The Central Bank of Nigeria has disbursed a cumulative total of N4.81 trillion in intervention funds to the private sector of the Nigerian Economy as of November 2022, a 6.9% increase from N4.5 trillion two months ago.

The data was compiled from official statements contained in the monetary policy communique of the apex bank as tracked by Nairametrics.

This was the latest update the CBN provided in the MPC communique.

- Between September and October 2022, under the Anchor Borrowers’ Programme (ABP), the Bank disbursed N41.02 billion to several agricultural projects.

- The cumulative disbursement under the Programme amounted to N1.07 trillion to over 4.6 million smallholder farmers cultivating 21 commodities across the country.

- The Bank also disbursed N300 million to finance large-scale agricultural projects under the Commercial Agriculture Credit Scheme (CACS), bringing the cumulative disbursement to N745.31 billion.

- CBN released the sum of N48.30 billion under the N1 trillion Real Sector Facility to seven new real sector projects in agriculture, manufacturing, and services. Cumulative disbursement under this Facility currently stands at N2.15 trillion to 437 projects across the country.

- The breakdown of the disbursement in the Real Sector Facility includes projects in manufacturing (240), agriculture (91), services (93) and mining sector (13).

- Under the 100 for 100 Policy on Production and Productivity (PPP), the Bank disbursed the sum of N20.78 billion to nine (9) projects in healthcare, manufacturing, and services, amounting to a cumulative disbursement of N114.17 billion across 71 projects.

- A sum of ₦4 billion was disbursed under the Intervention Facility for the National Gas Expansion Programme (IFNGEP) to promote the adoption of compressed natural gas (CNG) for transportation and liquefied petroleum gas (LPG) for cooking.

Others include

- Heathcare sector – the Bank disbursed N5.02 billion to four (4) healthcare projects under the Healthcare Sector Intervention Facility (HSIF), bringing the cumulative disbursement to N135.56 billion for 135 projects in pharmaceuticals (33), hospitals (60) and other services (42).

- MSME – CBN disbursed N1.33 billion under the Agribusiness/Small and Medium Enterprise Investment Scheme (AgSMEIS). Cumulative disbursement is now at N150.22 billion.

- Under the Micro, Small, and Medium Enterprise Development Fund (MSMEDF), the apex bank disbursed N10 million between September and October 2022, bringing the cumulative disbursement to N96.08 billion.

- Export Facilitation Initiative (EFI) – the Bank provided support for export-oriented projects to the tune of N5.34 billion, such that the cumulative disbursement under this intervention stands at N44.58 billion.

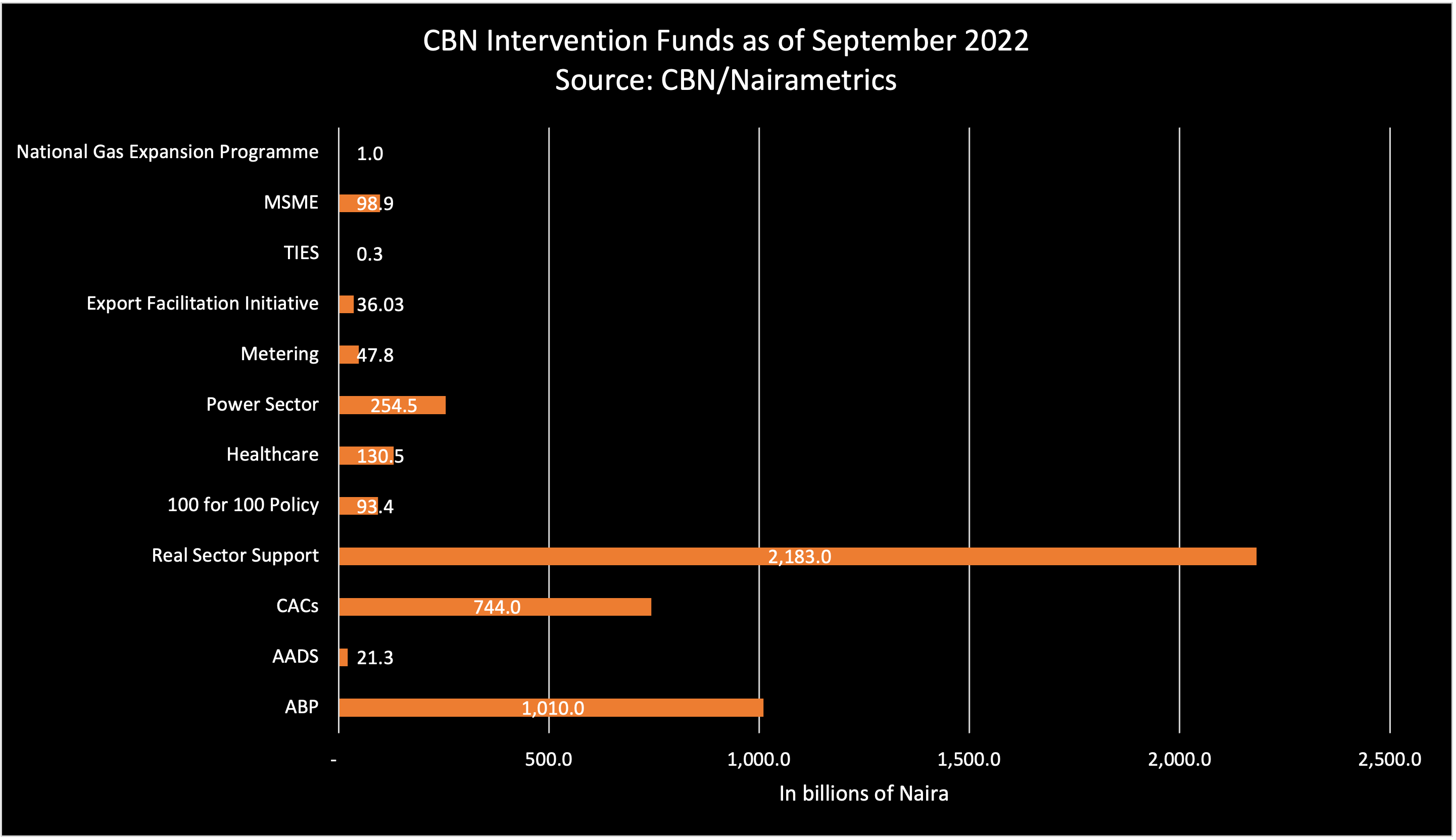

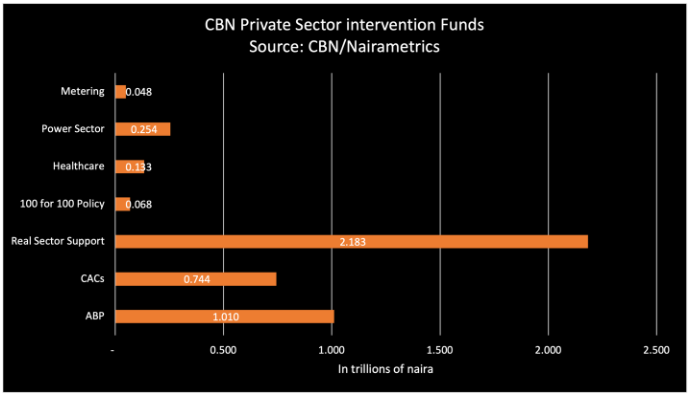

See the chart below for the breakdown of CBN Intervention Funds to the Private Sector

This chart is updated after every Monetary Policy Committee (MPC)Meeting.

The Central Bank of Nigeria has disbursed a cumulative total of N4.5 trillion in intervention funds to the private sector of the Nigerian Economy as of September 2022.

The data was compiled from official statements contained in the monetary policy communique of the apex bank as tracked by Nairametrics.

This was the latest update the CBN provided in the MPC communique.

- Under the Real Sector Facility, the Bank released the sum of ₦66.99 billion to 12 additional projects in manufacturing and agriculture.

- Cumulative disbursements under the Real Sector Support Facility (RSSF) currently stood at ₦2.10 trillion disbursed to 426 projects across the country.

- Furthermore, under the 100 for 100 Policy on Production and Productivity (PPP), the Bank disbursed the sum of ₦20.17 billion to 14 projects in healthcare, manufacturing, and services, bringing the cumulative disbursement under the facility to ₦93.39 billion to 62 projects.

- In the healthcare sector, ₦4.00 billion was disbursed to two (2) healthcare projects under the Healthcare Sector Intervention Facility (HSIF), bringing the cumulative disbursement to ₦130.54 billion for 131 projects, comprising of 32 pharmaceuticals, 60 hospitals and 39 other services.

- Under the Export Facilitation Initiative (EFI), the Bank funded several commodity projects in the non-oil export segment for value-addition and production to the tune of ₦3.24 billion, aside the ₦50.00 billion disbursed through the Nigerian Export-Import Bank (NEXIM).

- In the Micro, Small and Medium Enterprise (MSME) sector, the Bank supported entrepreneurship development with the sum of ₦39.26 million under the Tertiary Institutions Entrepreneurship Scheme (TIES), bringing the total disbursement under this intervention to ₦332.43 million.

- Under the Intervention Facility for the National Gas Expansion Programme (IFNGEP), the Bank disbursed ₦1.00 billion to support the adoption of Compressed Natural Gas (CNG) as the preferred fuel for transportation and Liquefied Petroleum Gas (LPG) as the preferred cooking fuel.

See the chart below for the breakdown of CBN Intervention Funds to the Private Sector

This chart is updated after every Monetary Policy Committee (MPC)Meeting.

The Central Bank of Nigeria has disbursed a cumulative total of N4.4 trillion in intervention funds to the private sector of the Nigerian Economy as of July 2022.

The data was compiled from official statements contained in the monetary policy communique of the apex bank as tracked by Nairametrics.

According to the CBN, it has spent a total of N4.4 trillion on the following.

- ABP – under the Anchor Borrowers’ Programme (ABP), the CBN has disbursed a cumulative of N1.01 trillion, to over 4.21 million smallholder farmers cultivating 21 commodities across the country.

- CACs – Under the Commercial Agriculture Credit Scheme, the CBN has disbursed a cumulative of N744.32 billion for 678 projects in agro-production and agro-processing.

- Real Sector Support – Cumulative disbursements under the Real Sector Facility for Manufacturers currently stands at N2.183 trillion for the financing of 414 real sector projects across the country.

- The funds were utilized for both greenfield and brownfield projects under the COVID-19 Intervention for the Manufacturing Sector (CIMS) and the Real Sector Support Facility from Differentiated Cash Reserve Requirement (RSSF-DCRR).

- 100 for 100 Policy – under the 100 for 100 Policy on Production and Productivity,

Others include

- Cumulative disbursements under the intervention are about N68.13 billion for 48 projects, comprising twenty-six (26) in manufacturing, seventeen (17) in agriculture, three (3) in healthcare and two (2) in the services sector.

- Healthcare Sector – Cumulative disbursements stood at N133.42 billion for 129 projects, comprising seventy-six (76) hospitals, thirty-two (32) pharmaceuticals, and twenty-one (21) other healthcare services.

- Power Sector - Cumulative disbursement under the NEMSF-2 currently stands at N254.46 billion. The money was given to Distribution Companies (DisCos) for their Operational Expenditure (OpEx) and Capital Expenditure (CapEx), under the Nigeria Electricity Market Stabilization Facility – Phase 2 (NEMSF-2)

- Metering – A further N47.82 billion has been disbursed under the National Mass Metering Programme (NMMP), for the procurement and installation of 865,956 meters across the country.

For subsequent reporting, how possible is it breaking down the report and consolidating some aspect? I was also hoping Metering and Power maybe reported together so also is the disbursement on CAC and ABP except there’s a differently perspective with reasons.

For the real sector support, i do hope the spend is commensurate to the contributions? .