The Securities and Exchange Commission (SEC) has reaffirmed its commitment to protecting investors in Nigeria’s capital market by cracking down on fraudulent activities.

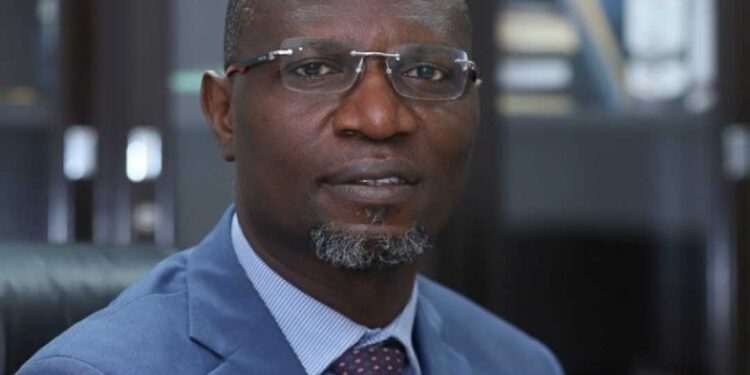

According to the Director-General of SEC, Dr. Emomotimi Agama, operators engaging in unscrupulous practices will face strict penalties as the Commission prioritizes safeguarding investor interests.

“So, clearly for us, it is getting people to understand that there is no hiding place anymore for anybody that has the intention to defraud Nigerians and to defraud anybody that is investing in this market,” Dr. Agama stated, emphasizing the Commission’s zero-tolerance policy.

Focus on Compliance and Ethics

Dr. Agama highlighted that the Investments and Securities Act (ISA) 2007 serves as the framework for securities regulation in Nigeria, ensuring that market operators adhere to high ethical standards.

He emphasized the importance of the “fit and proper person’s test,” which requires operators to meet specific regulatory criteria to maintain their licenses.

“This is because the very ethics of regulating or registering a securities market operator is in the principle of the fit and proper person’s test,” he explained.

“What you have been seeing most recently by the revocation of licenses, the suspension of operators and our follow-up to operators that are not registered with the SEC is only a tip of the iceberg as to what we intend to do this year.”

Dr. Agama assured stakeholders that the SEC will leverage its regulatory powers under Nigerian law to deter fraudulent activities, noting, “We believe strongly that a protected investor is a powerful investor.”

What you should know

- The SEC recently announced additional enforcement measures, including the introduction of a “name and shame” journal to publicly identify Capital Market Operators who violate regulations.

- This initiative emphasized the Commission’s zero-tolerance approach to infractions in the capital market and aligns with its enhanced enforcement strategies.

- In a public notice titled “Additional Enforcement Measures on Erring Capital Market Operators,” the SEC outlined its intent to impose severe penalties on violators as a deterrent.

Dr. Agama called on existing and prospective market participants to collaborate with the SEC to foster the development of a transparent and robust capital market.

He emphasized that compliance and information disclosure are fundamental to achieving this goal, stating that all stakeholders must understand and align with the Commission’s responsibilities.

This action is part of the commission’s broader efforts in 2025 to crack down on capital market operators it deems illegal.