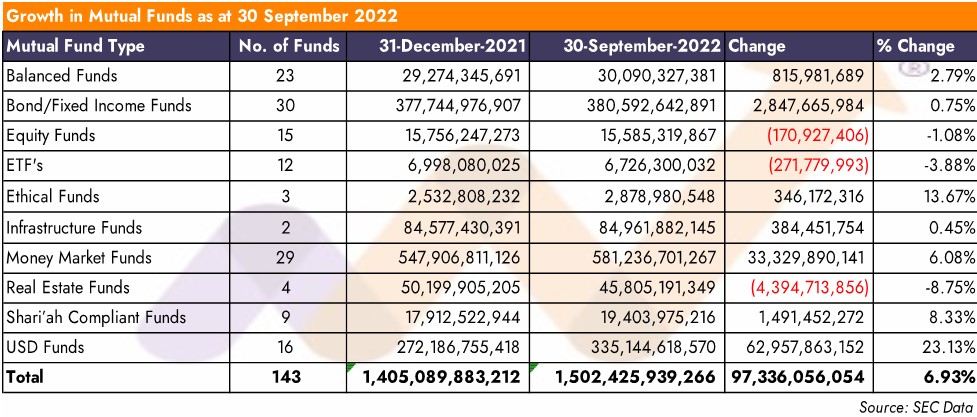

2022 has seen a 6.93% growth in the overall size of mutual funds as at 30 September 2022, growing from N1.405 to N1.502 trillion. USD funds grew by the largest centage points, growing 23.13% year to date from N272bn to N335bn, followed by ethical funds which grew by 13.67% and Shari’ah compliant funds, which grew by 8.33%. On the flip side, the overall assets of Real Estate Funds had the largest decline in assets, falling 8.75%, followed by ETF’s, falling 3.88%.

Whilst we highlight the growth and contraction in the total assets of mutual funds in general and the constituent respective fund classes and funds, detailed information to know if the growth is as a result of net subscriptions or investment growth is not available.

Number of Funds available

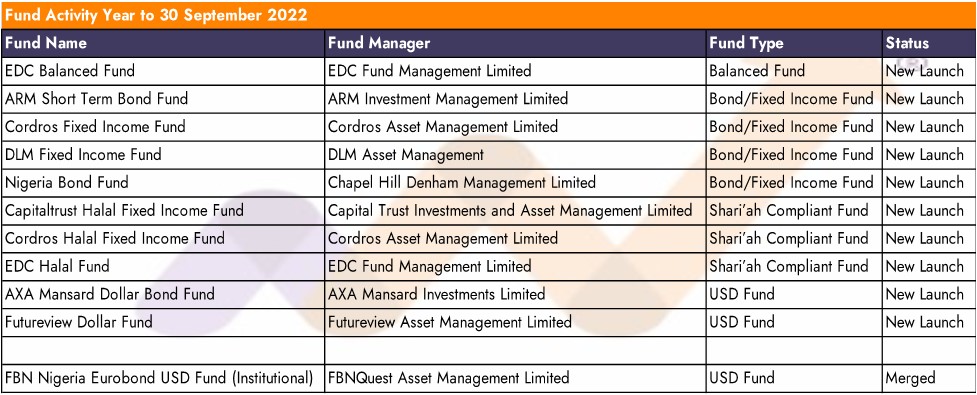

30 September 2022 closed the period with 143 funds compared with 134 available as of 31 December 2021, a net increase of 9 funds. The true position was that there were 10 new funds introduced into the market and one taken off by way of a merger. There was the introduction of 1 balanced fund, 4 Bond/Fixed Income Funds, 3 Shari’ah Compliant Funds and 2 new USD Funds and 1 USD Fund merging with an existing one already operational.

Return on Investment (ROI) of Mutual Funds as of 30 September 2022

Please note: This report has presented price returns YTD as reported and not taken into account fund managers different valuation policies. We would like to note though that whilst we have presented a ranking of returns for the funds, some factors have not been taken not account that may have occurred during the period that could have a material impact. For example, if a fund made a dividend distribution during the period, on the ex-dividend date the price would fall by the amount of the dividend which will have an impact on the period end price of the fund. Similarly, valuation policies of different funds may lead to a disparity in prices, which is not clearly visible to the untrained eye. Requests have been made and will continue to be made to fund managers to disclose such important information to investors, which is international best practice. The disclosure of such information ensures we are comparing ‘Apples with Apples’ and not ‘Apples with Oranges’ as one asset manager put it.

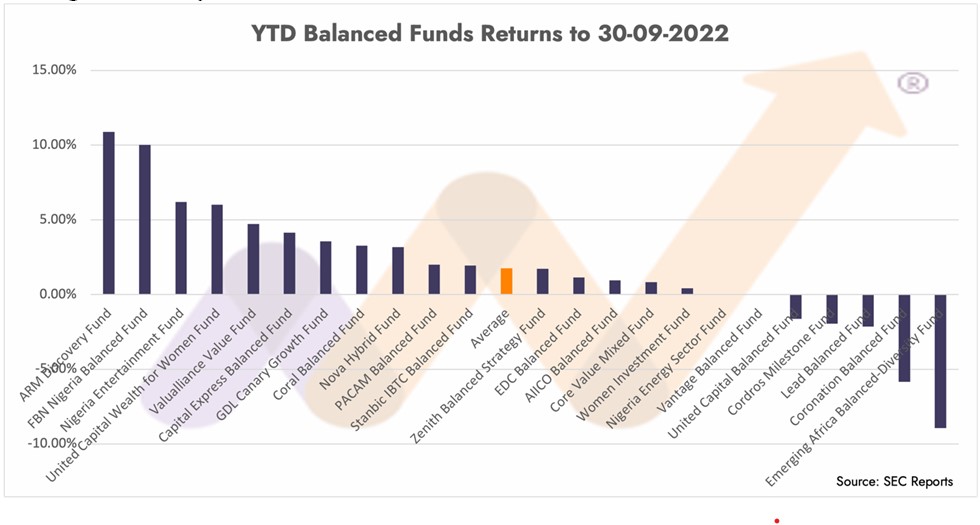

Balanced Funds

Balanced funds are mutual funds that invest in a mix of investment instruments that range from money market instruments, bonds, equities and at times real estate and other assets. The proportion and mix of such assets in a portfolio will vary with income and gains/losses coming from each asset class.

Year to date, the ARM Discovery Fund (10.89%) was the best performing Balanced fund, closely followed by the FBN Nigeria Balanced Fund (10.01%) and then the Nigeria Entertainment Fund (6.20%) managed by Greenwich Asset Management and then the United Capital Wealth for Women’s Fund.

Things to note here, in addition to dividends and valuation policies mentioned above, is that asset allocation will differ for each fund, and we look forward to when fund managers, through various means, such as newsletters or factsheets, will make periodic disclosures of their asset allocation and much more, as some managers already do.

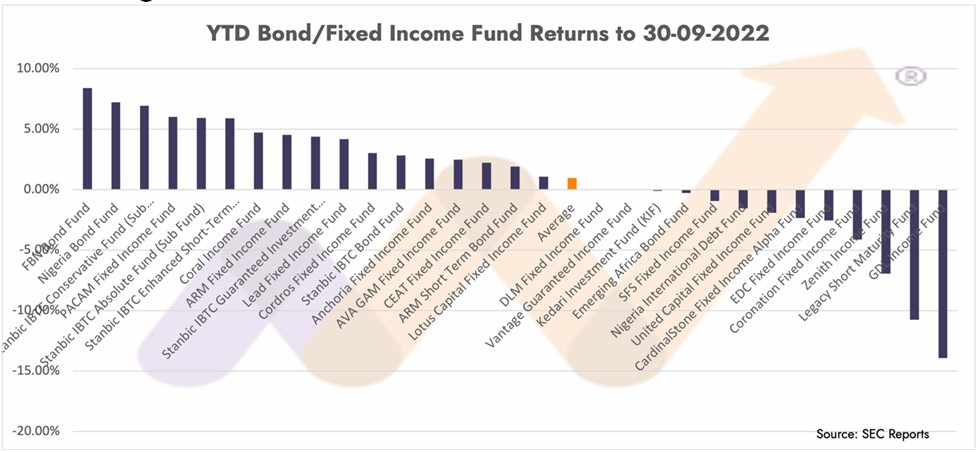

Bond/Fixed Income Funds

Bond/Fixed Income funds are mutual funds that invest in a portfolio of debt instruments issued by governments, companies, and other entities. Examples of such instruments include FGN Bonds, State government bonds, Eurobonds, Corporate bonds and may include such others like Commercial papers and Treasury Bills. Some of the instruments may pay a fixed level of cash flows at pre-scheduled intervals over time. The funds will likely make periodic dividend payments from interest earned and sometimes capital appreciation earned from the funds underlying instruments.

On a price basis, the best performing Bond/Fixed Income fund year to 30 September 2022 is the FBN Bond Fund (8.41%), followed by the Nigeria Bond Fund – managed by Chapel Hill Denham Management (7.22%), the Stanbic IBTC Conservative Fund (6.95%) and the PACAM Fixed Income Fund (6.04%).

Here, it is critical as well that disclosure of how the manager values the fund’s underlying assets is disclosed by asset managers, in addition to distributions made amongst other disclosures.

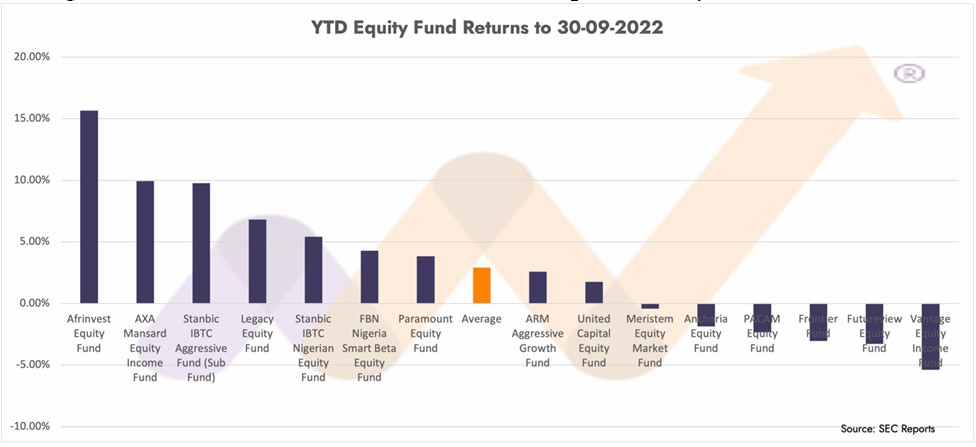

Equity Funds

Equity funds are mutual funds that invest primarily and mostly in shares.

The best-performing equity fund for the year to 30 September 2022 is the Afrinvest Equity Fund (15.66%), followed by the Axa Mansard Equity Fund (9.95%), the Stanbic IBTC Aggressive Fund (9.77%). According to FMAN, the trade body of mutual fund managers, the benchmark for equity funds should either be the NSE All Share Index (NSE ASI) or the NSE 30 Index. Over the same period to 30 September 2022, the NSE All-Share index returned 14.77% whilst the NSE 30 Index returned 1.43%. As with the mentions above, better comparisons can be made, and attribution analysis performed where asset managers disclose their funds’ asset allocation periodically to investors.

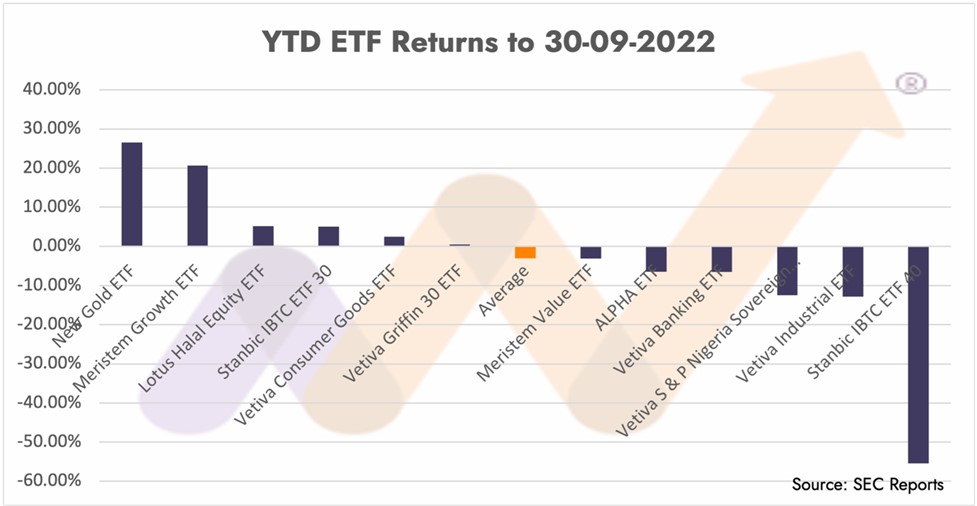

ETF’s

An Exchange Traded Fund, popularly known as ETF is a security that is listed and traded throughout the day on the stock exchange. This security is made up of a portfolio of securities in the fund that tracks an underlying index.

Each of the ETFs in the chart below track different indices. The New Gold ETF came out tops with a year to 30 September 2022 performance of 26.53% followed by the Meristem Growth ETF (20.70%). Some benchmark index returns were as follows: Banking Index (-6.62%), Consumer Goods Index (-0.78%), Industrial Index (-11.71), NSE 30 (1.43%).

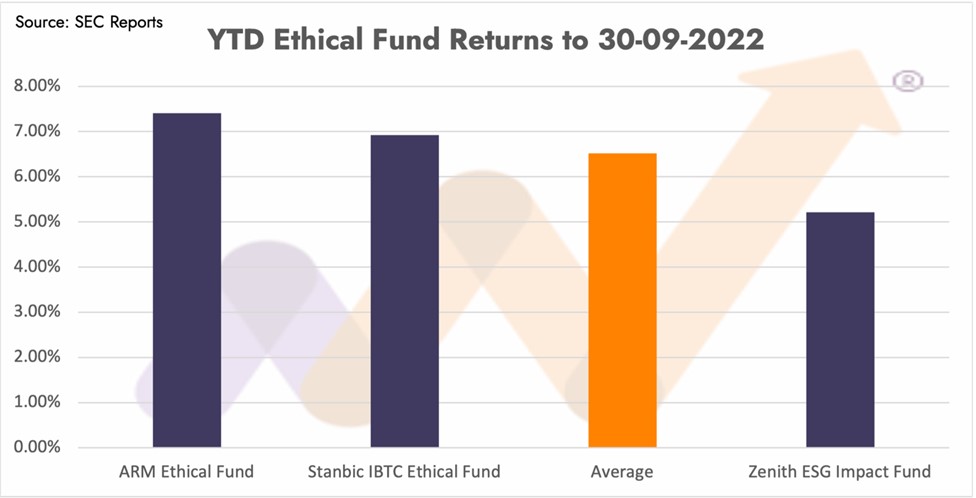

Ethical Funds

Ethical funds are mutual funds where investment decisions are made after taking into consideration some agreed ethical factors. Such factors can be set from a religious, environmental, social, governance or other moral perspective.

The best-performing Ethical mutual fund to 30 September 2022 was the ARM Ethical fund which returned 7.41% followed by the Stanbic IBTC Ethical Fund (6.92%) and the Zenith ESG Impact Fund (5.22%).

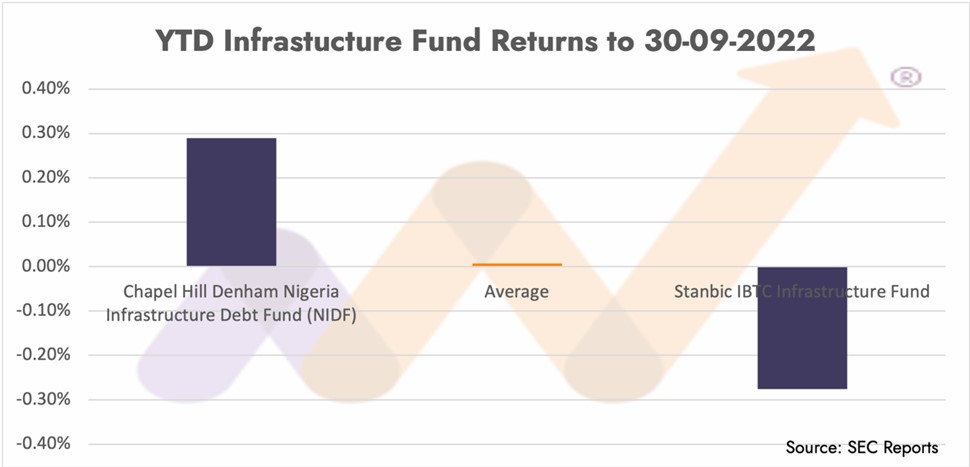

Infrastructure Funds

An Infrastructure fund will provide you opportunities to invest in infrastructure which could range from toll roads, airports, and rail facilities to power, telecoms and other utilities but is not limited to such.

It is known from the prospectuses of the two available infrastructure funds that they make quarterly distributions. In the absence of the information being made available the Nigeria Infrastructure Debt Fund (NIDF) managed by Chapel Hill Denham returned 0.29% on a price return basis (excluding distributions), whilst the Stanbic IBTC Infrastructure Fund lost 0.28% on a price return basis (excluding distributions).

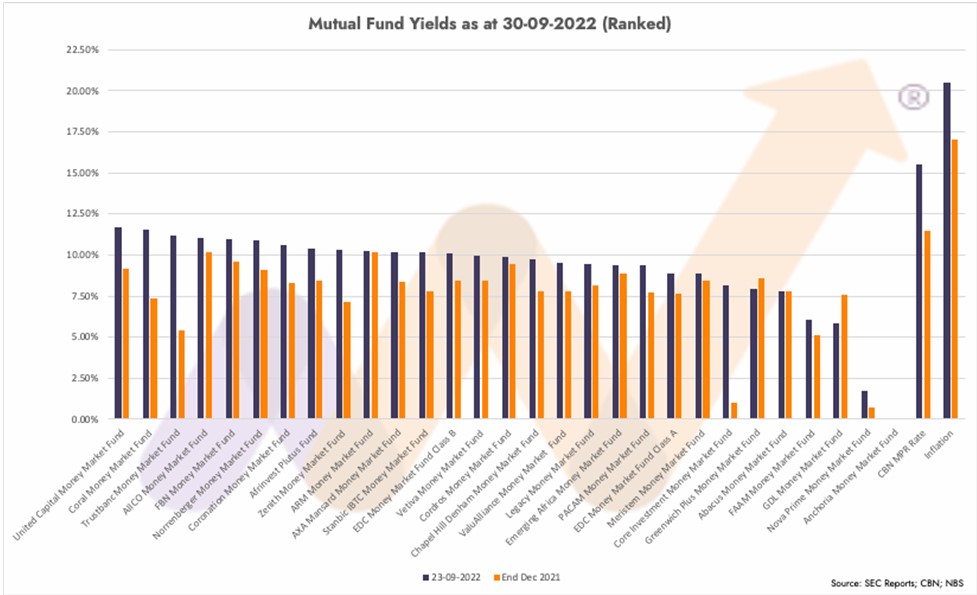

Money Market Funds

Money market mutual funds are low risk funds that invest in money market instruments such as treasury bills, commercial papers, bank deposits, etc. With current regulations, no instrument in the fund should have a maturity of more than 364 days, and an average maturity of no more than 90 days. Money Market Funds are required to maintain a stable NAV, i.e., the price should not fall below the issue price. All income is distributed out to investors, though an investor may choose to reinvest their income.

With inflation sprinting to 20.52% in August, the CBN having raised rates to 15.50% and the 12th of October 2022 364-day treasury bill stop rate closing at 13.00%, Money Market Funds have a bit of ground to make up to ensure their investors funds are not being eroded by inflation. The fund with the highest yield as at 30 September 2022 was the United Capital Money Market Fund at 11.66%, followed by the Coral Money Market Fund (11.52%) and the Trustbanc Money Market Fund (11.18%). As you see below, other than one fund, there has been a general rise in money market fund yields since 31 December 2021.

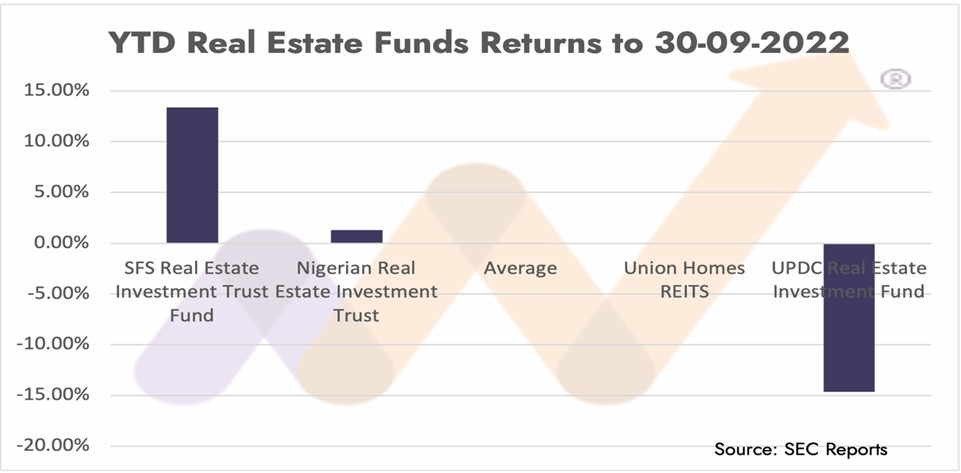

Real Estate Funds

Real Estate investment funds, also known as Real Estate Investment Trusts (REITs) are funds that owns, operates, and maintains income producing properties (real estate). They generate a steady stream of income for investors and may offer some capital appreciation too.

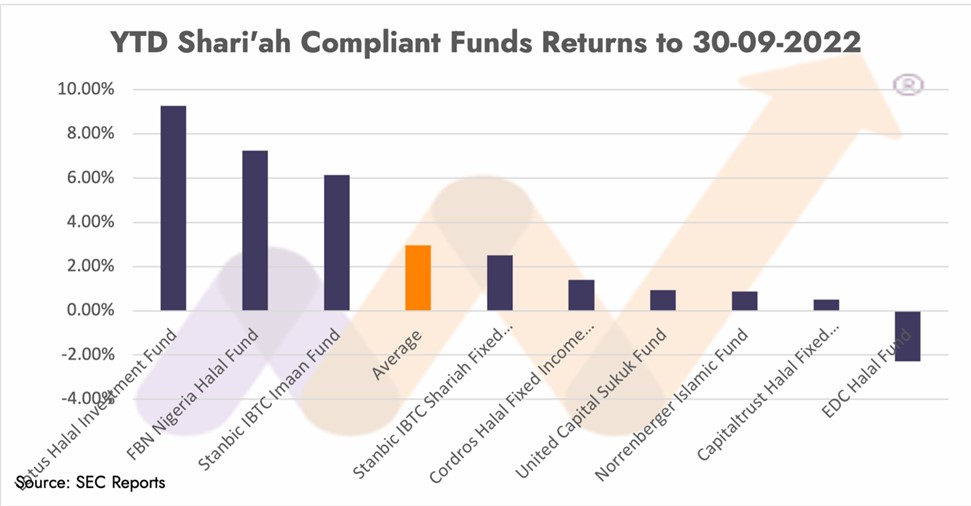

Shari’ah Compliant Funds

Shari’ah compliant funds are mutual funds setup to comply with Islamic law. These funds allow investors to invest their money in instruments and companies that engage in behaviour according to Shari’ah law.

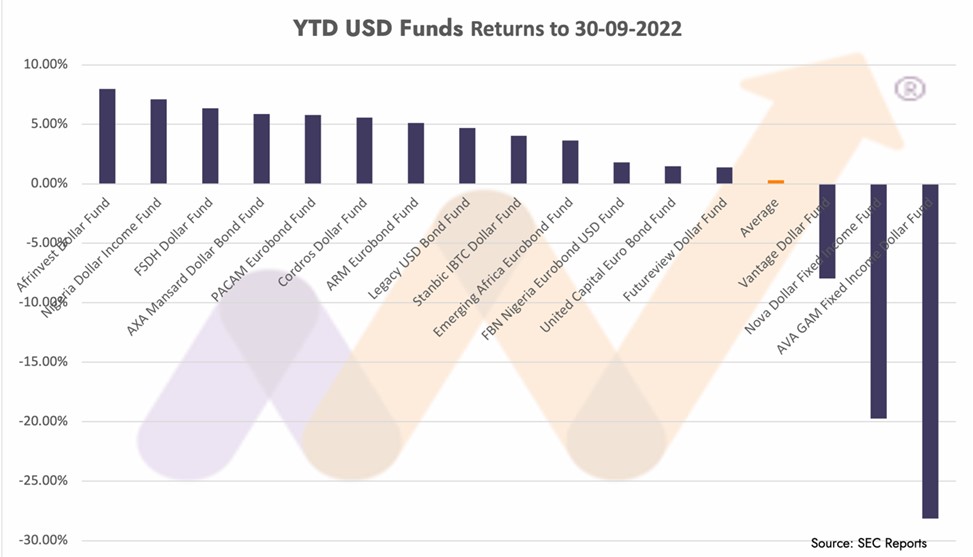

USD Funds

USD funds, are funds that invest in US$ denominated instruments, e.g., Eurobonds, US$ bank deposits, etc.

Dollar funds have been the fastest growing of all mutual funds year to date. Year to 30 September 2022, the Afrinvest Dollar Fund has returned 7.98% followed by the Nigeria Dollar Income Fund (7.11%) managed by Chapel Hill Denham Management and the FSDH Dollar Fund (6.35%).

You can visit moneycounsellors.com for more information and analysis all mutual funds.