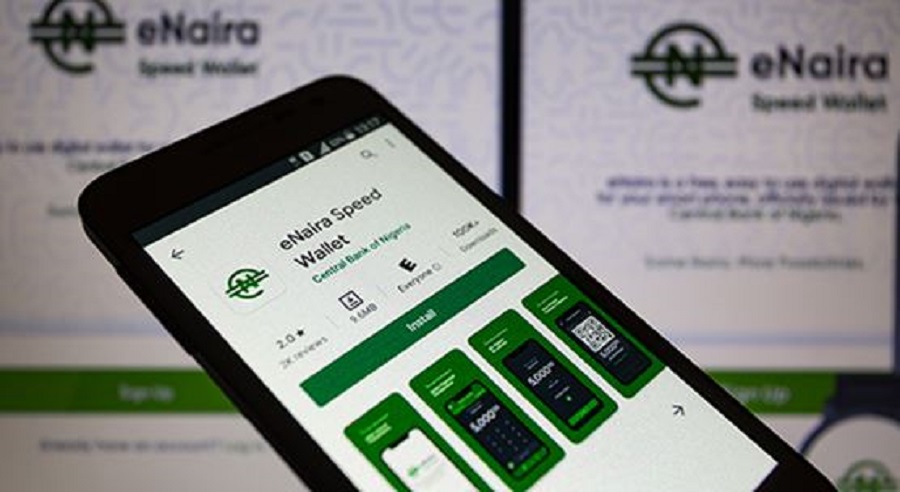

The Central Bank of Nigeria’s digital currency, eNaira has recorded 200,000 users and N4 billion worth of transactions since it debuted in 2021.

This was disclosed by Mr Godwin Emefiele, the CBN Governor at the grand finale of the “eNaira Hackathon”.

The hackathon is a joint project between CBN and the African Fintech Foundry (AFF). The purpose of the event was to bring together teams of outstanding African entrepreneurs, developers, designers, solution developers and problem solvers to create creative solutions for increased eNaira adoption.

What CBN is saying

Emefiele said “Since its inauguration, eNaira had reached 840,000 downloads, with about 270,000 active wallets comprising more than 252,000 consumer wallets and 17,000 merchant wallets. In addition, volume and value of transactions has been remarkable reaching above 200,000 and N4 billion Naira respectively”

“The eNaira will make a significant positive difference to Nigeria and Nigerians. It was also developed to provide Nigerians with a cheap, safe and trusted means of payment. It is unlike the offline payments channels like agent networks, USSD, wearables, cards and near-field communication technology.

“The eNaira would give access to financial services to underserved and unbanked segments of the population,” he said.

He asserted that the eNaira-based products and services would increase Nigerians’ engagement in the digital economy and encourage the expansion of the budding Fintech sector.

“To achieve these set-out objectives, the project adopted a phased approach with the first phase focusing on banked users, while the policy objective of the second phase borders around financial inclusion. In addition, the eNaira platform possesses an innovation layer for products and services to be built with the aim of enhancing Nigerians’ participation in the digital economy,” he said.

The project’s second phase, according to Emefiele, has started and aims to promote financial inclusion by bringing on unbanked consumers by utilizing offline channels. Using the eNaira platform, he said, the CBN was now prepared to accept unbanked Nigerians.

He said “Greater success is envisioned for the project with phase two expected to deliver more gains with a target of about eight million active users based on estimations using the diffusion of innovation model. When we launched the eNaira, we promised to increase the level of financial inclusion in the Country because just like the Naira, the eNaira is expected to be accessible to all Nigerians.

”I am pleased to inform you that by next week, Nigerians, both banked and unbanked, will be able to open an eNaira wallet and conduct transactions by simply dialling *997 from their phones.

What you should know

- Africa’s first digital currency, eNaira, has been ranked No 1 global retail CBDC, and app downloads have jumped to 756,000 from 700,000 seen in December 2021.

- PwC disclosed the ranking in its 2022 CBDC Global Index and Stablecoin Overview. The eNaira has also recorded 700,000 downloads as of December 2021, while over 35,000 transactions have been conducted on the platform.

- The report also gave Nigeria’s eNaira a retail index value of 95 while the country also ranked number one in Africa. The index is based on a BIS working paper, the World Bank, and PwC analysis.

- The IMF has warned about the potential expansion of the use of the eNaira for cross-border fund transfers and agency bank networks could lead to new money-laundering and terrorism financing risks.

- The IMF welcomed the gradual rollout of the CBDC and highlighted the need for vigilance to various risks, including monetary policy implementation, bank funding, cyber security, operational resilience, and financial integrity and stability, through regular risk assessment and contingency planning.

The CBN and the management team are making relentless effort to boost Naira and to make e naira accessible to. More Nigeria.Thanks .