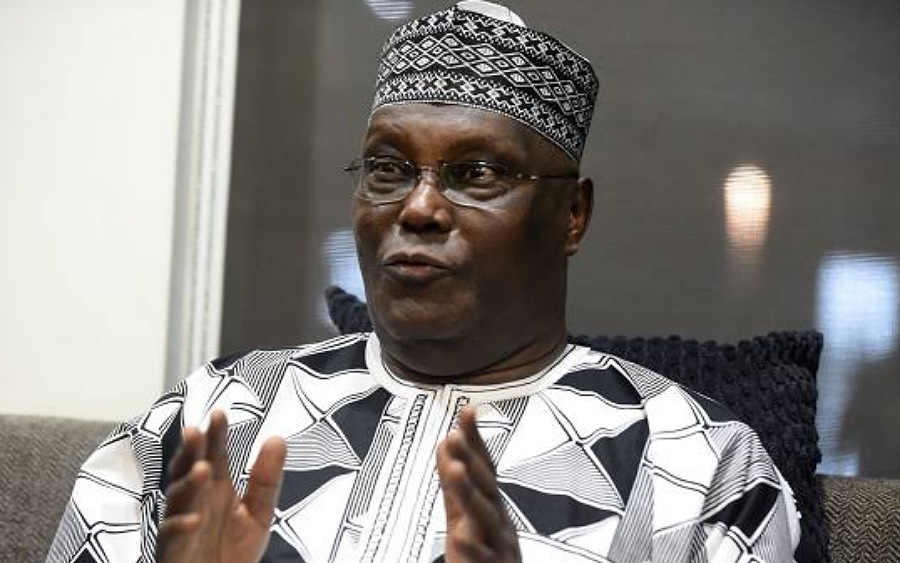

The presidential candidate of the main opposition party, the Peoples Democratic Party (PDP), Atiku Abubakar, has urged the Central Bank of Nigeria (CBN) not to further extend its February 10 deadline for swapping the old naira notes with the newly redesigned naira notes.

Atiku accused people who want to engage in vote buying as well as use money to corrupt the electoral system in the forthcoming general election of being against the cashless policy and the naira redesign.

This was made known by Atiku in a statement released on Wednesday in Abuja, where he asked the CBN to immediately review the measures it has put in place for ensuring the seamless circulation of the new naira notes.

CBN may consider printing more naira notes

- Atiku in the statement said, “The additional ten days will enable our people in the rural areas and ordinary people across the country to take the naira in their possession into the banks. It will also enable the CBN to further circulate the new currency notes among banks so that people can have easy access.

- “Within these ten days, I urge the CBN to initiate measures that will alleviate the problems being encountered by the people in exchanging their old naira notes for new ones and getting more new notes into circulation. The CBN may have to consider printing more currency notes to eliminate the current scarcity among ordinary people, especially rural dwellers who need them for their daily transactions.

- “If the CBN thinks its officials and banks must operate at the weekend in order to address the needs of the ordinary people and rural dwellers, it may have to consider this option, after all the amount these people require is not huge. The essential element here is ensuring that the new currency goes around and is well distributed to the points where people can easily access them. Every good policy must be people-centered and must not bring an avoidable difficulty to the people.’’

Vote buyers, and riggers seeking further extension

- The former vice president added, “However, the CBN should be wary of the elite whose motive for crying out about more postponement of the deadline for the tenure of the old naira notes is sinister and far from being altruistic. I am totally in support of building a cashless economy and reducing the amount of cash in our economy.

- “The cashless policy and reduction of the cash in circulation has many advantages and every patriotic Nigerian should support the CBN on this. It will help to reduce the flow of illicit funds in our economy. It will help to defeat the funding of terrorism and deter the circulation of drug money in our economy. It will help our fight against corruption.

- “More importantly, a cashless economy will help to save and grow our democracy. Those who have devised several means of buying votes in the coming elections and using money to corrupt the electoral system as well as destroying the principle of one man, one vote and the goal of a credible, peaceful, free, and fair poll are the ones shouting against the cashless policy and naira redesign.

- “The anti-democratic elements who are pretending to be democrats are the ones ganging up against the CBN because of the currency redesigning and the cashless regime it seeks to enthrone. They have been scheming and lobbying day and night to frustrate the policy. Now, their new measure is to lobby for a second postponement of the deadline for the change of currency. I urge the CBN and the government to ignore their antics. The CBN should not succumb to the current pressure.

- “There should be no further postponement of the new naira regime after the expiration of the February 10 deadline. The vote riggers are seeking to push the CBN to extend till after the election when they would have achieved their evil plots. The CBN and the Presidency should be steadfast. The merits of the new naira policy far outweigh the little inconvenience we are experiencing.

- “This is one policy that will benefit the country in the long term. We should not allow those selfish, parochial people with the narrow vision to derail it.’’

For catch up

- Recall that on January 28, 2023, Atiku Abubakar in a message called for a slight extension of the January 31 deadline given by the CBN for the swapping of the old naira notes with the redesigned new naira notes at the banks.

- The former vice president who applauded the monetary conversion policy as a worldwide practice, however, maintained that the deadline is unsuitable and as such should be slightly adjusted.

Good.. CBN should not extend the deadline.

Atiku is not a sincere human being. Inspite of the public outcry over this swap, people are going naked to press home demand for cash to feed, please reflect on the lousy position of Atiku.Atiku is not showing compassion and emphaty. Someone like Atiku cannot be trusted. A vote for Atiku is continuous suffering in the midst of plenty.