Article Summary

- About 60 NGX-listed companies have declared interim and final dividends worth over N1.5 trillion for the 2022 financial year.

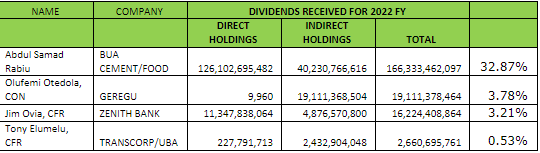

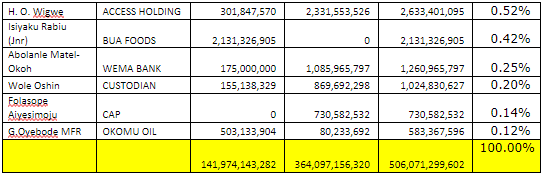

- The significant dividend payments have resulted in billionaires such as Aliko Dangote, Abdul Rabiu, Femi Otedola, and others earning a total of N506 billion in dividends.

- This emphasizes the importance of stock investment as a means of generating revenue, reflects the profitability of these companies, and underscores the potential for individuals to benefit from investing in the stock market.

Over the years, Nigerian companies across various sectors, such as banking, telecommunications, oil and gas, consumer goods, and more, have demonstrated resilience in paying dividends to their shareholders.

A cursory analysis of the financial statement of listed companies on the Nigerian Exchange reveals that about 60 companies have so far declared dividends worth over N1.5 trillion for the 2022 financial year. These dividend payments are derived from an aggregate net income of approximately N2.65 trillion in FY 2022.

This underscores the significant dividend payouts made by Nigerian companies during the 2022 financial year. An indication that a substantial portion of the companies’ earnings is being distributed to shareholders as dividends, reflecting their profitability and commitment to rewarding investors.

Basis

Our analysis and ranking are specifically based on dividends above the N1 billion mark from both direct and indirect shareholdings.

However, it is indeed important to note that dividends from indirect holdings do not necessarily imply that the entire dividend amount goes solely to the individuals as sole beneficiaries.

What the data is saying

The analysis reveals that eleven (11) billionaires received a total of N506 billion in dividends for the 2022 financial year.

#5. Tony Elumelu – N2.66 billion

The chairman of the United Bank for Africa, Tony Elumelu, owns a total of 2.38 billion in the Pan-African Bank.

The breakdown of these figures shows that he owns a direct share of 194.67 million units and a further 2.185 billion units of indirect shares in the bank.

With an improved total dividend of N1.10 (interim: 20k, and final: 90k) from N1 (interim: 20k, and final: 80k) in 2021, Mr. Elumelu earned a sum of N2.66 billion as dividends from his direct and indirect shareholdings for the period under review

The final dividend of 90k was paid on April 27, 2023. The share price currently offers a dividend yield of 11.83%.

#4. Jim Ovia – N16.224 billion

Jim Ovia founded Zenith Bank in 1990 and served as CEO until 2010 when he became chairman.

He earned N16.244 billion from his direct and indirect stake in the bank as the company declared and paid a total dividend per share of N3.20 for 2022.

Zenith Bank declared an interim dividend of 30k per share in the half year-period of the year and N2.90 final dividend for the full year, which was paid to shareholders on May 2, 2023.

Mr Ovia owns 3.55 billion units of shares directly in the bank with an additional 1.52 billion indirect shares, giving him a 16.15% stake in the bank.

He earned N11.347 billion as a dividend from his direct stake in the bank and an additional N4.877 billion from his indirect holdings, summing up to N16.224 billion.

#3. Olufemi Otedola – N19.111 billion

Femi Otedola and his indirect investors received a total of N19.111 billion in dividend earnings. This stems from his 95.65% stake in Geregu comprising 1,245 units of shares held directly and 2.389 billion units held indirectly.

Geregu declared a final dividend per share of N8, which was paid on March 30, 2023.

This pay-out represents an approximately 196% pay-out ratio, indicating that the company also paid dividends out of its retained earnings in addition to dividends paid from its profits. Geregu has about N47.8 billion in retained earnings.

#2. Abdul Samad Rabiu – N166.333 billion

The Chairman and founder of BUA Group, Abdul Samad Rabiu, and his indirect investors are set to earn N166.333 billion from his holdings in BUA Cement and BUA Foods for the 2022 financial year.

His dividend earnings account for approximately 32.87% of the total dividends received by the twelve billionaires covered in the analysis, indicating the significant income generated from his investments.

BUA Cement declared a dividend per share of N2.80, which will be paid on August 23, 2023. Similarly, BUA Foods declared a final dividend per share of N4.50, with a payment date set for September 21, 2023

Abdul Samad Rabiu has a substantial ownership in BUA Foods, with 16.172 billion units of shares owned directly and 501.189 million units owned indirectly, totaling a controlling right of 92.63% in the company. Similarly, he holds a 98.04% stake in BUA Cement, reflecting his significant influence and control over these companies.

These figures underscore Abdul Samad Rabiu’s significant role as an entrepreneur and investor in the Nigerian business landscape. His dividend earnings showcase the success of his investments and the value created through his holdings in BUA Cement and BUA Foods.

#1. Aliko Dangote – N293.960 billion

Alhaji Aliko Dangote, along with his indirect investors, is set to earn a total of N293.960 billion in dividends.

This represents a significant portion of the total N506.071 billion dividend compilation, accounting for approximately 58.09% of the total amount.

The dividend earnings for Alhaji Aliko Dangote reflect his substantial ownership and involvement in Dangote Cement and Dangote Sugar Refinery, two prominent companies in Nigeria’s industrial sector.

The dividend payments declared by these companies, with Dangote Cement declaring a final dividend of N20 and Dangote Sugar Refinery declaring a final dividend of N1.50 for the 2022 financial year, contribute to the significant dividend earnings of Alhaji Aliko Dangote

Perspective

The dividend figures suggest that companies see and use dividend payments as a significant tool to reward shareholders and a demonstration of a company’s financial strength, stability, etc.

Dividends can be particularly appealing to income-oriented investors who rely on regular cash flow from their investments. These payments can supplement an investor’s overall income and contribute to their financial goals.

However, investors interested in dividend income should research companies that have a history of consistent dividend payments, review their financial reports, and stay informed about any changes in dividend policies or announcements made by the companies.