Despite being in the news for negative reasons, especially as a result of the nefarious activities of the crooked ones known as loan sharks, loan apps continue to bridge the gap left by the traditional commercial banks in providing quick loans to many Nigerians. For the good ones that are keeping to the ethics of the business, the market remains a vibrant one to explore as millions of Nigerians in need of emergency funds keep leveraging the various platforms.

Among the few ones known to have built a good reputation over time in the industry is Carbon. Previously known as One Credit, Carbon Loan is a money-lending platform that only targets salary-earners who urgently need to get an amount of money to sort out a personal need.

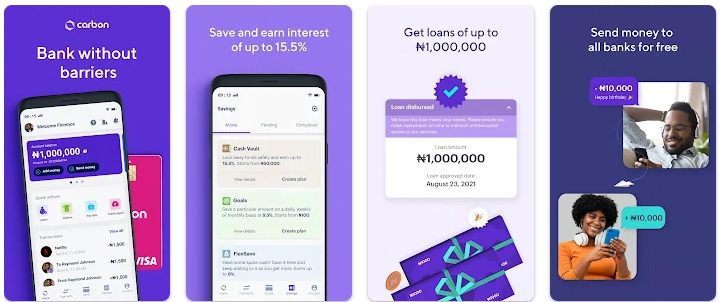

Carbon provides a range of financial services, including personal loans, business loans, payments, funds transfers, credit scoring, savings, and investments. The Carbon loan application process typically takes less than 5 minutes to complete. Their rates range from 2% to 30%, and this depends on the loan repayment period and the amount of money you wish to borrow.

Read also: Fair Money app Review

Users’ review

The Carbon app is flexible with a beautiful design and simple user interface. While many of the app users are testifying to smoothness and the ease of using the app to access quick loans, the latest update to the app seems to be a problem for some users. Some users of the app who spoke with Nairametrics have these to say about their experience:

- According to Taiwo Olawale, Carbon is the best loan app he has ever used. “Their repayment process is quite simple and the app is very user-friendly and easy to navigate. Regarding the repayment timeline, they are quite flexible with repayment options ranging from 14 days to 6 months and above depending on the interest rate the lender is comfortable with. They are prompt in customer service delivery and quick to resolve any issues being experienced by their users,” he said

- For Precious Olaiya, though she considers the interest rate on the app very high, she admitted to having had a smooth experience on the platform. She said: “Carbon is a great App, well-designed with a friendly interface and simplicity. I could not believe that an app could be this awesome. The process was smooth. Once you have all the correct information they need, your application will be processed in minutes. The awesome part of everything was that my loans were done on Saturday. However, the interest rate is high.”

- Another user, Tosin Salami said he had been enjoying the app until recently when it was updated and he started having problems. “I’ve been enjoying this app since 3years ago, applying for loan seamlessly and do repay earlier than schedule. But after the recent update, the experience has become terrible. Having successfully repaid my loan, the app kept denying me access to loan again despite the assurance from the team that I’m qualified for higher amount. I’ve reached out to the support team multiple times with no solution in sight. Very bad experience from Carbon,” he said.

Google Play Store reviews

On the Google Play Store where the app has been downloaded over 1 million times, the app also enjoys positive reviews with the only snag being problems with its recent update.

- Emmanuel Aluyi wrote: “The most recent update has been frustrating. I can’t login in, always giving me an internet connection error, even though I have a connection. I decided to clear the app’s data to start afresh, and that made it worse. I can’t even load the app. It’ll open for a few seconds, then give me an “unable to load configuration” error, then close.”

- Another user, Shamah Godoz wrote: “Over the past 7 months, Carbon’s software has had serious problems. They say they’ve resolved it but then it fails again. I’ve lost time and trades on this app. And after using their loan features and building credit for over two years, they ask me to verify my account again. And guess what…verification has been failing for the past three months. I don’t think I can again. As soon as I can get my money out, I’m going away. Nice invest feature though.”

- Buchi Maximus wrote: “It’s been smooth so far. Although the downtimes are there, I like the fact that you get informed. However, I think the transaction details should be made in a way for you to open it when you want to see them, not everything popping up on your screen once you open the app. And please, fix save beneficiary. I love the app, money pinching from other banks I was experiencing has come to an end.”

- For Bello Adebayo, his issues with the app also began with the latest update after 3 years of smooth experience. “Great app for payday loan. I’ve been using it as an alternative bank for my daily financial transactions since (sic) 3 years ago when it was pay later, and I enjoyed the service. However, recently, I got a notification that I should update the app and I did but haven’t been able to use it since updating. It just kept on loading since two days ago. The developer or operators should fix this bug or hitch on time before they lose more users,” he said.

- Faith Okoro says she has been using the app since 2018 and it was beautiful “until this update issue came up and spoilt everything. Whoever came up with this idea didn’t do well at all. It’s almost impossible to upgrade to level 3 and now I’m getting reduced amounts with outrageous interest rates. Please, make Carbon what it used to be, it’s becoming like every other trash app on the internet, I’m really disappointed, I should never have updated my app.”

- The experience for Cecilia Oduh was no different. According to her, the Carbon app had been comfortable for her for years until a recent update came. “I have used this app for years without any issue. I have been operating without problems but recently, I started having challenges with it. I have been giving a top-up for my accurate and on-time payments, but can’t access it. Even when I have met the requirements, I am still denied my top-up, which is very unusual in Carbon. This is not a good one,” she wrote.

Bottomline

The Carbon app is, no doubt, one of the best out there when it comes to loan apps in Nigeria. The recent experience shared by the users shows that the app owners need to fix the bugs that are creating issues that were non-existent on the app before.

Please l need to know any of your customer service agent that I need to talk to, l am Olufowobi Taye A, l have paid back my loan, yet , l am still being disturbed

Not able to download on play store

Haven’t been able to login into my carbon account why?? The carbon app refuses to open for the past 3 days now