President Bola Tinubu is set to forward an executive bill amending the National Identity Management Commission (NIMC) Act to the National Assembly mandating all residents of Nigeria, including foreigners, to register for the National Identity Number (NIN), enabling them to be taxed.

Bayo Onanuga, Special Adviser to the President on Information and Strategy, made this known while briefing State House correspondents at the Presidential Villa on Wednesday. He was accompanied by O’tega Ogra, Senior Special Assistant to the President on Digital Strategy, Engagement, and Communications.

“This bill will amend the law that was made some years ago, and it now provides, if the National Assembly passes that bill, that everybody living in Nigeria, foreigners, all of them will now be registered and be given tax identity,” Onanuga stated.

He further emphasized that once foreigners engage in income-earning activities within the country, they will be taxed under Nigeria’s tax framework. “Once you are doing some work here and you are earning income, you will be registered and given tax identity and you will be taxed, and you come under our tax structure,” he said.

The bill, part of broader economic stabilization efforts, was approved during the Federal Executive Council meeting on Monday to ensure that both Nigerians and foreign residents are captured in the country’s tax system through NIN registration.

Backstory

The Nigerian Senate passed for a second reading, a bill to broaden the eligibility criteria for obtaining the National Identification Number (NIN) under the National Identity Management Commission (NIMC) system.

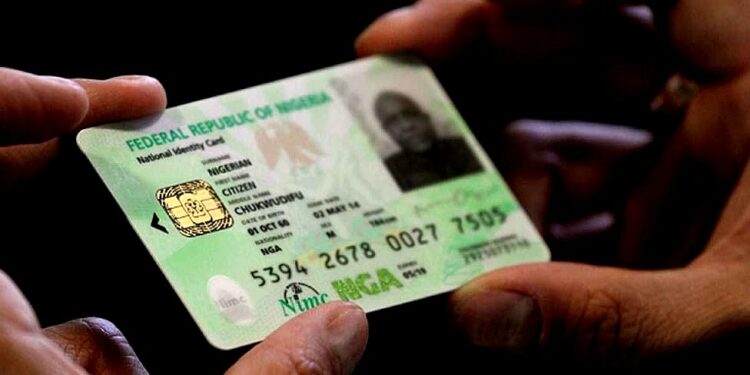

The proposed bill, titled “National Identity Management Commission (Repeal and Enactment) Bill 2024 (SB.472),” aims to allow all individuals residing in Nigeria to register for and obtain the NIN, promoting inclusivity and universal coverage.

The bill was sponsored by Deputy Senate President Barau Jibrin, the bill was to amend the existing NIMC law to include all residents of Nigeria, regardless of nationality or immigration status. The bill outlines that every citizen and resident of Nigeria, including those without permanent residences, should be eligible for NIN enrolment. This would allow NIN to be used as a valid form of identification for all individuals residing in the country.

During the debate, the Senate supported the bill, and it was passed for a second reading without any objections to its clauses. The bill now awaits further consideration and potential passage into law.

What you should know

Following the recent developments in the Nigerian Senate, where a bill to broaden the eligibility criteria for obtaining the National Identification Number (NIN) was passed for a second reading, the legislative process now moves forward with several important steps. The bill will first be referred to a relevant Senate committee for further examination. This committee will assess the bill’s provisions, gather additional insights, and consider any necessary amendments.

Once the committee completes its review, the bill will be brought back to the Senate for further debate. This stage allows Senators to discuss any changes recommended by the committee and express their support or concerns regarding the bill. Following this debate, the Senate will hold a vote on whether to pass the bill in its revised form. If approved, it will be sent to the House of Representatives for consideration.

The House will undergo a similar process, which includes committee review and debate, before voting on the bill. If the House makes any amendments, the bill will return to the Senate for agreement on the final version.

Once both chambers agree on the final version, the bill will be sent to President Tinubu for his approval. If signed, the bill will become law, and the National Identity Management Commission (NIMC) will be responsible for implementing the new provisions, facilitating NIN registration for all eligible residents.