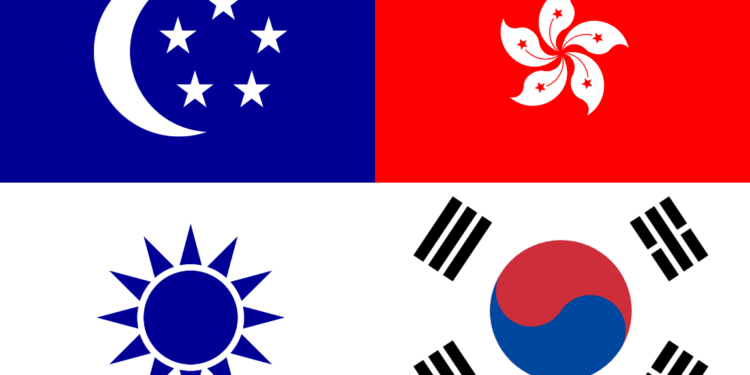

The Asian Tigers is a term used to describe how Hong Kong, Singapore, Taiwan, and South Korea gained prominence as one of the world’s biggest economies in the 1960s by capitalizing on growing technology and globalization to thrive.

Before they emerged as world economies, the Asian Tigers were countries that struggled economically. Their emergence through industrialization and high growth rates of more than seven per cent annually is also known as the ‘Asian Miracle’.

While each of these countries has a distinct path toward economic stability and growth, they share some distinct features that Nigeria can emulate to become great.

Favorable economic policies

Nigeria currently faces a problem where business owners have decried the state of doing business there. One of the lessons Nigeria can pick from the Asian Tigers is to create a business-friendly environment for medium- and large-scale businesses to thrive.

According to a report by Nairametrics, as of 2019, Nigeria ranked 131 on the world’s Ease of Doing Business (EoDB) list.

The Asian Tigers formulated policies that worked for them. Hong Kong and Singapore encouraged free trade.

The former invested in its textile industry, while the latter allowed oil ships carrying oil from the Middle East to Japan and China to have a stopover to refine their chemicals and continue with their cargo voyage.

On the other hand, South Korea and Taiwan adopted policies that created incentives for exported goods.

Agriculture

Nigeria once shared some similarities with the Asian Tigers, especially at the development stage. Before becoming an oil-dependent economy, Nigeria’s foreign earnings were primarily in agriculture, with the export of cocoa, cotton, palm oil, palm kernels, groundnuts, and rubber.

For the Asian Tigers, agriculture was a key component of their development in the early stages. South Korea invested about 30% of aid from the United States into agriculture equipment, making it easier for agriculture to be done on a large scale. Similarly, Taiwan was an exporter of rice, sugar, and pineapples.

According to a report by Nairametrics, the Food and Agricultural Organisation (FAO) recommends that 25% of the government capital budget be allocated to agricultural development; however, Nigeria’s budgetary allocations between 2019 and 2022 were 3.61%, 1.51%, 1.92%, and 1.25%, respectively.

Leverage education and technology

One of the lessons Nigeria can learn is to leverage the nexus between education and technology to improve the country’s economy. One of the distinct features of the Asian Tigers, especially during the developmental stage, was the rise of the technologically proficient educated class.

Nigeria currently has a high rate of public and private tertiary institutions, some of which are specialized. However, there’s a gap in the employability skills of graduates every year and in the emerging trends in each industry.

Nigeria must follow the path of the Asian Tigers and invest heavily in the educational sector to produce an educated class that will provide skilled labour for emerging industries.

Macro-economic Policies

The Asian Tigers largely focused on creating macroeconomic policies that helped stabilize their economies.

One of them is that they manage to keep their budget deficits and external debt low.

According to a report by Nairametrics, Nigeria’s 2023 budget deficit stood at N11.34 trillion; similarly, in another report, the country’s debt as of December 2022 was N77.8 trillion.

Nigeria must cut its excessive borrowings and keep debts within its financial limits rather than spending over 97% of its income on debt servicing.

Also, Nigeria must devise means to generate revenue and use it judiciously.

Industrialization

This period saw a growth in the number of industries in the four countries, and the raw materials used for most production were sourced locally.

Nigeria must invest in the local sector and reduce its dependency on imported materials for production. This not only helps to cut costs but also helps to boost local economies.

One notable thing about the Asian Tigers was the willingness of the governments of each country to invest in human and capital development rather than a government that benefits a few.