Renaissance Africa Energy Company Limited has announced that it exceeded its oil production target by 40 percent within its first month of operations.

According to a statement issued on Friday by the company’s spokesperson, Michael Adande, the impressive performance underscores Renaissance’s immediate impact in Nigeria’s energy sector, the News Agency of Nigeria (NAN) reports.

Adande noted that this early achievement, well above the target set for the Joint Venture (JV), signals a promising outlook for Nigeria’s oil production growth and broader economic gains.

NNPCL Commends Renaissance’s Performance

The Nigerian National Petroleum Company Limited (NNPCL), which holds a 55 percent interest in the joint venture, praised Renaissance’s performance, describing it as “sterling and remarkable.”

In a letter signed by Mr. Udobong Ntia, NNPCL’s Executive Vice President, Upstream, the national oil company commended the leadership and staff of Renaissance for surpassing the April 2025 production target.

“This is to commend Renaissance Africa Energy Company Limited, your esteemed leadership team, and staff for exceeding the production target in your JV assets for April 2025,” the letter read.

NNPCL expressed hope that the April success would motivate Renaissance to accelerate the realisation of its initiatives to boost production while maintaining base output.

It also reiterated its commitment to collaborating with the JV operator on efforts to grow production volumes, maintain cost discipline, and adapt to current market realities.

The company reaffirmed its ambition to increase Nigeria’s crude oil output to over 2 million barrels per day by 2025, sustaining that growth through 2027 and reaching 3 million barrels by 2030.

Renaissance CEO Reacts

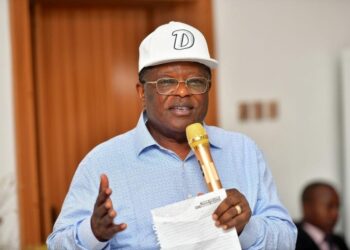

Renaissance Managing Director and CEO, Tony Attah, described the recognition from NNPCL as both “encouraging and motivating.”

“For us, it is a taste of the new beginning we have promised,” he said, noting that the company is already evaluating additional high-impact initiatives and operational enablers to unlock further production volumes while safeguarding existing output.

Attah attributed the company’s early success to strong collaboration with community stakeholders, government agencies, joint venture partners, and the dedication of the Renaissance workforce.

What you should know

Renaissance Africa Energy Holdings completed the acquisition of the Shell Petroleum Development Company of Nigeria (SPDC) in December 2024, following regulatory approvals from the Nigerian government.

The acquisition marked a significant shift in Nigeria’s upstream sector, with Renaissance now playing a key role in driving production growth.

The Renaissance consortium comprises the following companies:

- ND Western Limited,

- Aradel Holdings Plc,

- FIRST Exploration and Petroleum Development Company Limited,

- Waltersmith Group and Petrolin, an international energy firm.