A major bane in the Nigerian economy is the accessibility to financial services in the country, especially for those living in the northern and remote regions. Nigeria is named amongst the countries with the highest number of unbanked and underbanked citizens in the world.

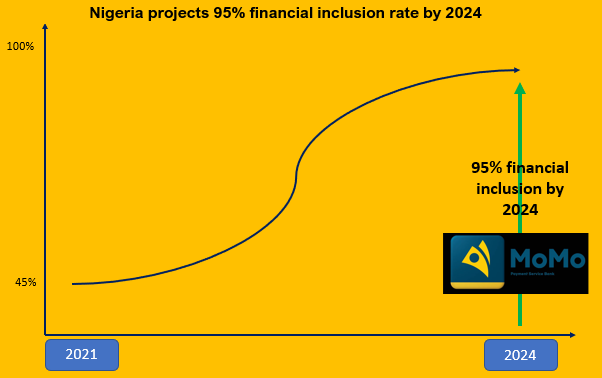

Specifically, according to the Global Findex Database 2021 of the World Bank, only about 45% of the Nigerian population have a bank account, ranking the African giants with the likes of Malawi (43%), Mali (44%), Morocco (44%), Panama (45%), amongst others.

Threading in the same direction, Global Finance Magazine noted that a staggering 60% of the Nigerian population is unbanked, indicating an estimated of 123.7 million people without access to banking services, despite having an internet penetration rate of 70% and being the largest economy in the African continent.

Meanwhile, growing Nigeria’s banking penetration and access to financial services have been a growing concern for the apex bank, which had resulted in several innovations to drive financial inclusion in the country. The Central Bank of Nigeria launched the National Financial Inclusion Strategy in October 2012, aimed at reducing the financial exclusion rate to 20% by 2020. However, this target is yet to materialise; the apex bank has now set another target of a 95% financial inclusion rate by 2024.

Before delving into the numbers and growth recorded in recent years, it is imperative to understand what it means to be financially included. According to the World Bank, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, and insurance – delivered in a responsible and sustainable way.

Financial inclusion has been identified as a key enabler to reduce extreme poverty and boost shared prosperity since a transaction account allows people to store money (save), and send, and receive payments.

Following the need to drive financial inclusivity and as Nigeria continues to struggle with its target of 80% financial inclusion, the licensing of telecommunication operators as Payment Service Banks (PSBs) through their subsidiaries has revolutionised the payment space and is expected to fast-track the journey towards a well-captured market, leveraging on their huge mobile subscription base across the country.

MoMo PSB leading the drive for financial inclusion

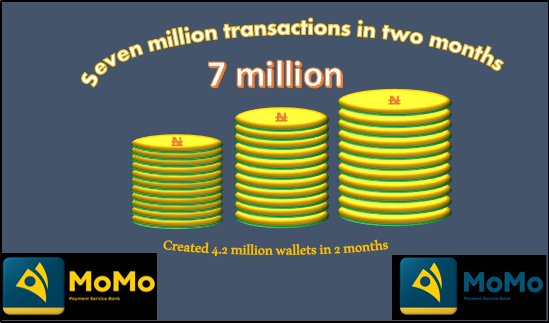

MoMo PSB is currently leading the charge to improve financial inclusion with its mobile money business in Nigeria. The Central Bank of Nigeria gave the approval to launch MoMo Payment Service Bank in April 2022 and has since created 4.2 million wallets in less than two months of operation.

The feat achieved in the space of two months is an indication of the potential the PSB has in improving financial service delivery in the country. Basically, MoMo PSB is a secure electronic service that enables MoMo wallet holders to store funds, send and receive money, make payments, and do several other transactions simply using their mobile phones.

According to MTN Nigeria’s half-year 2022 report, the MoMo service, which is a subsidiary of MTN Nigeria and was launched on the 19th of May 2022, has registered about 4.2 million wallets while transaction volume within the period stood at 7 million. From May 2022 till November 2022, MoMo PSB has recorded a transaction volume of over 35 million with a value of over 32 billion naira.

Nigerians are beginning to migrate to mobile-enabled payment channels due to the increasing young population residing in the country, with an affinity for shopping online and are more tech-oriented compared to the older generation. The preference for cashless transactions can also be attributed to security concerns, which have necessitated the transition in banking and payment methods.

To drive financial inclusion in Nigeria, MoMo PSB is leveraging MTN Nigeria’s customer base as the largest telecommunication service provider in the country, controlling about 38.4% of the market. Note that PSBs are expected to extend financial services to rural areas and areas where Nigerians do not have bank accounts.

MoMo PSB leading the drive for female financial inclusion.

According to a report by EFInA (Enhancing Financial Innovation and Access), nearly 50% of Nigeria’s population endures extreme poverty, with the unemployment rate at 23%, and the financial exclusion stands at 36% for women and 24% for men, with a relative gender gap of -33%, placing Nigeria below its peers.

To further drive female financial inclusion in Nigeria, in 2021, the African Development Bank Group (AfDB) signed a $500,000 grant agreement with Y’ello Digital Financial Services (YDFS), a fintech subsidiary of MTN Nigeria, for a study into economic, religious, and social factors hampering access to finance for women in northern Nigeria. The research, which includes a feasibility study, women-focused design, and testing, was focused on both agents and customers to provide insights into women’s use of mobile money services. Findings from the research will help create strategies to further improve financial inclusion in Nigeria, especially in the north.

Nigeria’s high unemployment and economic hardship create cccccc a need for female financial inclusion. By empowering women through female agent networks, MoMo is ensuring that women in rural Nigeria are financially included.

Impact of MoMo PSB on the Nigerian economy

An innovation that has no positive effect on the host community or economy is useless, to say the least. Here is a highlight of how the MoMo Payment Service Bank (PSB) is impacting the Nigerian economy while driving financial inclusion.

- Financial inclusion: MoMo PSB strengthens the Central Bank’s financial inclusion drive by ensuring the penetration of the unbanked and underserved in the northern part of the country and across the country. This innovation basically removes the hassle involved in the opening of regular bank accounts, queuing, and verification processes amongst others.

- Inbound remittances: MoMo PSB, through the MoMo wallets feature, allows users to receive inbound remittances from any country in the world.

- Employment opportunities: A constant economic doldrum affecting Nigerian society is the level of unemployment. According to the National Bureau of Statistics (NBS), Nigeria’s unemployment rate stood at 33.3% as of Q4 2022, an indication that at least 23.2 million were without jobs. However, MoMo PSB has been able to offer employment opportunities to Nigerian youths by empowering them as mobile money agents.

- Female empowerment: PSB enables the empowerment of women and youth through Agent banking, and populations in Northern Nigeria to deepen financial inclusion. MoMo PSB allows for the inclusion of women into the financial services net in the country.

- Economic growth: With the improvement recorded in the financial space and a decrease in the number of unemployed citizens, the Nigerian economy is set to grow further in the coming years as a result of the contribution of the telecommunication sector.

Bottom line

The MoMo PSB is poised to improve financial inclusion in Nigeria by penetrating the northern and rural areas so that the unbanked and undeserved can have access to affordable and seamless financial services. This could in turn return to significant growth for the Nigerian economy, provide employment and empowerment opportunities, as well as a medium to receive diaspora remittances within the comfort of our homes.