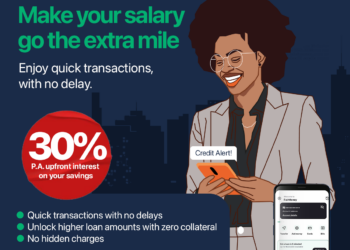

Africa’s leading neo bank, FairMoney, is raising the bar for savings in Nigeria, offering up to 30% interest per annum (P.A.) The Neobank’s high-yield savings options cater to both new and existing users, making it an attractive choice for anyone looking to secure their finances, save towards big purchases, or simply earn more from their money.

Whether it’s buying a new car, paying rent, or preparing for emergencies, FairMoney ensures that savers get maximum returns.

Henry Obieka, MD FairMoney MFB, Nigeria explains the thinking behind the product offerings:

We’ve created savings options that aren’t just about putting your money aside, they’re about making your money work harder for you, so you don’t have to worry as much about inflation or rising costs. The current economic situation has shown that now’s the time to take advantage of these high interest rates and set yourself up for financial security. Our goal isn’t just to offer higher returns; we want Nigerians to feel confident about their financial future, knowing that they’re making the right decisions for themselves, their families, and their goals.”

Tracy Iwu, Brand Manager at FairMoney, highlights how effortless the process is:

“Saving shouldn’t feel like a chore. We’ve made it simple, no hidden rules, no stress, just solid returns on your money.”

With three core savings plans, FairMoney ensures there’s something for everyone. Each is designed to cater to different financial needs. FairSave is a flexible savings plan with daily interest payouts. Users can deposit and withdraw anytime without penalties, making it perfect for people who want liquidity while still earning good returns. The interest rate is 17% per annum, allowing savers to earn while maintaining easy access to their funds.

If you have a specific goal in mind, FairTarget provides structured savings for rent, school fees, vacations, or major purchases. Users can set a goal and save manually or automatically, earning up to 20% per annum.

FairLock is the highest-yield option, offering up to 28% per annum for existing users and 30% for new users. It requires users to lock their funds for a set period, making it ideal for long-term planners. The interest rates vary depending on the tenure, starting from 18% for a 7-day lock period and increasing to 28% for a two-year commitment. New users can access an exclusive rate of 30% rate on select tenures, making it one of the most competitive savings plans available.

To put it into perspective, locking N5,000,000 in FairLock for a year at 26% per annum earns N1,300,000 in interest. A two-year lock at 28% effortlessly increases earnings to N2,800,000. For new users who qualify for the 30% rate, the potential returns are even higher, making FairMoney a top choice for wealth growth in Nigeria.

Saving with FairMoney is easy and takes just minutes. Customers can simply download the FairMoney app, fund their accounts, and select a savings plan. Whether opting for the flexibility of FairSave, the goal-oriented approach of FairTarget, or the high-yield potential of FairLock, users can start earning immediately.

FairMoney started in 2017 as a lending platform and became a CBN-licensed microfinance bank in 2021. Since launching its savings products, the bank has managed over N35 billion in savings deposits and paid out more than N3 billion in interest to users. As a licensed MFB, FairMoney ensures responsible fund management and operates under CBN regulations. Deposits are insured by the NDIC up to the applicable limits, providing users with added security.

Interestingly, FairMoney savings offers up to 30% upfront interest payouts flexible, and the possibility of upfront payouts on select plans. Compared to many platforms offering rates between 15-20%, FairMoney provides competitive returns, subject to terms and conditions.

As Nigerians continue to look for ways to navigate economic uncertainty, FairMoney provides a trusted and rewarding solution. Whether saving for a new car, rent, business, or long-term financial security, FairMoney helps people grow their wealth while keeping their money safe.

Start saving today and earn up to 30% interest because your money should work as hard as you do.

About FairMoney

FairMoney, a leading Nigerian Neobank, launched in 2017 with a mission to build Africa’s money story and bring financial inclusion to underbanked people in emerging markets, empowering them with innovative, tech-driven financial solutions. FairMoney’s neo-banking solutions include current accounts, savings, lending, deposits, peer-to-peer payments, bill payments, POS payment acceptance, and business solutions amongst many other disruptive services. With over 17 million app downloads, FairMoney is considered one of the fastest-growing companies in Africa and the leading Neobank on the continent. FairMoney is backed by the most prominent fintech investors like DST, TLcom Capital, newfund, Flourish Ventures, SpeedInvest, and Tiger Global.