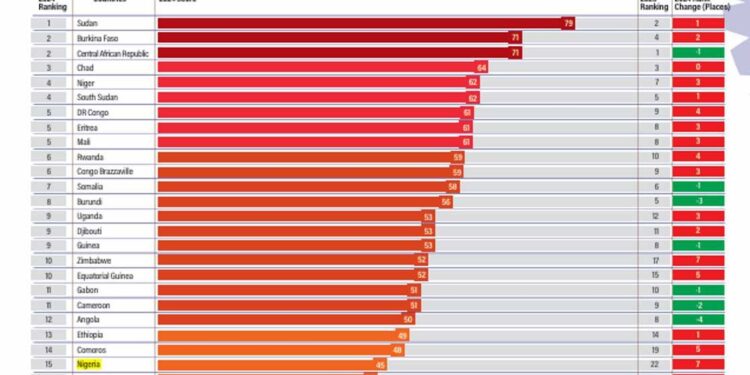

Nigeria has been classified as “vulnerable” to instability in 2024, according to the latest SBM Intelligence Africa Country Instability Risk Index.

This marks a downgrade from its “stable” status in 2023, driven by economic challenges linked to government policies.

Nigeria dropped six points this year, scoring 45 compared with 39 in 2023.

According to SBM Intelligence, a higher score in the risk index means a higher level of political risk to business.

Other African nations sharing this risk status include Ethiopia, Comoros, Côte d’Ivoire, Benin, and Togo, reflecting broader economic and governance concerns across the continent.

Key drivers of instability in Nigeria

The report highlights Nigeria’s deteriorating economic environment, worsened by factors such as rising food inflation, insecurity, and rising poverty level as the drivers of instability in the country.

“Nigeria’s economy continues to worsen, with rising food inflation, persistent insecurity across all geopolitical zones, and many people falling into extreme poverty.

“It is more polarised now than ever after the 2023 election and the unpopular reforms of the new government, such as the removal of petrol subsidies, which has worsened living conditions and led to the closure of businesses,” SBM Intelligence stated in the report.

More Insights

The analysis shows that SSA recorded an average of 45.4% in 2024, an improvement from 47.7% in the previous year.

- Of 48 countries, 31 reported improved performance, while the rest deteriorated. Angola, Burundi, Chad, Togo, and Madagascar were the biggest gainers.

- A cutback on governance costs drove Angola’s performance, while Madagascar’s GDP growth improved to 4.4% in 2023 from 4.3% in 2022.

Botswana, Seychelles, Nigeria, Namibia, and Zimbabwe were the biggest losers. Botswana experienced a GDP decline of nearly 2% in the first quarter of 2024, and Zimbabwe experienced economic challenges such as debt and currency crises.

Regional performance

On a regional count, Central African countries had the most representation, in the top ten, with about 40% of the lot having countries such as Angola, Central African Republic, Chad, and Gabon.

- Following closely is West Africa at 30% with Guinea, Sierra Leone, and Togo. The regions with the lowest representations are East Africa, with 20% represented by Burundi and Madagascar, and Southern Africa, at 10%, with Eswatini as its sole representative.

“The worst-performing entities are shared by Eastern and Southern Africa, at 40% each–represented by countries such as Seychelles, Kenya, Mauritius, and Comoros on the East side and Botswana, Namibia, Zimbabwe, and Zambia on the South,” SBM Intelligence stated.

- For the second year running, Southern Africa retained its spot as the most stable region, with a score change of -1.3.

- In reverse, Central Africa was the least stable, ending the year with a score change of 6.78, performing worse than East (1.07) and West (2.47).

This performance can be explained by an improvement in South Africa’s economy, which grew by 0.4% in the second quarter of 2024 from 0.1% in the first quarter.