Nigeria’s external reserves have fallen to their lowest level in a year, raising concerns about the country’s ability to weather external shocks and maintain economic stability.

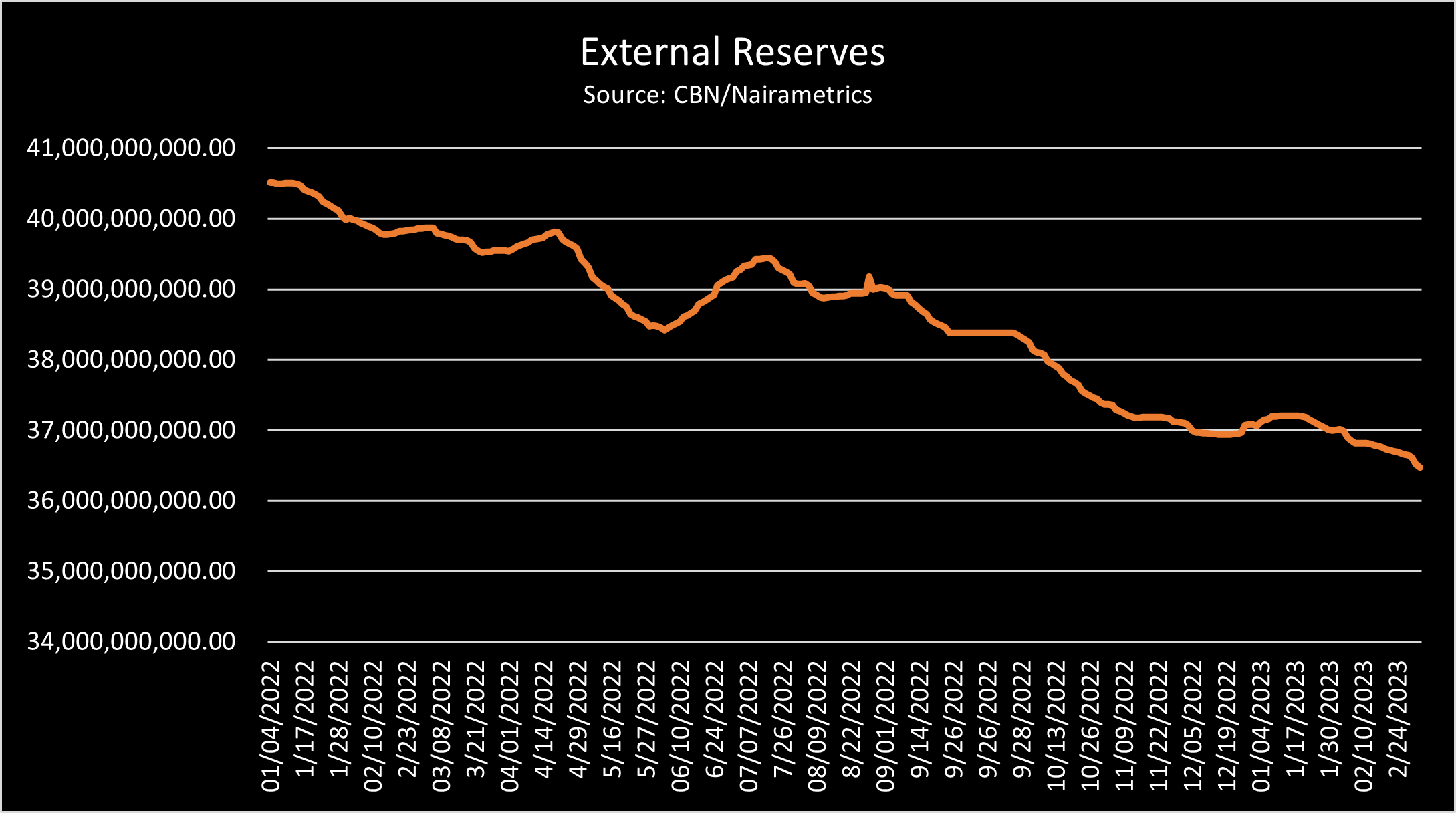

According to data from the Central Bank of Nigeria (CBN), Nigeria’s external reserves stood at $36.6 billion as of March 7, 2023, down from $37 billion at the start of the year. This marks a decline of 1.1% over the first two months of the year.

This is a worrying trend for Nigeria, which relies heavily on its external reserves to buffer its economy against external shocks such as fluctuations in oil prices, a major source of the country’s foreign exchange earnings.

Furthermore, this decline is even more significant when compared to the same period last year, when external reserves stood at $39.5 billion at the end of Q1 2022, having opened the year at $40.5 billion.

We also observed the spate of a quarterly drop in the external reserve is yet to fall when compared to the last two quarters of 2022. In the second half of last year, the external reserves recorded a net drop of $1 billion in the last two quarters respectively. However, this year, reserves have fallen by $611 million with three weeks still to go.

Why the drop: The decline in external reserves can be attributed to several factors, including a drop in oil prices and a slowdown in foreign investment inflows. This has led to a decline in the country’s foreign exchange earnings and increased pressure on the country’s currency, the naira.

In response to this trend, the CBN has taken several measures to bolster Nigeria’s external reserves, including tightening restrictions on foreign exchange transactions and increasing interest rates. However, these measures have yet to show significant results.

Experts have expressed concern about the sustainability of Nigeria’s current economic trajectory, particularly in light of the country’s high debt levels and dependence on oil revenues. They have called for urgent action to diversify the country’s economy and reduce its dependence on oil.

Optics: The drop is especially poignant as Nigerians await a change of government on May 29th, marking an end to one of the most challenging economic periods of any regime since 1999. Questions are also likely to be asked regarding the tenure of the current CBN Governor who was reappointed for a second term by the Buhari administration in 2019. His term ends next year.

The new government will have to work with the CBN r to implement policies that will promote economic diversification and sustainable growth.