The rise of FinTech Companies in Nigeria has seen a new wave of virtual banks that offer convenient banking services for Nigerians. The major advantage these virtual banks have over legacy banks has always been convenience. But beyond convenience, there are many issues that customers want banks to address that help them understand their finances better.

gomoney, a digital bank designed to simplify money management, is taking up this challenge by delivering a full-service digital bank with innovative solutions that give users better control of their finances. Built on the promise of simplicity and transparency, gomoney offers customers different money management tools, with free intra-bank transfers and a flat fee of N8.50k for inter-bank transfers. To bolster the money transfer offer, 29 banks were recently added to the platform, taking the number of options available to 54 banks across the country.

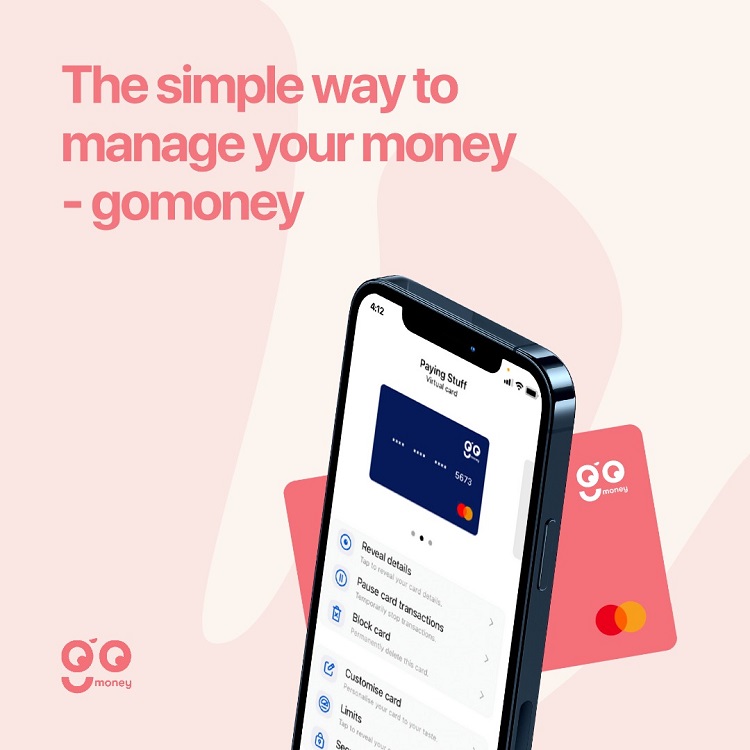

Furthermore, the bank has virtual cards that allow local and international transactions; it is the comfort and efficiency of a physical card without the risk of losing the card or carrying an additional card in your wallet. Also, with fully functional cards you can easily pay for Apple Music, Spotify, and Netflix. While virtual cards are amazing, many customers require physical cards for transactions like POS payments, and more. gomoney is also developing physical cards that would be available to customers upon request. This is to ensure customers have a variety of payment options available to them.

In addition to this, the gomoney app has several features that allow you to ‘split the bill’ with friends, schedule bills and transfers, and other options to help develop a healthy ‘money’ culture. To make these features accessible, even without data, there’s a USSD code (*586#) that customers can use to make transfers, buy data and airtime, and even check their account balances.

One of the amazing things the gomoney app offers is the user interface and experience that neatly arranges these features and options in a way that users can easily find them and get a clear picture of their finances. It is simple and easy to use, with access to a dedicated team ready to assist users who may require additional support.

The goal of gomoney is to simplify banking so users can become their financial advisors. It’s quite clear that the gomoney team has taken a good look at the market and has paid close attention to the concerns and desires of customers, to create solutions that give them better value.

While this is impressive, this is just the beginning of a race. The gomoney app is constantly upgraded and iterated to improve the platform and further simplify the banking experience for users. For a start, it’s a brilliant start. The road ahead looks great for gomoney and its customers.

If you are ready for a digital bank that is simple, transparent and designed to continuously help you make better decisions with your money, you deserve gomoney.

The race is on!

Ready, set, go with gomoney! It’s the bank you deserve!