Following the removal of the long-standing fuel subsidy and the unification of the various official FX windows by the new administration, the global rating company S&P Globa Ratings revised the outlook on Nigeria from negative to stable.

The rating agency had in February maintained the country’s credit rating at B-/B but changed its outlook to negative in May, predicated on the country’s fiscal and debt position amidst the constrained revenue inflow and low FX supply.

Despite upward reviews of the nation’s economic outlook, the country’s fiscal deficit was N4.0tn in Q1 2023 as reported by the Central Bank of Nigeria (CBN) in its Quarterly statistical bulletin.

If evenly distributed across the quarters, the deficit of N11.34tn as pegged in the 2023 budget should be N2.84tn in the period.

However, the current deficit of N4.0tn is 100% higher than the fiscal deficit of N2.0tn in Q4 2022 and 81.82% higher than the 2.2tn reported in Q1 2022.

That said, we may likely see an improvement in the country’s fiscal position.

The government expenditure for 2023 was estimated at an all-time high of N21.8 trillion.

Given expected savings on subsidy, the impact of the currency devaluation on FX revenue and expectations of growth in tax revenue from new taxes introduced in the new Finance Act, the target budget deficit of N11.34tn may as an exception to the recent pattern, not be exceeded.

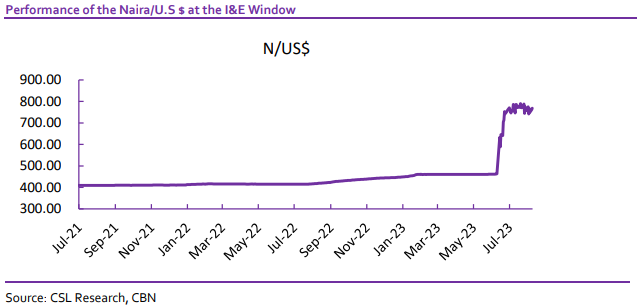

Though the parallel market rate was the benchmark used when the FX unification of the various official windows was done, the fact that the demand for FX still significantly exceeds its supply has once again resulted in an increasing premium between the I&E window rate and the parallel market rate.

The Naira closed at N757.51/$ at the I&E window and N902.0/$ at the parallel market as of 08-August-2023.

Though we believe a lot of structural reforms must be done for these policy pronouncements to be sustainable, we believe we may begin to see foreign capital trickle in as more global rating companies revise the country’s rating positively.