Globally, fintech has become the in-thing in the financial sector. In Nigeria, as in the rest of the world, the ecosystem of companies using technology to provide financial services has been revolutionizing access to finance and banking services.

The potential in these digital banks has seen global venture capitals pumping funds into fintechs in Nigeria. As more fintechs spring up by the day, the market is becoming highly competitive as the target customers now have many choices from the array of companies offering innovative financial services via mobile apps.

Interestingly, as more Nigerians embrace the fintech apps, for their convenience and easy access to financial services on the go, they are also giving feedback through ratings and reviews based on their experience.

Nairametrics took a look at the ratings of these apps on the Google Play Store by users who have been using them. Here is what we found:

Renmoney (3.4)

Renmoney is a microfinance bank that prides itself as Nigeria’s most convenient lending company with innovations that deliver outstanding service experiences. They grant both personal and micro-business loans ranging from N50,000 to N6 million.

The Renmoney app is a loan app in Nigeria that fast-tracks loan applications and credit disbursements. It collects information seamlessly, verifies loan applications, and disburses money within 24hours. On Google Play, the app has recorded 500,000 downloads. Its rating by 8,732 users stands at 3.4.

Piggyvest (4.1)

PiggyVest provides its over 3 million customers with savings and investment tools, but it’s not exactly a full-fledged digital bank. The company offers fixed, flexible, goal-oriented, and automated savings options, as well as pre-vetted low-medium risk primary and secondary investment avenues for 6 –12 months.

On Google Play, the Piggyvest app, which has been downloaded by over one million customers scored 4.1 out of 5. The rating was done by 41,032 users of the app.

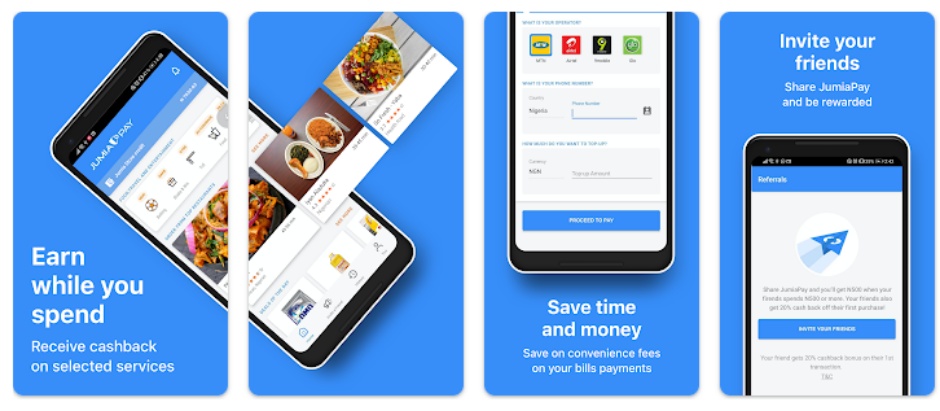

JumiaPay (4.2)

The e-commerce company, Jumia, first introduced its JumiaPay app in 2016 and is now used to pay for more than 50% of sales on the platform. The company also recently launched consumer loans on the app via collaborations with banks.

Ranking as one of the most downloaded fintech app on the Play Store, Jumia pay had garnered over 5 million downloads as of August. For the 130,000 users that have reviewed the app, the quality of experience on JumiaPay is 4.3 out of 5.

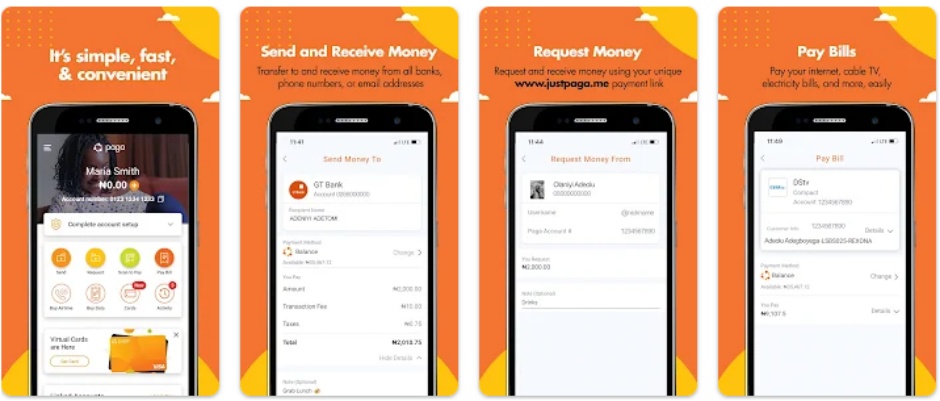

Paga (4.3)

Paga is a mobile money solution that offers transfers, bill payments, top-ups, and even remittance services. The company has 17 million users and is accessible to the unbanked, offline users through a mobile money agent network as well.

On Google Play, the Paga app has exceeded 500,000 downloads. The app is rated 4.3 by 8,704 users. Though it has a larger number of customers offline, the number of downloads and reviews on the Paga app places it behind other apps above with the same rating.

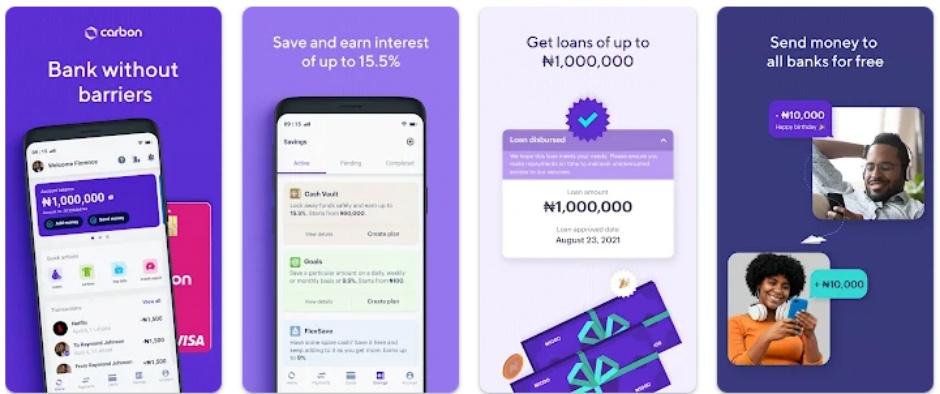

Carbon (4.4)

Carbon is a CBN-licensed digital bank that also provides a loan facility and investment opportunities, in addition to usual digital banking features such as debit cards. Accounts are enabled for P2P payments, as well as bill payments and mobile recharges.

Though the fintech company currently has over two million customers according to its website, its app on Google Play has been downloaded by one million-plus customer. The app users believe that the app deserved a 4.4 rating based on their experiences. The app has recorded 128,128 user reviews as of this month.

Recommended Reading: Users Review on Carbon app

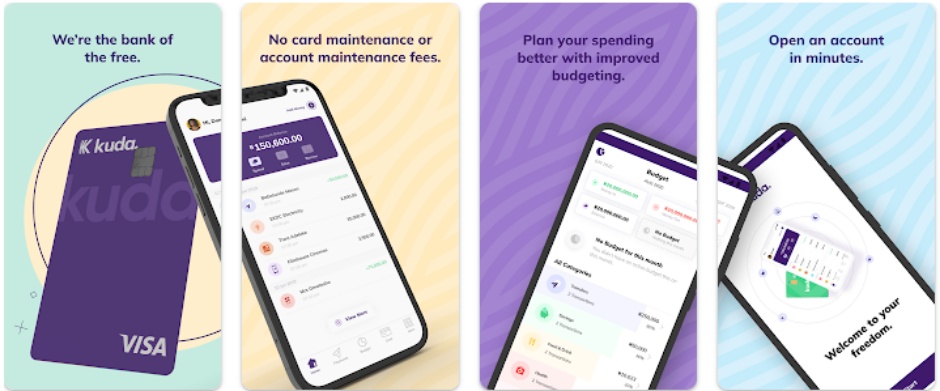

Kuda (4.4)

The fintech valued at US$500 million is fully licensed by the Central Bank of Nigeria (CBN). Although Kuda is based in London, it is currently focused on the Nigerian market. Kuda accounts come with a free debit card, budgeting and spending controls, and transfers and savings functions as well. The bank has also killed maintenance fees and provides users with a specific list of free transfers each month.

With over one million downloads, the Kuda app enjoys positive reviews from many of its users. As of this month, 160,790 users had reviewed the app, giving it a 4.4 rating.

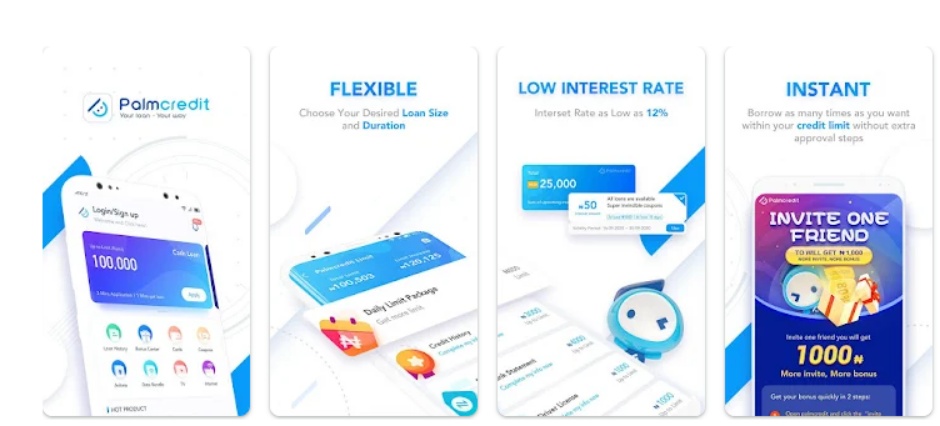

Palmcredit (4.4)

With over 5 million downloads, Palmcredit, is a loan app in Nigeria owned by Newedge Finance Limited where users can get a loan without collateral. As one of the most downloaded fintech apps, there is no doubt that many Nigerians are taking advantage of the loan services being provided through the app. Google Play shows that 173,00 users had given the app a 4.2 rating as of August this year.

Recommended Reading: Top 10 loan apps in Nigeria in 2022

FairMoney (4.4)

FairMoney is a digital bank focused on lending. The company provides instant loans of up to one million naira, as well as a bank account and a debit card. According to the company, FairMoney processes over 10,000 loans every day, with one loan disbursed every eight seconds.

This is reflected in the fintech’s app on the Play Store as it crossed 5 million downloads as of April. For the 471,180 users that had reviewed the app, a 4.4 out of 5 was considered appropriate for their experience.

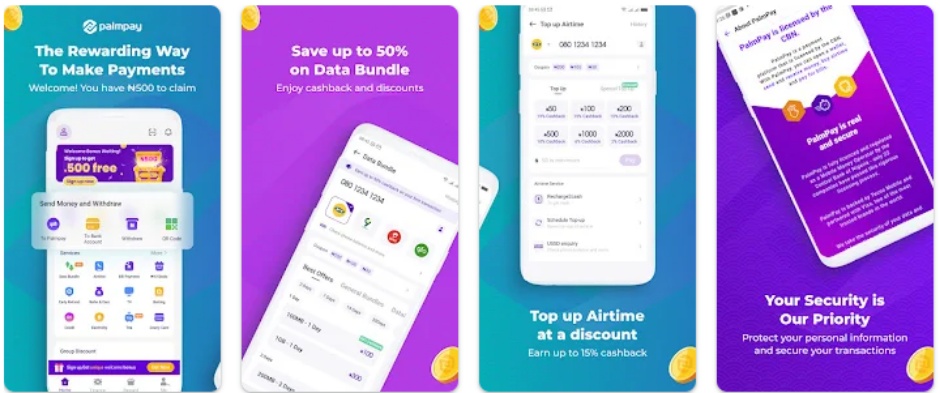

Palmpay (4.5)

The Palmpay fintech app was first released in September 2018, according to information on Google Play. But a pilot phase was launched in July 2019 after the company secured a mobile money operator licence from the Central Bank of Nigeria (CBN). It officially became available to Nigerian users in November 2019.

Obviously one of the most downloaded fintech apps at over 5 million, Palmpay is also highly rated by users as it scored 4.5 out of 5. The app, however, has fewer reviews compared with Opay. Google Play shows that 222,289 users had reviewed the app as of this month.

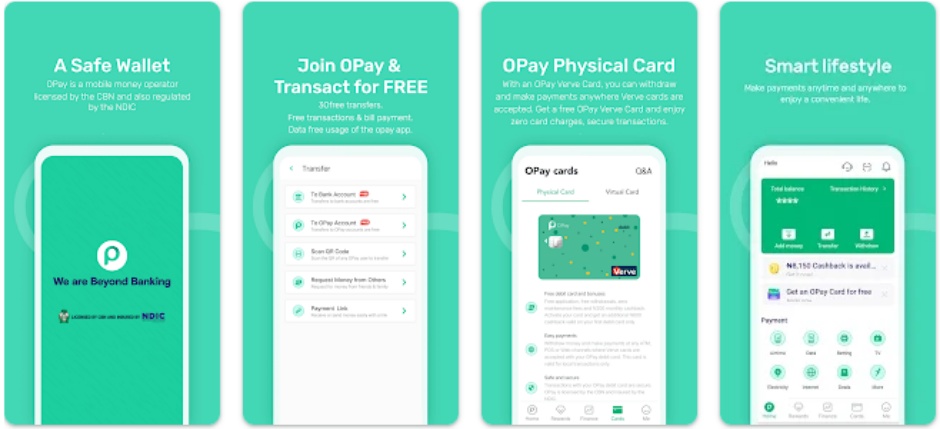

Opay (4.5)

Opera’s Africa fintech startup OPay, launched its mobile money platform in Lagos in 2018 on the popularity of its internet search engine in Africa. OPay’s mobile money service gives users the ability to pay for utilities, make P2P transfers, and save as well. The company also offers an offline banking service through which users that don’t have smartphones can still carry out transactions.

As of April 30, 2022, the fintech app had crossed 10 million downloads. Based on 227,416 users’ reviews, the app was rated 4.5, one of the highest ratings for any app in the same category.

Did you guys check out Cowrywise?

Nice