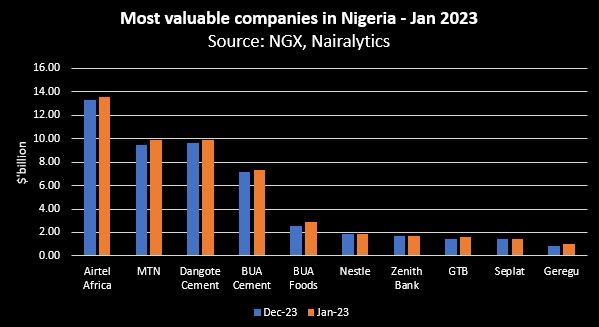

Airtel retained the top position as the most valuable listed company in Nigeria as of the end of January 2023, as MTN Nigeria overtook Dangote Cement for the second position.

This is according to an analysis by Nairalytics, the research arm of Nairametrics.

Although there are very valuable privately-owned companies with unicorn status in Nigeria, this article only focuses on companies listed on the Nigerian Exchange.

Nairametrics determines the valuations of listed companies using their publicly available market value. This is unlike the valuations of many privately-held companies which are often based on venture capital or private equity.

- All the companies are quoted on the Nigerian Exchange.

- The companies also have sizeable Nigerian ownership.

What the data is saying: The Nigerian Equities market, represented by the All Share Index (ASI), started the year on a bullish note, printing a gain of 3.88% in January 2023 following a 7.53% gain recorded in the previous month. The market capitalization also gained N985 billion in the review month to stand at N28.9 trillion at the end of January.

Nigeria’s top ten most valuable companies had a combined market valuation of N23.58 trillion or an equivalent of $51.09 billion assuming the official exchange rate of (N461.5/$1), which represents about 81.6% of the entire market valuation.

- Among them are 5 stocks worth over one trillion naira which we term SWOOTs at Nairametrics.

- The Combined SWOOTs are worth about N20.08 trillion or $43.49 billion or a whopping 69.5% of the total market cap of $62.6 billion.

- The SWOOTs are Airtel, MTN Nigeria, Dangote Cement, BUA Cement, and BUA Foods.

- Companies are often revered when they attain unicorn status, which means they are worth over $1 billion.

- Based on our data and using the official exchange rate, all of the companies on our list are worth over one billion dollars.

Biggest gainers in January 2023: Geregu Power joined the list of quoted Nigerian companies valued above $1 billion, having gained 29.9% in January 2023 to stand at $1.05 billion or N484 billion.

- BUA Foods followed with a 14.6% increase in valuation to stand at N1.34 trillion ($2.91 billion) at the end of January 2023 from N1.17 trillion ($2.54 billion) recorded as of the previous month.

- GTCo recorded an 8.5% increase in its valuation in January, closing the month at N734.31 billion ($1.59 billion) from N676.92 billion.

- MTN Nigeria also gained 4.7% in the review month to overtake Dangote Cement as the second most capitalized company in the Nigerian equities market. As of the end of January 2023, MTN Nigeria was valued at N4.58 trillion ($9.92 billion).

On the flip side, Nestle was the only company on the list that recorded a decline compared to the previous month. Specifically, Nestle lost 1.81% to stand at N856.15 billion ($1.86 billion).

In terms of ranking: Airtel Africa is top on the list with $13.52 billion, accounting for 21.6% of the total market capitalization.

- MTN Nigeria followed with a valuation of $9.92 billion, while Dangote Cement was valued at $9.86 billion.

- The two BUA companies, BUA Cement and Foods, were both valued at $7.29 billion and $2.91 billion, respectively.

- Others include Nestle ($1.86 billion), Zenith Bank ($1.7 billion), Seplat Petroleum ($1.4 billion), and Geregu ($1.05 billion).

See the chart below.

It is good you stated the focus is only in NGX listed companies. We have more valuable companies outside the Exchange. In fact, some of these valuable companies are exiting the exchange to become private. As it is, the report is inadequate. Perhaps you deploy market surveys across the country working with the bureau of statistics to come up with a national valuable companies report. The result might be that Tingo, Masab, Moda Dola, Elizade, Doyin Group etc might be much more valuable than your current first team. My personal thinking

Sorry, how many of this companies are in Nigeria?

Your valuation outcome is a good idea and serves as a guide. However, your metrics should be broad-based. I give you Kudos for that concept.