Ecobank Group has reported 24% growth in unaudited H1 2022 profit before tax to $261 million from $210 million posted the prior-year period.

According to the group in a statement, if adjusted for the impact of foreign currency translation (or at constant currency), PBT increased by 53%, driven by positive operating leverage.

In addition, PBT increased in each of its business lines with Corporate and Investment Banking (CIB), Consumer Banking (CSB) and Commercial Banking (CMB), growing their PBTs by 33%, 43%, and 15%, respectively, in the first half of 2022.

Profit available to ETI shareholders of $130m was up 23% and diluted EPS of 0.53 US cents, up 24%

Net revenue (operating income) was $910 million, increasing by 10% or 23% at constant currency. The increase in revenue was primarily driven by a 13% growth in non-interest revenue and an 8% growth in net interest income.

In addition, each of our businesses grew revenues, with CIB up 17%, CSB up 11%, and CMB up 10%, reflecting growing success in our revenue expansion goals stated in our ‘Execution Momentum’ strategy. Overall, revenues benefited from rising interest rates, higher spreads on buying and selling currencies for clients, increased card spending, and cash management-related fees.

What the bank is saying

“Our results for the first six months of 2022 reflect not only the benefits of the firm’s diversification but also our resilience and capabilities to continue serving our clients and customers in a challenging environment and still generate adequate returns responsibly for our shareholders.

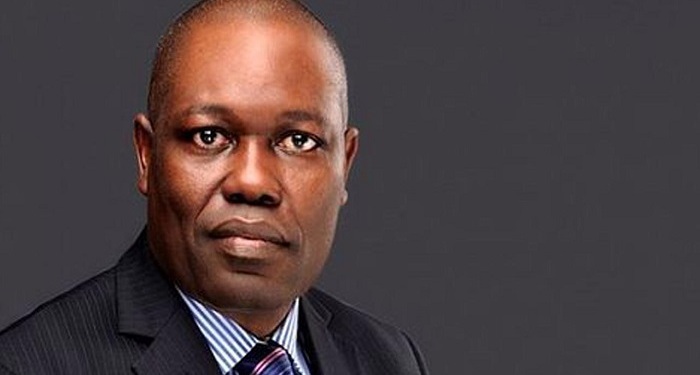

As a result, we delivered a return on tangible equity of 19.5%, a record, and increased earnings per share for shareholders by 24% year-on-year. In addition, profit before tax increased by 24% to $261 million and by 53% if you adjust the increase for the significant depreciation of some of our critical African currencies to the US dollar, says Ade Ayeyemi, CEO, Ecobank Group.

Ayeyemi continued: “We performed well because of our investments, including in technology, and Ecobankers’ continued dedication to meet customers’ financial needs, despite a challenging operating environment of high inflation, weakening African currencies, worsening government fiscal balances and lowering economic growth.

“In our Consumer Banking business, pre-tax profits increased 43% on higher deposit margins, loans, and debit card spending. In Corporate and Investment Banking, profits rose 33%, as we gained share in the letters of credit market, payment volumes increased by 43% on Omniplus, and FX volumes grew by 25% as client activity rebounded from the pandemic. In addition, an increase in SME activity and growth in the payment business lifted profits in Commercial Banking by 15%.” “Our investments in technology and digital capabilities have contributed to a reduction in our cost-to-serve.

“Along with revenue growth, the outcome is our record cost-to-income ratio of 56%. In addition, we increased impairment charges to reflect heightened credit risks. More importantly, we have proactively built central impairment reserves of $206 million, which we can deploy in a stressed credit environment. At the same time, our balance sheet remains liquid and adequately capitalised, providing us the capacity to serve our customers better.”

“Our service to our customers and communities, anchored on our vision to advance Africa’s economic development and financial integration, is widely recognised. Recently, Euromoney adjudged Ecobank for 2022 – Africa’s Best Bank, Africa’s Best Digital Bank and Africa’s Best Bank for SMEs. These accolades are a testament to our passion for serving clients and customers and our continued investments in technology, processes, and people. I am extremely proud of my colleague Ecobankers and thank them for their diligence. As always, we are passionately working towards realising our vision and remaining the bank that Africa and friends of Africa trust.” Ayeyemi concluded.

Other key financial highlights

- Payments business grew 23% or $22 million to $119m (13% of Group revenues), driven by merchant acquiring, cards businesses and wholesale payments.

- Record cost-to-income ratio of 56.0% benefited from higher revenues and stringent cost containment measures in an inflationary environment.

- Customer deposits (EOP) increased by 3% or 16% at constant currency to $19.7 billion.

- Gross customer loans (EOP) increased by 6% or 18% at constant currency to $10.1 billion. Commercial Bank loan growth was offset by lower CIB and Consumer bank loans.

- NPL ratio improved to 6.2% compared to 7.4% a year ago and proactively improved the NPL coverage ratio to 113.5%. In addition, our allowance for impairment charges includes a central macro-overlay buffer of $206m for any future downside risk