Ease of doing business (EoDB) index is a concept created by Economists, whose Word Bank sponsored research seeks to show the relationship between the economic growth of countries and the impact of their improving business regulations and proprietary rights regulation. Simply put, the index shows how easy it is to do business in a country.

Purpose of EoDB index

Some analysts have opined that the index is merely a benchmark study on regulation. A view most likely shared by Academics who have referenced data from the work (over 3,000 times) since its inception in November 2001, as the index seems to show some sort of relationship between improved regulations and economic growth.

However, to the political class of developing countries, the Ease of doing business index is a different ball game. To them, EoDB index is more of an economic assessment tool and is used in political propaganda as a sort of economic endorsement by the World Bank. Nigeria’s political class is no different, and who can blame them?

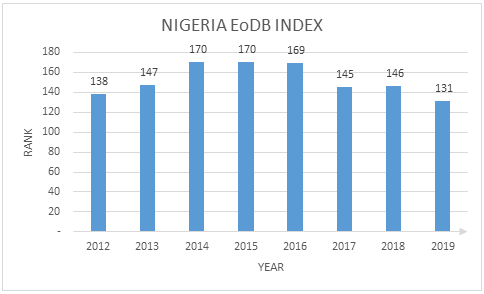

Nigeria’s EoDB index history

The above chart was plotted using information from World Banks’ DOB reports.

A perfunctory look at Nigeria’s ease of doing business index history shows a correlation with Nigeria’s economic history. Nigeria’s worst rating was in 2014 and 2015 when the nation held its Presidential elections and later fell into recession through to 2016 when the country gained a point on the index table as it clawed its way out of recession.

Upon recovery, economic reforms coupled with the government’s strong anti-corruption stance saw the country leap 24 spots to 145th position; eventually dropping to 146th (perhaps due to the political instability that came with the campaigns of another Presidential election) and then gaining a few extra spots to reflect the stability of the polity after the incumbent President won.

The above analysis is plausible, but I would be remiss if I led you to believe that such a simplistic explanation suffices for carefully analyzed data when in fact, there are clearly outlined sub-indices that make up the EoDB index as listed below:

- Starting a business – Procedures, time, cost, and minimum capital to open a new business.

- Dealing with construction permits – Procedures, time, and cost to build a warehouse.

- Getting electricity – procedures, time, and cost required for a business to obtain a permanent electricity connection for a newly constructed warehouse.

- Registering property – Procedures, time, and cost to register commercial real estate.

- Getting credit – Strength of legal rights index, depth of credit information index.

- Protecting investors – Indices on the extent of disclosure, the extent of director liability, and ease of shareholder suits.

- Paying taxes – Number of taxes paid, hours per year spent preparing tax returns, and total tax payable as a share of gross profit.

- Trading across borders – Number of documents, cost, and time necessary to export and import.

- Enforcing contracts – Procedures, time, and cost to enforce a debt contract.

- Resolving insolvency – The time, cost, and recovery rate (%) under a bankruptcy proceeding.

A case of ignoring the obvious?

Insecurity, inflation, incoherent monetary and fiscal policies do not seem to have an effect on the Ease of Doing Business Index and rightly so. The EoDB index is a rank of 190 countries strictly showing how easily a business can be set up in a Nation vis-à-vis an optimal standard, using data gathered from thousands of expert respondents. The comparative advantage and/or profitability of the business notwithstanding.

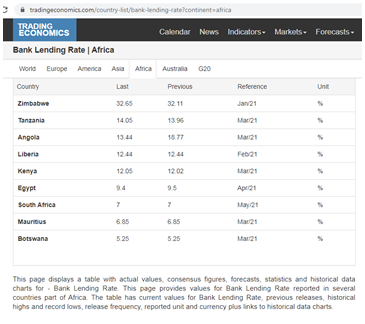

The availability and integrity of the data to be compared is another shortcoming of the index. An example is in the page below showing the Bank Lending Rates of African Countries being compared as input for the Credit sub indice of the Ease of doing business index. Nigeria’s Bank Lending Rate (which should be common knowledge) is conspicuously missing although the table says it displays “actual values, consensus figures, forecasts, statistics and historical data charts.”

Perhaps a consensus rate could not be agreed upon by Nigeria’s lenders.

Consequently, data irregularities have led to the report being suspended after it was observed that data of some countries were “inappropriately altered.”

The reality of doing business in Nigeria

Doing business in Nigeria is rife with uncertainties. No matter how good the indices look on paper, there is a remarkable distinction between setting up a business and sustaining a business. While the former can be readily influenced by dialling back a few business registration regulations, the latter needs serious policy ramifications as well as a huge investment in infrastructure and institutions.

As Nigeria’s Federal Government seems a little preoccupied with making a good showing on the ease of doing business index, so much so that it replicated a similar report nationally, it is quite telling that in recent times, Nigeria has lost potential investments from Amazon and Twitter to South Africa and Ghana respectively. Google also took its AI research centre to Accra, Ghana.

No, it’s not just the tech giants; Shoprite divested its holdings in its Nigeria subsidiary, and FanMilk is moving its operational headquarters to… you guessed it, Accra, Ghana.

Data on SMEs are not readily available so I will resist the urge to publish hearsay of how many businesses go under weekly, nor of how many startup founders have begun to seek employment elsewhere.

I admit I am not writing this piece from Ghana yet, but I reckon it seems to have become more economically viable to do business with Nigerians from neighbouring countries than from within Nigeria, and the biggest supporter of this move seems to be the Nigerian Government whose Ease of Doing Business interpretation is remarkably different from the needs of the economy, and whose best-intended approach to “rulership” is more damaging to the economy than it cares to admit.

Perhaps instead of reveling in the accolades from international bodies on how quickly it rose on the World Bank’s Ease of Doing Business Index, it is high time the government looked to reassess this so-called Ease of Doing Business from the Entrepreneurs’ perspective; they know where the shoe pinches. At least for those who still have their shoes on.

Yeah… Many have lost their shoes, and many others prefer not to bother with wearing the business shoes. All the same, politicians in Nigeria still have the last say at a cost.

It appears, the government may consider implementing domestic registration for all the tech giants who have chosen other countries to Nigeria using the twitter suspension as leverage. Should they succeed, it will be celebrated as a win from the pololitical class, while in practise, it would mean the country won the battle, but lost the war. Tech giants and other serious minded businesses will set up regional head offices elsewhere and bring local operational offices to Nigeria in a bid to meet the minimum requirement of the government. What would be the impact of this perspective on Nigeria, considering the AfcFTa agreement which was reluctantly assented by the president?

This is a serious subject that affects employment and development. While govt doesn’t provide right atmosphere for economy growth most states taking lagos as an example do business competition with the citizens and even kill the people own through bad laws. Ghana is striving because corruption was 1stly dealt with all same.

I love the anecdote about shoes. The govt has taken everyone’s shoes. Ease of doing business? Try to register with CAC, pay land use charge online or do DPR registration? Or simply go ask all those trying to survive around Apapa port! We love the glitz not th he substance.