- Traders at Alaba International, Trade Fair, and Onitsha Markets say naira harmonization will make trading fairer than before

- Say prices of imported goods are not likely to rise due to the new policy

- Experts say the parallel market rate might be 1-5% higher because of convenience

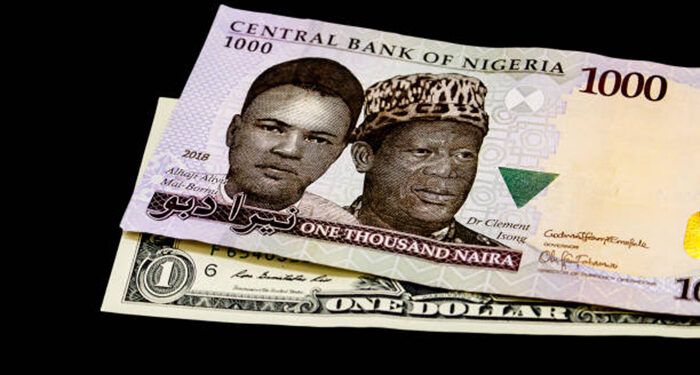

Traders at Alaba International Market, Trade Fair and Onitsha Market have told Nairametrics that the new Central Bank of Nigeria (CBN) policy to float the naira on a willing buyer-willing seller basis will offer fairer trade, bring more competition, and may bring down the prices of their imported products.

They said these in interviews with Nairametrics yesterday. Recall that the CBN announced last week in a circular that all FX windows are now collapsed into the investors & exporters (I&E) window.

What traders are saying

In an interview with Livinus Nosike, an importer and trader at Alaba International Market, the new CBN policy can only have a positive effect on his business because he had been sourcing dollars on the parallel market before the policy pronouncement.

Noting that there may be a convergence point with the official rate, he said the exchange rate may be cheaper to obtain than before now.

Jonathan Aimure, also a trader and importer of goods at Alaba International Market, said the free-for-all nature of the new CBN policy will create a level playing field for all.

- “Nobody will have the advantage of getting a lower rate than others again. We will all have access to the same market and enjoy fair trade,” he said.

A similar sentiment was shared by Uche Ibenta, also a trader and importer at Onitsha Market. Ibenta noted that although he has not bought any foreign currency since the new policy pronouncement, he said it can’t be worse than when Nigerians were sourcing forex at multiple rates.

He said the multiple rates gave an unfair advantage to certain people and a disadvantage to other people.

- “This is one of the best policies of the Tinubu administration. How can you have many exchange rates for the same market and the same economy when most of the goods we consume in the country are imported?” he questioned.

Similar opinion

David Akudinobi who trades at the Trade Fair market, also welcomed the new policy. He said whereas Nigerians may be expecting inflation because of the new policy, it may have the opposite effect.

He noted that before the pronouncement by the CBN, there were hardly any traders sourcing their forex from the CBN; all traders were sourcing their foreign exchange from the Bureau de Changes.

He said,

- “Except the Bureau de Change rate rises further beyond the N750/$ it traded before, the prices of imported goods will either remain the same or fall.”

A car importer who trades at the Berger axis of Apapa Road, Godwin Ogamba, shared a similar opinion. Although admitting that he has not sourced any forex from the market over the last two weeks, he said the business would become interesting since everyone will henceforth get his forex from the same source.

He added that the competition would become interesting over the coming months.

It is worthy of note that The Central Bank has said that the status quo remains on the 43 non-eligible items banned from the forex market under Godwin Emefiele.

Baring that policy, Livinus Azosiwe, the CEO of Cashlinks, said even in the worst-case scenario, he does not expect the exchange rate to rise more than N750/$.

What experts are saying

Dr Yemi Kale, Partner at KPMG, told Nairametrics that depending on the structure of implementation, the official naira rate will likely depreciate toward the parallel market rate to somewhere between N600 and N700/$. He said it will depend on when it is done and how it is done.

Dr Andrew Nevin, the chief economist at PwC, although shies away from making predictions, said there will be one rate, adding that the parallel rate might be 1-5% higher because of convenience.

Wole Ogundare, Managing Partner/CEO, Carthena Advisory, also told Nairametrics he expects the unified exchange rate to close between N500 and N550/$ by the end of the year, depending on the prevailing circumstances.

He said he expects the country’s foreign reserves to rise, which will positively affect the value of the local currency.

Though a good policy, the implementation would need to be seen first. This is Nigeria where what is said may not be done once certain interests come to play.