Nigeria experienced a substantial decline of 62.4% in foreign investments from countries visited by President Bola Tinubu and Vice President Kashim Shettima, according to the third quarter 2023 Capital Importation report by the National Bureau of Statistics (NBS).

A quarterly analysis reveals that capital inflow dropped from $643.3 million in Q2 2023 to $242.09 million in Q3 2023 representing a 62.4% decrease.

There is also a yearly decrease of 66.1% from $714.36 million recorded in the same quarter of the previous year.

Since occupying the top offices in the country, Tinubu and Shettima have been to at least 16 countries separately and to the same country once – the United States of America.

In fact, Shettima is currently attending the annual meeting of the World Economic Forum in Davos, Switzerland.

Nigeria got about 36.98% of foreign investments for Q3 2023 from the countries visited by Tinubu and Shettima.

Countries visited by Tinubu

Tinubu has been to at least ten countries, visiting France and Guinea-Bissau twice since he came into power. However, Nigeria has no record for foreign capital from Guinea-Bissau, according to the data from NBS.

The other countries include the United Kingdom, Kenya, India, the United Arab Emirates, Saudi Arabia, and German.

In total, Nigeria got $123.81 million from the countries visited by Tinubu by Q3 2023. Investment from these countries declined by 47.1% quarter-on-quarter from $234.19 million in Q2 2023 and 77% year-on-year from $537.53 million in Q3 2022.

The United States, from where Nigeria got $67.04 million in Q3 2023, is not included in the breakdown analysis, since it was visited by both the president and vice president.

Source: adapted from NBS

One of Tinubu’s visits to France about seven months ago was to network with international finance corporations, investors, and leaders, and seek collaborations and partnerships in agriculture and infrastructure at the “Summit on a New Global Financial Pact”.

On his visit to United Kingdom about six months ago, Tinubu urged the UK government to deepen its partnership with Nigeria and Africa by investing more across sectors that would ensure the African continent attain more sustainable and broad-based prosperity.

In Kenya, during the Africa Climate Summit (ACS), it was disclosed that the Federal Government plans to raise capital through Just Energy Transition Partnerships (JET-Ps) and the government is working to draft a proposal to the G7 for a JET-P for Nigeria. However, there is yet to be any publicly available information on this after four months of the summit.

One of the most memorable trips was to India, with Tinubu leading 38 prominent members of the Nigerian Private sector to attend the Nigeria-India Presidential roundtable and conference in New Delhi, India. After this trip, it was announced that Indian investors pledged nearly $14 billion in the petrochemical, steel, and automobile sectors.

The government of Saudi Arabia promised to support the reforms being implemented by the Central Bank of Nigeria (CBN) and revamp Nigeria’s existing refineries during a bilateral engagement between Tinubu and the Kingdom’s leader, Crown Prince, HRH Mohammed Bin Salman. Tinubu also assured potential Saudi investors looking to invest in Nigeria that they would have no hindrance in repatriating their funds in and out of the country even as Nigeria struggles with forex scarcity and meeting its FX obligations.

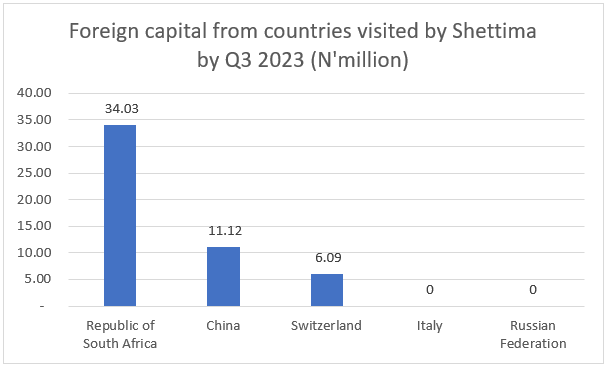

Countries visited by Shettima

While Tinubu has been to 10 countries, Shettima has been to seven. The countries include Italy, Russia, South Africa, Cuba, China, the US, and Switzerland.

Total investment from six out of these countries (the US was excluded since it was visited by both the president and vice president) was $51.24 million. Investment from these countries declined by 62.7% quarter-on-quarter from $137.20 million in Q2 2023 and 45.7% year-on-year from $94.32 million in Q3 2022.

Source: adapted from NBS

In July 2023, during the first day of the food systems summit in Rome, Italy, Vice President Kashim Shettima said the federal government has mobilized half a billion U.S. dollars for innovative, profitable, equitable, and sustainable food systems transformation initiatives in the country. This is yet to be reflected in the country’s foreign capital.

Also, during a plenary session of the Russia-Africa Summit in St. Petersburg in July, Shettima urged Russian companies to take advantage of the investment opportunities in Nigeria. However, it appears that these investors are yet to be fully convinced as there was zero foreign capital from Russian investors in Q3 2023.

In August, Nigeria’s Vice President, Sen. Kashim Shettima attended the 15th BRICS summit in South Africa, with the country planning to join the group in the next two years.

However, Nigeria experienced a substantial decline of 59.84% in foreign capital from BRICS countries in the quarter under review.

Towards the end of Q3 2023, Nigeria’s delegation to the G77+China Summit led by Vice President Kashim Shettima signed a Memorandum of Understanding (MoU) with the Republic of Cuba on the sidelines of the G77+China Summit at Hotel Palco La Habana. The MoU aims to enhance bilateral collaboration in the fields of innovation, science, and technology.

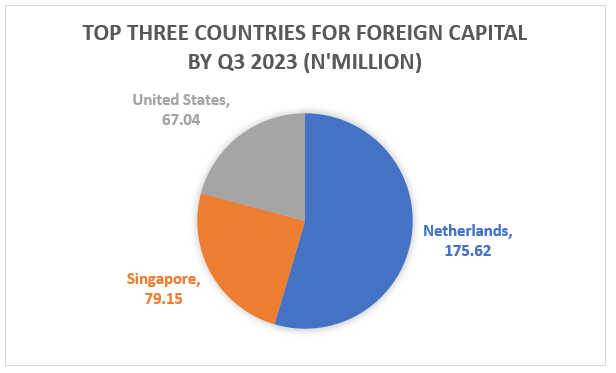

Nigeria’s top three countries for foreign capital

Among the top three countries from where Nigeria got foreign capital, only the United States has been visited by the president and the vice president.

The country is Nigeria’s third highest foreign capital source in Q3 2023, as Nigeria attracted $67.04 million from US investors.

This is not surprising as the Chargé d’Affaires for the U.S. Embassy in Nigeria, David Greene, earlier in August said that businesses and investors in the United States are satisfied with the policies of Tinubu’s administration and will soon be investing more in the country.

However, there was a Q-o-Q decrease of 75.3% from $271.92 million recorded in Q2 2023 and a Y-o-Y decrease of 18.8% from $82.52 million in Q3 2022 for foreign capital from US investors by Q3 2023.

In second place, there is Singapore, with $79.15 million in foreign capital. The Nigerian Investment Promotion Commission (NIPC) participated in the Africa Singapore Business Forum (ASBF) 2023, which commenced on August 29th, 2023, in Singapore. This shows an existing bilateral relationship between the two countries. However, Singaporean investors reduced their investments in the country by 55.4% Q-o-Q from $177.44 million in Q2 2023 and 57.2% Y-o-Y from $184.86 million in Q3 2022.

Top of the list is the Netherlands, with $175.62 million in foreign capital. The Netherlands and Nigeria signed an investment promotion and protection agreement in June 2023, and this seems to have a positive effect on investors from the Netherlands as they more than doubled their investments in three months. Foreign capital from the Netherlands rose by 195.4% Q-o-Q from $59.45 million in Q2 2023 and 1,355% Y-o-Y from $12.07 million in Q3 2022

Source: adapted from NBS

Foreign capital from these top three countries makes up 49.2% of the total capital importation into the country by Q3 2023.

More Insights

- In their inaugural seven months in office, President Bola Tinubu and Vice President Kashim Shettima of Nigeria embarked on an extensive international tour, collectively spanning no less than 16 countries, consuming over 91 days in foreign pursuits. Tinubu incurred expenditures amounting to a staggering 4 billion, encompassing both domestic and overseas travel expenses, within the initial six months of their tenure.

- For 2024, it is expected that the international and domestic journeys of President Bola Tinubu, Vice President Kashim Shettima, and their accompanying aides may impose a financial burden of approximately 96 billion on the national coffers. In an earnest endeavour to substantially curtail government expenditure, Tinubu gave his nod to a 60% reduction in expenses related to the international and domestic travels of government officials.

- Despite relentless efforts by the current administration through a myriad of foreign excursions and diplomatic appeals, Nigeria has witnessed a considerable decline in foreign capital inflow, registering a meagre $654.65 million in the third quarter of 2023. The Foreign Direct Investment (FDI) constituted a mere 0.091% of the overall capital imported during this period.

- However, optimism abounds regarding the prospective positive impact of foreign investment commitments secured by Tinubu during his overseas sojourns. These commitments reportedly exceed $15 billion in Foreign Direct Investment (FDI) across various sectors, and a slew of economic deals have been inked during these trips.

- As Nigeria navigates its economic terrain, its future trajectory hinges on the realization of these pledges and concerted efforts to bolster foreign capital inflows.

- While the foreign trips undertaken by the president and vice president have ostensibly elevated Nigeria’s diplomatic standing on the global stage, they have yet to materialize into the much-needed financial windfall for the nation, according to the Q3 capital importation report.

- Beyond diplomatic overtures, investors are more concerned with tangible realities – well-defined economic policies, a stable business environment, and addressing pressing issues such as security and bureaucratic red tape are decisive factors that beckon substantial foreign investment as we wait to see if there would be an improvement when the Q4 report is released.

The Olabisi Ajala School of Governance….