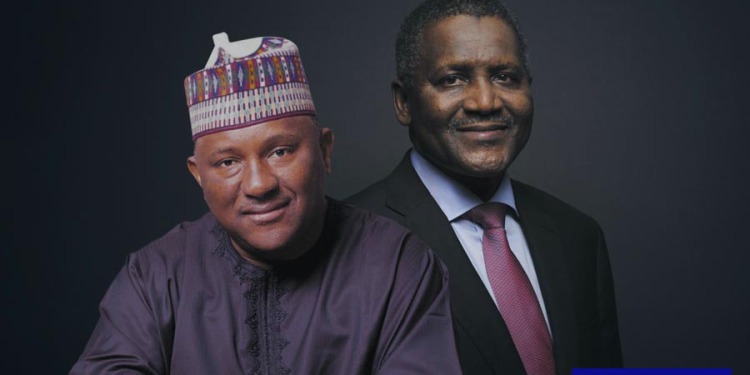

Despite the current sell-down in the Nigerian stock market due to the build-up to the 2023 general elections and interest rate hike, the shares of Dangote Cement Plc and BUA Cement Plc recorded a combined gain of N400 billion in the first three days of November 2022.

Checks by Nairametrics revealed that Dangote Cement Plc, a leading cement manufacturer listed on the industrial goods sub-sector of the NGX, led with a gain of about N332 billion during the three days trading sessions.

The cement stock grew by 8.84% to close at N240 per share from N220.50 on November 1.

BUA Cement Plc, also listed in the industrial goods sub-sector of the NGX, followed with a gain of about N68 billion during the three days trading session.

BUA Cement’s stock price grew by 2.87% to N72.00 per share from N70 which was the opening figure before trading activities commenced on November 1, 2022.

It is important to state that the remaining cement company quoted on the NGX (i.e., Lafarge Africa Plc) closed flat during the review period at 22.25 per share and N358.398 billion in market capitalization.

Recall that market analysts had advised investors that there’s still money to be made if they invest in the right sectors. The analysts recommended the industrial goods sector (where cement companies are listed) as a good sector to buy and hold stocks for future capital gains.

Further analysis of the cement companies’ performance

- Further checks showed that Dangote Cement closed Thursday’s trading session at N240.00 per share and N4.089 trillion in market capitalization on the Nigerian Stock Exchange (NGX), as against N220.50 per share and market capitalization of N3.757 trillion the previous day, gaining N332 billion or 8.84%.

- Also, BUA Cement’s stock movement showed it closed Thursday’s trading session at N72.00 per share and N2,438 trillion in market capitalization, as against N70.00 per share and market capitalization of N2.370 trillion at the beginning of trading on November 1, 2022. Consequently, the stock gained N68 billion or 2.87%.

What the financial analysts are saying

Some investment analysts who spoke to Nairametrics said dividend-paying stocks with good fundamentals would continue to do well, given their decent third-quarter financial performances.

They also noted that the fact that the share prices of some industrial goods stocks are dropping makes them more attractive. Hence, this is the time for investors to accumulate the stocks to reap capital gains and bigger dividends as the economy adjusts.

One of the investment analysts Mr David Adonri, the Executive Vice Chairman of Hicap Securities Limited, said:

- “As interest rates rise, the financial assets will then migrate from equities to the debt market or fixed income securities, which means the prices of equities will fall. It is an opportunity to buy stocks. Areas that are elastic in demand like consumer goods stocks and banking stocks are likely to be stocked to pick during interest rate hikes.

- “Investors should take a position in Food and pharmaceutical companies such as Okomu Oil Plc, Presco Plc, BUA Foods Plc, GSK Plc, Neimeth Pharmaceuticals Pl, and May & Baker Plc.

- “Banking sector is always the veritable area, particularly during this period of an interest rate hike and inflation. Banks such as Zenith Bank Plc, UBA Plc, GTCO Plc, Access Bank Plc Fidelity Bank Plc, and Stanbic IBTC are good investment destinations. Industrial goods sector such as Dangote Cement Plc, BUA Cement Plc, and Lafarge Africa are also good to buy in this period. Oil and gas stocks are also likely to benefit from inflation.

- “Most of these companies with good records which have declined so low as investors migrate to fixed income offer investment opportunities to investors because they are likely to recover as the economy is being adjusted. Like the banking stocks that have fallen so low are likely to recover very quickly when the economy has adjusted”.

Mr Mike Eze, the Managing Director of Crane Securities Limited said:

- “The banking sector is always the viable area. Banks such as Zenith Bank Plc, UBA Plc, GTCO Plc, Access Bank Plc Fidelity Bank Plc, and Stanbic IBTC are good investment destinations for this period.

- “When they were marked down for interim dividend, their prices started going down and that is to the advantage of investors. This is a good area to invest in now not only because they will pay their dividend but also for the capital gains on the share price. Investors should move towards those high-flying banks and also industrial goods stocks like Dangote Cement, BUA Cement, and Lafarge Africa”.