Thirteen publicly listed banks in Nigeria spent a sum of N7.2 billion on corporate social responsibility (CSR) in 2022, a notable 70% decrease compared to N23.9 billion incurred in the previous year.

This is according to data tracked and compiled by Nairalytics, the research arm of Nairametrics from the audited reports of the banks.

Corporate social responsibility is a way for businesses to contribute to the social, economic, and environmental well-being of their stakeholders and society at large.

CSR can also enhance the reputation, brand value and customer loyalty of businesses, as well as attract and retain talent.

Businesses are urged to allocate a portion of their earnings for philanthropic purposes in line with their Corporate Social Responsibility (CSR) guidelines.

While certain donations may be eligible for tax deductions, others may not. In Nigeria, companies have the discretion to determine the recipients, timing, and manner in which they make charitable contributions.

However, CSR is not without its challenges and costs. In Nigeria, where the banking sector is one of the most profitable and influential sectors in the economy, CSR spending has been declining in recent years, especially in 2022.

The sharp decline may be attributed to banks prioritizing their expense line following the harsh business environment across the world and the Nigerian economy.

The pressure from shareholders and regulators to improve returns on equity and capital adequacy ratios.

Nigerian banks face stiff competition from fintechs and other non-bank financial institutions, as well as regulatory headwinds such as higher cash reserve requirements and lower interest rates.

These factors have impacted on profit margins, leading to a cautious approach towards discretionary spending.

The banks were able to reduce their cost-to-income ratio to an average of 65.8% in 2022 compared to 65.95% recorded in the previous year.

Further analysis showed that profit marginally increased by 6.4% year over year from N1.07 trillion to N1.01 trillion.

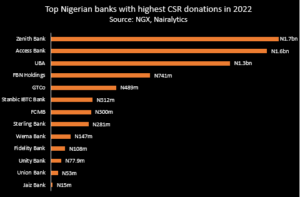

Meanwhile, despite this downturn the likes of Zenith Bank, Access Bank, and UBA led the list of banks with the highest charity donations in the review year, surpassing the N1 billion mark.

Top banks by CSR donations in 2022

GTCo – N488.7 million

GT Bank incurred a sum of N488.71 million on donations and charitable gifts, an 82% decline compared to the previous year’s N2.7 billion. The donations were spread towards community development, education, and others.

Notable donations under community development include support for people living with autism (N87.79 million), support for healthcare, water and sanitation provision for families in Lebanon (N77.8 million), and provision of basic healthcare for underprivileged children in partnership with SRC (N45.2 million).

In terms of education, GT Bank donated N93.9 million towards the sponsorship of the NUGA Games, which is a school sports tournament. N48.2 million was also donated towards financial literacy training for schools, while N12.3 million went towards the support for risk awareness and prevention conferences.

Others include support for UNEP and Africa’s largest musical concert.

FBN Holdings – N741 million

FBN Holdings recorded a total CSR expense of N741 million in 2022, representing an 83% drop compared to N2.71 billion recorded in the previous year.

It is worth noting that FBN Holdings as a company did not make any donations during the review year. However, the subsidiaries of the company that are operating entities, including First Bank of Nigeria made donations to various worthy causes.

UBA – N1.34 billion

United Bank for Africa (UBA) spent a sum of N1.34 billion on corporate social responsibility in the review year, slightly lower than the N1.41 billion recorded in the previous year. According to findings by Nairametrics Research, UBA’s cost-to-income ratio dropped slightly to 59.1% in 2022 from 62.7% in the previous year.

The bank’s profit also surged by 43.5% to N170.3 billion in the year under review.

Access Bank – N1.6 billion

Access Bank’s CSR donations dropped significantly by 60% to N1.61 billion in 2022, a sharp contrast from the N4.06 billion spent in the previous year. The newly restructured Holdco bank had spent N2.6 billion in 2020.

The highlight of some of the bank’s charitable donations includes the sponsorship of a workshop on banking, finance and fintech industries in Nigeria with N50 million, a N295 million donation towards the sponsorship of the 2022 Art X Lagos Exhibition, N10 million to the Kogi State government for Flood Relief Materials amongst others.

The bank made a profit of N152.9 billion in the review year, slightly lower than the N160.1 billion declared in the previous year. Its cost-to-income ratio however improved from 58.8% to 57.9% in the year under review.

Zenith Bank – N1.69 billion

Zenith Bank incurred a sum of N1.69 billion as donations and charitable gifts in 2022, representing a 61% decrease when compared to N4.37 billion recorded in the previous year. The makes the banks the highest CSR spender in 2022, a position occupied by UBA in the previous year.

Some of the notable donations made by Zenith Bank in 2022 include N522 million directed to various charity organizations, N331 million support towards various state government infrastructure and security trust funds, and N171 million to educational institutions, amongst others.

Zenith Bank’s profit after tax declined by 8.4% in the review year to N223.9 billion from N244.6 billion recorded in the previous year.

Other banks that made the top 10 list include:

- Stanbic IBTC – N311.9 million

- FCMB – N299.9 million

- Sterling Bank – N281 million

- Wema Bank – N147.3 million

- Fidelity Bank – N107.8 million

Bottom line

Corporate Social Responsibility signifies the ethical responsibility of businesses to create beneficial impacts within the communities and environments where they operate.

The contributions made by banks mirror their chosen areas of emphasis for CSR endeavours in Nigeria, which encompass security, education, healthcare, environmental concerns, and empowerment.

Nevertheless, there is an ongoing debate among analysts who contend that Nigerian banks should strive to enhance their CSR expenditure and effectiveness, particularly considering their substantial profitability and significant societal influence.