The Nigeria Union of Pensioners (NUP) has formally apologized to Fidelity Bank Plc for a false story that was published earlier in the year by one of its members, Comrade Abiodun Michael, regarding the bank’s stability.

The union expressed regret over the false story published by its members as well as its failure as a Union to refute the story when it was published immediately.

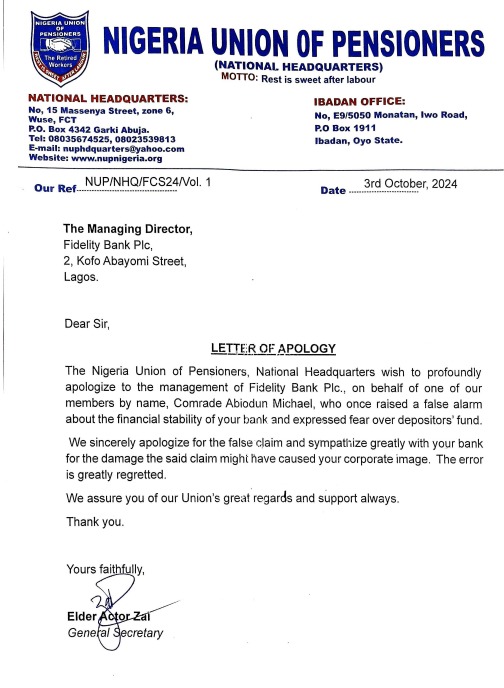

In a letter signed by Elder Actor Zal, the General Secretary of NUP, the union stated, “We sincerely apologize for the false alarm and sympathize greatly with your bank for the damage the said alarm might have caused your corporate image. The error is greatly regretted.”

The letter reassured Fidelity Bank of the union’s ongoing support.

The bank, on the other hand, has continued to surpass investor expectations with very strong positive performance. It recently reported an impressive N200.9bn profit for H1 2024, a 163.1% growth from the corresponding period.

The bank’s strong PBT performance is further reflected in its Share Price which has grown by over 680% since it established a bullish trend in 2018. Since completing its Public Offer in August 2024, the stock price has increased from N9.75 to an all-time high of N17.95 in September 2024.

In recognition of its commitment to strong corporate governance practice, the bank has been the recipient of several local and international awards, including the prestigious CG+ award.

This is the highest rank under the Corporate Governance Rating System (CGRS) of the Nigerian Exchange Group (NGX), which evaluates listed companies against established best practices and standards.

The incident involving the Nigerian Union of Pensioners underscores the need for media practitioners to always vet information before reporting.

The Nigerian Police must also be commended for acting swiftly in apprehending the faceless operators behind the irresponsible attack against the bank. NUP’s apology comes amidst a broader context when Nigerian banks are faced with a barrage of malicious stories in the media, which, in the long term, can only do more harm than good to our economy.