Saving is an age-long practice that will never die irrespective of the economic situation. Some financial experts believe that saving is even as important as feeding for anyone that wants a better tomorrow. This is why even in the face of the current economic situation where many Nigerians are barely feeding, the saving culture still continues.

Until now, commercial banks were the only means of saving and a departure from the traditional piggy bank or joint saving (Ajo), methods. Interestingly, technology has made savings easier and fun with the emergence of different apps offering varieties of saving plans and interests. Not only are the apps making savings convenient, but they are also offering better incentives (interests) than you can get from your normal savings account with a commercial bank.

While some of these apps combine investment with savings, a look at the savings offerings of these apps shows that some are better than others in terms of interest promised to their customers. It must be noted, however, that these interests in savings are as promised by the respective apps.

Here are the top 7 savings apps based on promised interest as of August 2022:

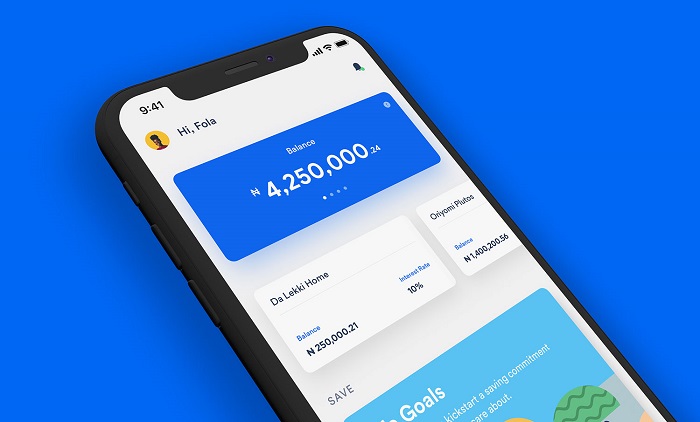

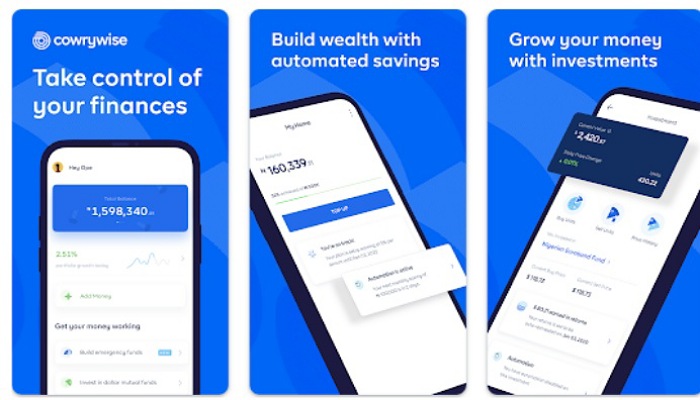

1.Cowrywise

Launched in 2017, Cowrywise offers savings with interest rates at periodic, fixed, and one-time rates. With this app, you can build your savings and investment portfolios and manage your money securely. It also allows you to save as an individual or with a group. A notable highlight of Cowrywise is the friendly user interface and the ‘Savings Challenge’, which challenges you to engage in rigorous savings plans that help you build emergency funds or a better stash of funds at the end of the specified period.

Interest rate: Based on its rate calculator that determines how much interest you get per time, the company promises up to 8.5% interest per annum.

Recommended Reading: Cowerywise Review

2. ALAT by Wema

ALAT is the innovative brainchild of WEMA Bank Nigeria and is fully digital. This means that you can perform all your transactions on your electronic devices and from the comfort of your home – you do not have to go to a physical branch.

ALAT allows you to set your savings goal and determine how much you want to save and for how long. You can automate your savings or choose to save at your own pace. You can also choose to save alone or with friends via the Group Savings option.

Interest rate: The platform promises an interest rate of up to 8.75% on savings.

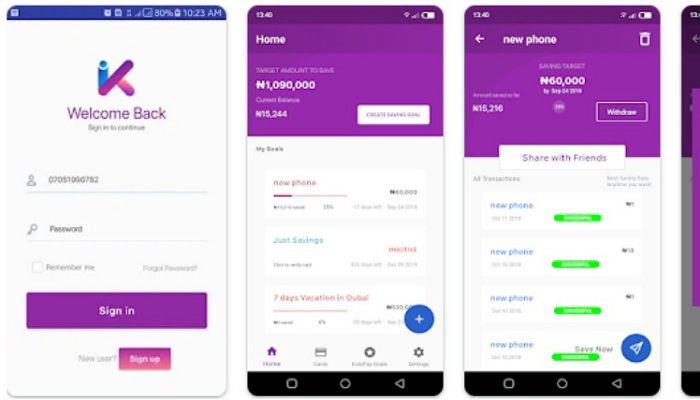

3. KoloPay

KoloPay is a mobile application that greatly helps you save money more than you thought you could. With the EasySave and Autosave options, you can choose to automate your savings by schedule – daily, weekly, or monthly. Through these plans, the app helps you easily save little by little towards your goals.

You can also use the Koloshare feature to invite others to contribute to your saving goal. KoloPay allows you to have multiple saving goals at a time.

Interest rate: Just like many of the other apps, KoloPay has a withdrawal date policy and offers an interest rate of up to 10%.

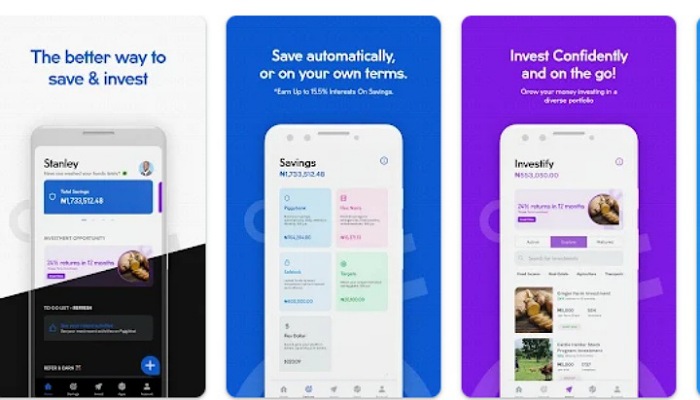

4. Piggyvest

PiggyVest is one of the largest single online savings & investment platforms in Nigeria. The company says it currently helping over 3 million customers achieve their financial goals by helping them save and invest with ease.

Launched in 2016, Piggyvest has continued to deliver excellent service to its customers, helping them manage their finances with simplicity and transparency. With over 1 million downloads on the Google Play Store, Piggyvest has different savings plans to tailored to meet the different needs of its customers.

Interest rate: Piggyvest offers different rates based on its different savings plans. The company offers an 8% per annum interest rate on its Piggybank savings plan and 8% on its Target savings, while it promises up to 13% per annum on its Safelock plan.

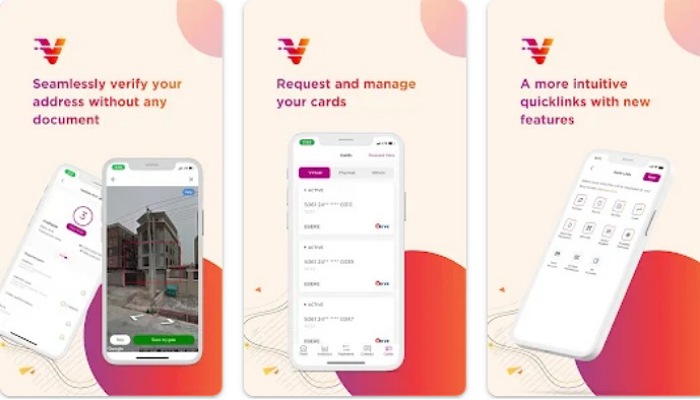

5. V Bank

V Bank owned by VFD Microfinance Bank is another digital bank in Nigeria that offers people the ability to save and get high interest on their savings. You can open a V bank account in 2 minutes with just your smartphone. With a V account, you can expect a streamlined digital and mobile banking experience, with ease of access to your accounts, swift and secure transfers, withdrawals, and bill.

You can take charge of your banking. No confusing charges, no paperwork, and everything happen on your phone. The V app allows its users to track their expenses and income, group budgets, and set spending limits.

Interest rate: V Bank says its customers get up to 14% interest on savings with the bank.

Recommended Reading: V Bank review

6. SumoTrust

SumoTrust is an automated savings and investment platform helping reshape the poor saving and investment culture of Nigerians. The saving app allows you to set aside money easily and automatically and offers both savings and investment services.

The app offers its customers 3 saving plans, which include Main Savings, a plan that gives its users the liberty to make choices to either go for daily, weekly or even monthly savings; Fixed Savings, a plan that keeps you away from the funds you’ve saved for one year; and Mission Savings, a plan designed for users with projects that need to be completed within a specific time frame.

Interest rate: SumoTrust promises 10% interest on savings on ‘Main savings’ account and ‘Mission savings’ account and 15% on the ‘Fixed Deposit’ account per annum.

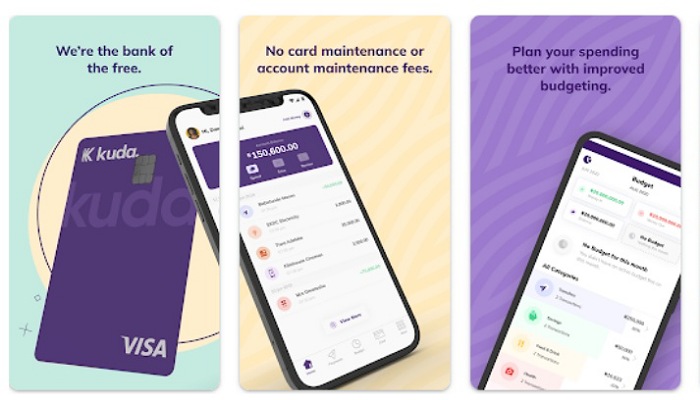

7. Kuda Bank

Kuda is a free, digital-only bank with a microfinance banking license from the Central Bank of Nigeria. Kuda includes tools for tracking your spending habits, saving more, and making the right money moves.

The app allows you to decide whether you want to be saving daily, weekly or monthly. The flexible savings plan ensures you put some money away regularly. With over 5 million downloads on the Google Play Store, Kuda continues to attract more customers through its free banking services.

Interest rate: Kuda offers different savings plans with different interest rates. While its flexible savings plan attracts 10% interest per annum, Kuday says its fixed savings yields up to 15% interest annually.

Recommended Reading: Kuda bank review

Note: The interests are as promised by the respective app platforms as of the time of filing this article. Interest rates are subject to change at any time based on market conditions.

i am a big fan of kolopay

Opay is always never on your list which surprising

PiggyVest all the way.

Branch International services is the best, surprising that they’re not on your list. They y offer 20% interest p.a

Piggyvest all the way. For just topping up your Piggy save, you get points that can be converted to cash. My favourite is Safelock, it helps you lock money until you need it, then you get instant interest for locking the money.

Piggyvest is a brilliant idea

Carbon has better savings rates than all of these and a better app and it isn’t even listed here