and is currently trading at the parallel market at N1,810.00/€1 on Thursday, the same rate as Wednesday.

IMF backs CBN’s monetary policy

On Wednesday, the International Monetary Fund (IMF) backed the CBN’s sustained tight monetary policy stance, describing it as a critical tool in managing inflation and safeguarding macroeconomic stability.

In its latest 2025 Article IV Consultation Report on Nigeria, the IMF stated that the CBN’s disinflationary measures are appropriate and should be maintained until inflation expectations are firmly anchored.

The Fund’s Directors expressed broad support for Nigeria’s monetary policy framework while urging continued fiscal and structural reforms to complement these efforts.

“Directors agreed that the Central Bank of Nigeria is appropriately maintaining a tight monetary policy stance, which should continue until disinflation becomes entrenched,” the IMF stated.

At its 300th Monetary Policy Committee (MPC) meeting held on May 20, 2025, the CBN held the Monetary Policy Rate (MPR) at 27.50%. The Cash Reserve Ratio (CRR) remained elevated at 50% for commercial banks and 16% for merchant banks.

These policy tools are designed to tighten liquidity, reduce speculative pressures on the naira, and contain inflation, which has hovered at multi-decade highs in recent years.

The IMF commended the CBN for discontinuing deficit monetization, a practice that previously contributed to inflation, and welcomed the institution’s commitment to strengthening governance as a foundation for transparent inflation targeting.

More insights

The IMF projected a 3.4 percent expansion in the country’s real GDP for 2025.

On April 22, the IMF projected that Nigeria’s economy would grow by 3 percent in 2025, down from the 3.2 percent forecast in October 2024.